Currently, the price is consolidating inside a crucial demand zone. However, considering the current global markets’ sentiment and recent price action, it’s too early to label the present region as the bottom.

Technical Analysis

Technical Analysis By Shayan

The Daily Chart

Despite the recent equilibrium in the $29-30K range, the price might simply be forming a mid-downtrend consolidation pattern before another leg to the downside.

On the other hand, the daily RSI attempts to break above a mid-term descending trendline. If this plays out, a relief correction could take place in the short term. The first significant supply zone, in any upward movement, would be the $37-40K range (on the daily timeframe).

The 4-Hour Chart

On the lower timeframes (LTF), Bitcoin is forming a wedge pattern and will decide on its next direction upon breaking out of the wedge.

If the wedge gets broken down, a bearish expansion phase will be the most likely scenario for the following few weeks. On the other hand, a bullish breakout might signal a reversal, pushing Bitcoin’s price to the $34K critical resistance level.

Furthermore, on the 4-hour timeframe, the RSI has reached its resistance trendline and is struggling to break it. The reversal scenario will be imminent if this breakout occurs.

Onchain Analysis

Onchain Analysis By Shayan

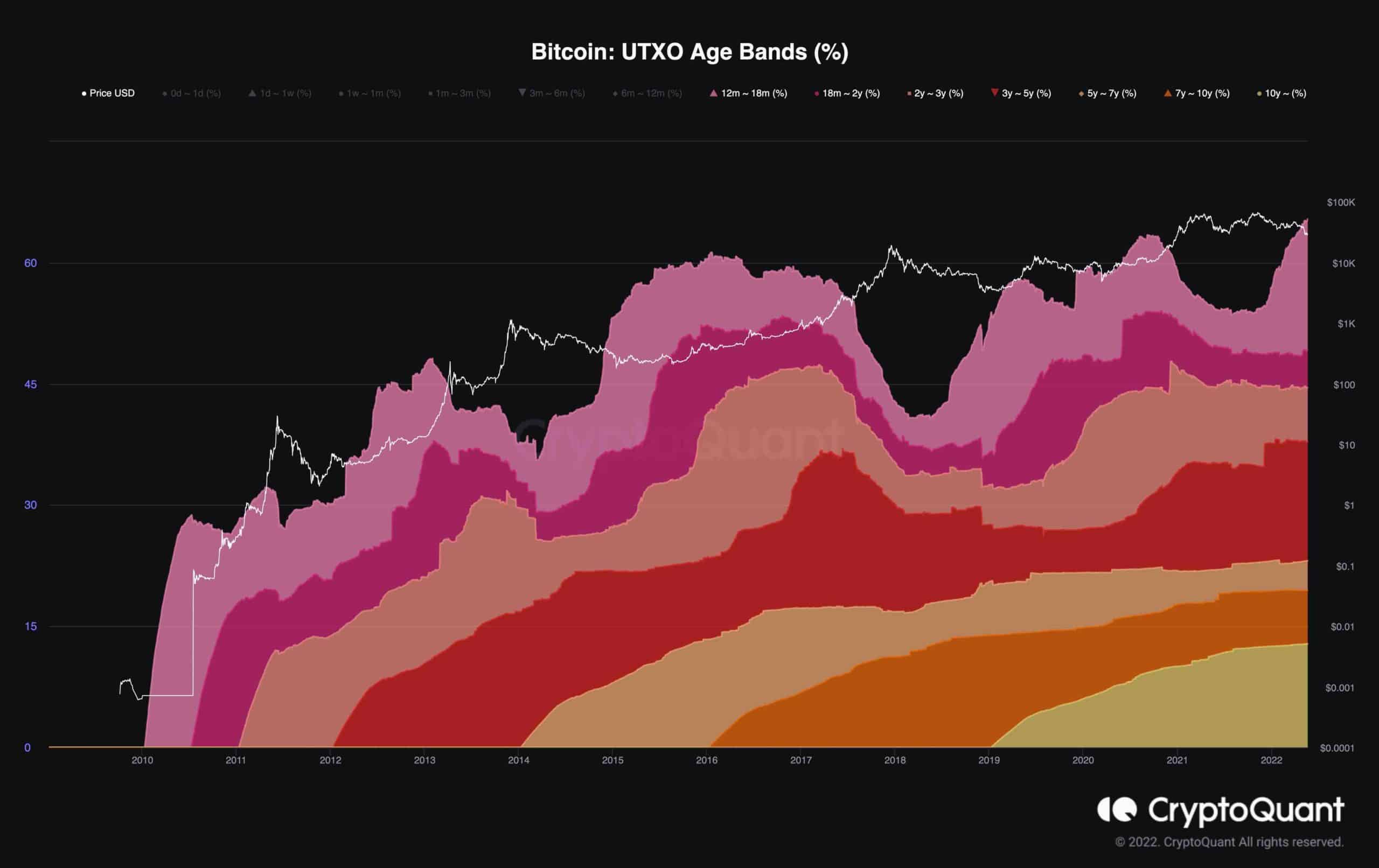

The following chart shows the price of Bitcoin and the percentage of UTXOs that were last active over a year ago.

As can be seen below, the percentage of coins that have been dormant for more than a year has just reached a new all-time high. This indicates that long-term investors have been careless about the previous weeks’ price fluctuations and continue holding their bitcoin.

This behavior indicates on a possible supply shock; however, demand must enter the market in order to increase the chance for a bullish reversal.

cryptopotato.com

cryptopotato.com