Bitcoin has slumped more than 8%, over a 24-hour period, a drop attributed to U.S. President Joe Biden’s proposed tax hike for capital gains on those earning above $1,000,000, but the effect may be temporary, according to the CEO of a leading crypto-dedicated payment services provider.

Biden’s proposed treatment of gains in equities as income, which proposes a rate of up to 39.6% instead of the current 23.8%, has had “a shock effect in all markets,” BCB Group CEO Oliver von Landsberg-Sadie told CoinDesk via private message. Still, cryptocurrency is likely to be unaffected long-term, he said.

“While the shock may be sustained in stock markets, the nature of cryptocurrency will see straight through this dip,” said Landsberg-Sadie.

The CEO said Microstrategy’s Michael Saylor and Tesla’s Elon Musk had both made it “abundantly clear” in regards to their corporate treasury positions and holding bitcoin.

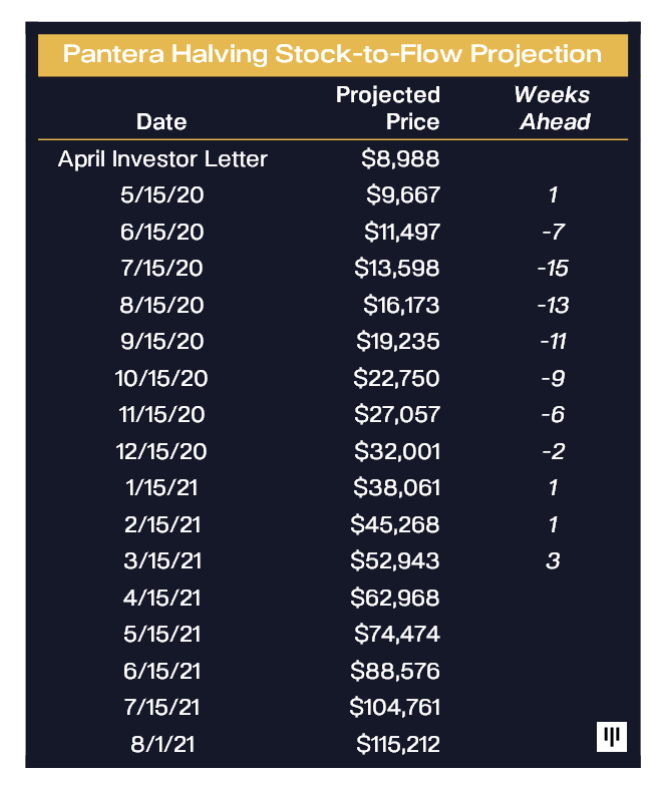

“The difference between cryptocurrency and any other market is that we’re seeing more and more large-scale crypto buyers who simply have no intent on exiting the position,” said Landsberg-Sadie. Instead, the halving stock-to-flow economics provided by Pantera Capital will be a “much stronger driver of value than fiat-based tax.”

According to Landsberg-Sadie, the drop in bitcoin’s value on Friday has been an “overreaction” to Biden’s capital gains proposal and will likely bounce back to the Pantera projections where its next high is somewhere north of $70,000.

Bitcoin is currently changing hands for around $49,400, according to data from Messari.

See also: Bitcoin Dominance Sinks Below 50% for First Time Since 2018

coindesk.com

coindesk.com