A pair of widely-followed crypto analysts are revealing their take on Bitcoin’s trajectory after the leading cryptocurrency bounced from a seven-day low of $16,351.

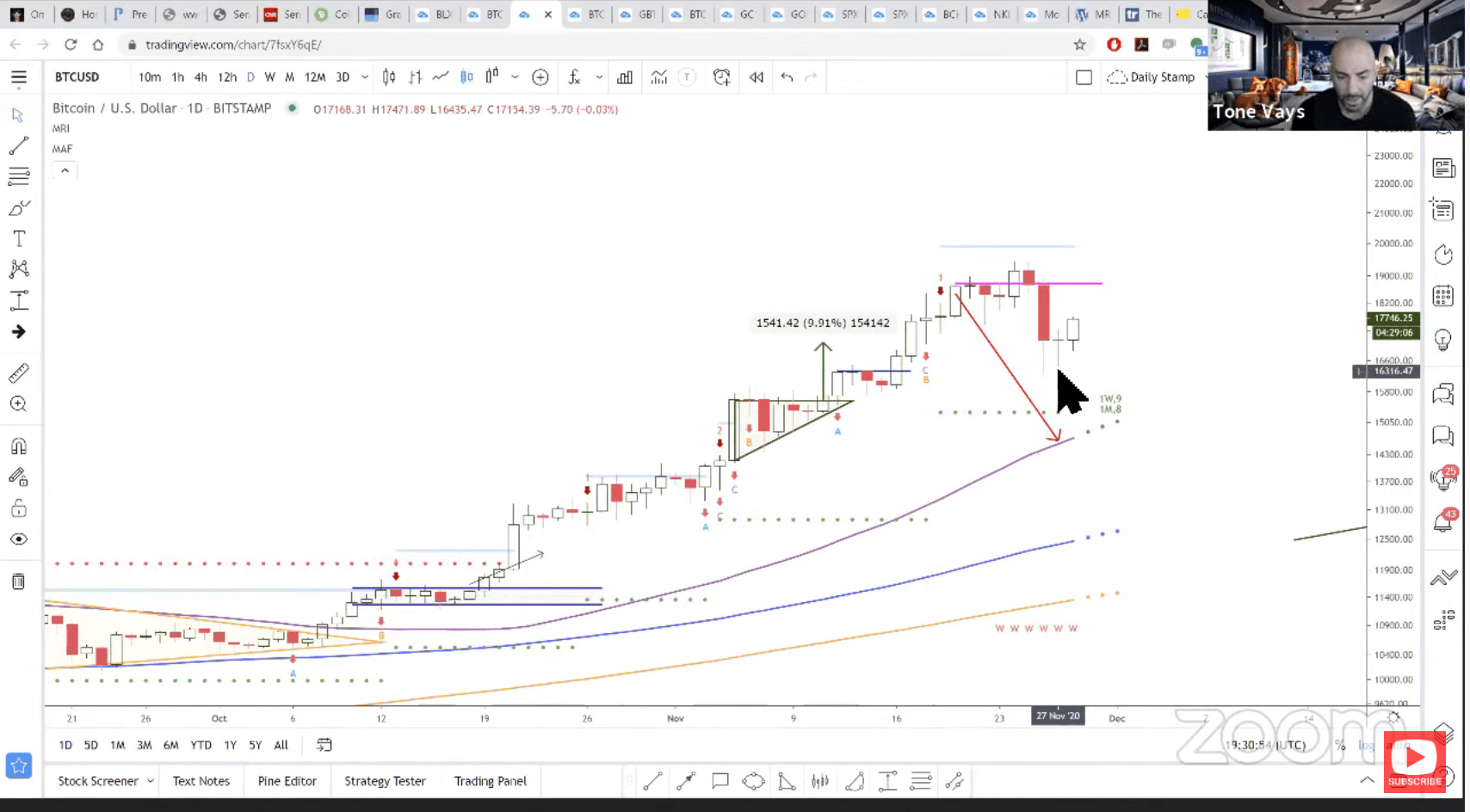

In a new video, Wall Street veteran and crypto strategist Tone Vays tells his 95,000 YouTube subscribers that he’s waiting for Bitcoin to give him a clear signal before entering the market.

“We’re going to wait and see… The daily chart at the moment is also in an absolute no-trade zone. I was looking for a slightly deeper correction into the $14,000 range, which means lower than $15,000. We did not get there.

It appears that so far, we bottomed at just above $16,000. Now because we bottomed at just above $16,000, creating a point in the middle of nowhere to reverse the price, I will wait until we break this pink line ($19,000) to be bullish in the current rally… At the moment, I am not yet buying this dip. I would rather buy the breakout than buy the dip.”

Vays predicts that we will see a new all-time high should bulls take out a key level.

“I would rather buy above the purple line and watch it go to $30,000 because that’s what I think is most likely to happen the next time we break $20,000. Breaking $19,000 at this point is almost the equivalent of breaking $20,000 because they are so close. The momentum that we will have if we break $19,000 next week is enough to push us into a new all-time high but I am not yet buying this dip.”

Meanwhile, crypto analyst Michaël van de Poppe is outlining two possible scenarios that can play out and they both depend on Bitcoin maintaining a crucial area.

“As long as $16,000 holds, we don’t get another drop, but if we drop south, $14,000 around this previous high is the area to watch. I think that once we get to $14,000, the majority will be eyeing $12,000 and I do not believe we will be hitting $12,000. That would be a very harsh correction. I think $14,000 is also the 0.382 Fibonacci level and the previous high which formerly gives the support resistance flip.

Second scenario is that we get the chopperino like we had after the halving. And in this case, you see that we’ve had the test of the previous OB (order block) like we do see here and after that, we just see the price going sideways, granting support. In that perspective and in that light, we most likely get a rejection at the range that we have discussed between $18,000 and $18,600. After which, we drop south… If we sustain support at $17,100 and come back up again, then you might be arguing that we won’t be getting any further corrections.”

Featured Image: Shutterstock/pixelparticle

dailyhodl.com

dailyhodl.com