TL;DR Breakdown:

- Bitcoin illiquid supply rose to 3.2x this week.

- About 54,000 BTC were moved off cryptocurrency exchanges less than two weeks ago.

New on-chain report from Glassnode indicates that the majority of Bitcoin supply is currently illiquid, regardless of the market volatility and bearish performance of the largest cryptocurrency in the past weeks.

Bitcoin illiquid supply spikes

Early Monday, Glassnode informed that Bitcoin illiquid supply has ticked higher this week, as per the Illiquid Supply Shock Ratio (ISSR) created by Will Clemente, the current lead insights analyst for Blockware Solutions.

Illiquid Supply accounts for coins that have little to no history of spending and sometimes can be attributed to long-term holders. The Bitcoin Illiquid supply ratio has jumped to 3.2x, which is larger than the Liquid and Highly Liquid supply combined, according to Glassnode.

Also, about 54,000 BTC were reportedly moved off crypto exchanges within nine days, which coincides with the declining liquid supply of Bitcoin.

54K #Bitcoin taken off exchanges in just 9 days…🤔 pic.twitter.com/MkAaeKq446

— Bitcoin Archive 🗄🚀🌔 (@BTC_Archive) March 14, 2022

Perhaps, an increase in illiquid supply means a decline in the liquid supply; hence, there should be fewer coins available to meet demand. This can be considered a potentially bullish indication for Bitcoin; however, the current state of the leading cryptocurrency doesn’t correlate.

Less demand for BTC

While price can go either way, the ISSR data confirms that the number of Bitcoin available for purchase is dropping, which paints a bullish picture for the cryptocurrency based on the economics of scarcity. Yet, this only matters, especially if people are increasingly willing to buy (demand). At the moment, there seems to be no new demand for Bitcoin.

The absence of market demand plausibly explains why the price of Bitcoin currently shows no correlation with the on-chain data.

BTC price update

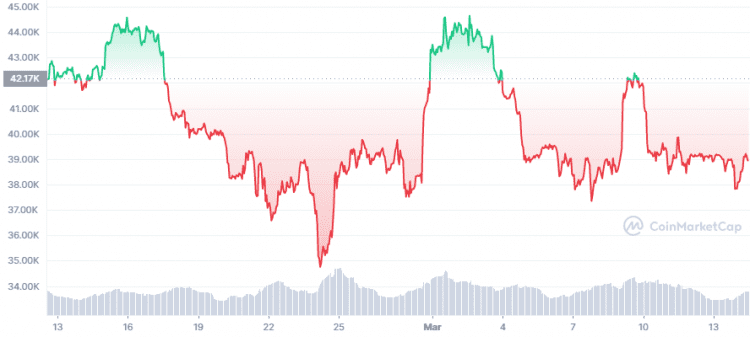

BTC was trading at $38,948 with a market capitalization of $739.37 billion during the time of writing. Since reaching an all-time high of $68,789 in November 2021, Bitcoin has declined by over 40%. Over the last 30 days, BTC has been struggling to reclaim the $45,000 mark.

cryptopolitan.com

cryptopolitan.com