Widely followed crypto analyst Benjamin Cowen says that the fears of Bitcoin’s (BTC) price dipping if the Federal Reserve raises interest rates may be unfounded.

In a new strategy session, the analyst tells his 716,000 YouTube subscribers that historical evidence doesn’t support the notion that BTC will suffer a price drop if interest rates rise.

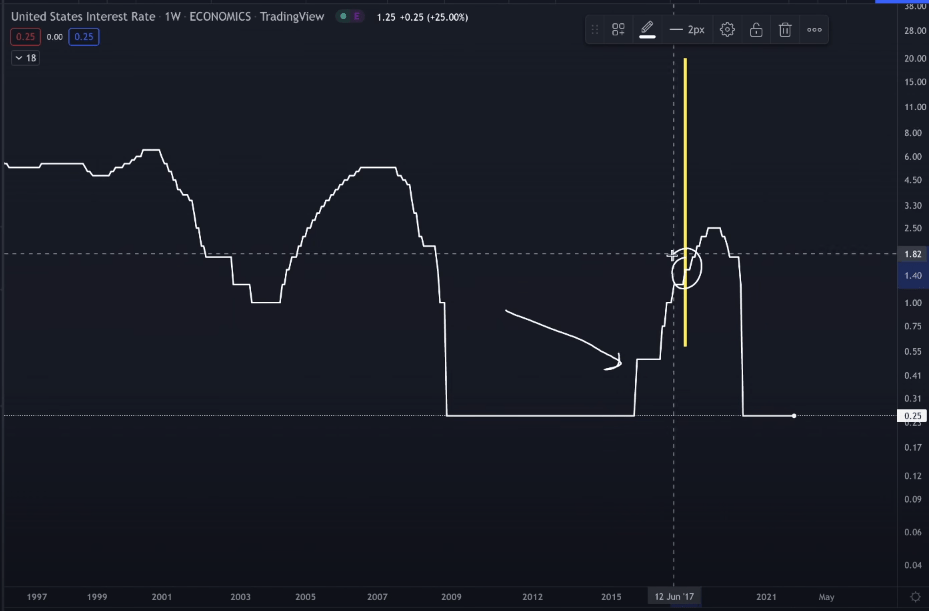

Cowen points to BTC’s major peak near the end of 2017 and says that Bitcoin’s value at the time coincided with rising federal interest rates.

”Bitcoin’s peak [in 2017] was in December. If we go draw a line at December of 2017, it corresponds to [a period of rising interest rates]. So Bitcoin’s market cycle peak occurred not before they were raising interest rates, not when they decided to stop raising interest rates, not even when [interest rates] first started coming down…

In fact, when the interest rates started coming down in July of 2019, that was the local top that Bitcoin hit at $14,000. I think it’s always important to challenge our assumptions about things and not just accept the narrative that we hear.”

However, Cowen notes that nothing is guaranteed and that Bitcoin’s price could indeed go down if interest rates rise. Such a scenario would, however, contradict historical data, according to the analyst.

“I’m not saying that the price of Bitcoin can’t go down. We know that it can… We know these are possibilities but the idea that raising interest rates necessarily has to lead to doom and gloom for Bitcoin for a couple of years until the interest rates start coming back down, I do think is not supported by the data.”

Bitcoin is exchanging hands at $38,496 at time of writing, a 3.4% decrease from its 24-hour high of $39.851.

dailyhodl.com

dailyhodl.com