Bitcoin could be heading toward a new all-time high between $160,000 and $170,000, according to market analyst Bitcoin Teddy.

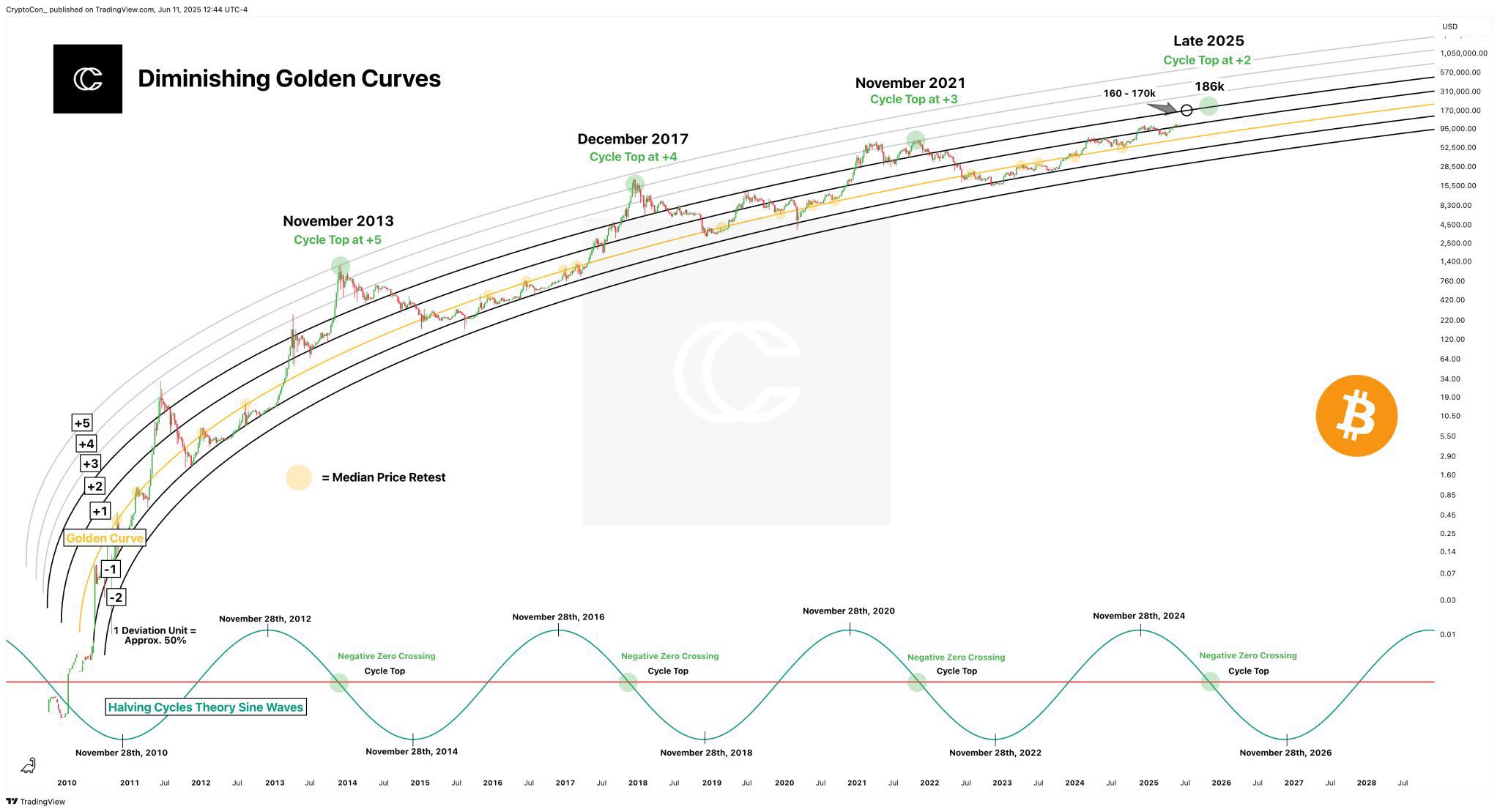

The analysis cites the “Diminishing Golden Curves” model developed by CryptoCon as the basis for this bold outlook.

Notably, the model has accurately outlined Bitcoin’s historical market cycles over the past decade. It now suggests that the next major top could form in the final weeks of 2025, following the same cyclical rhythm that has defined every Bitcoin bull market since 2011.

- November 2013: Cycle top at +5

- December 2017: Cycle top at +4

- November 2021: Cycle top at +3

Following this pattern, CryptoCon’s model anticipates that the next cycle top will occur near the +2 curve over the next six weeks. This sets a potential Bitcoin price target between $160,000 and $170,000, with a possible extension toward $186,000.

Bitcoin Cycle Timing Aligns With Bitcoin Halving

The chart also incorporates Bitcoin’s Halving Cycle Sine Waves, which show that major peaks typically appear 12–18 months after each halving. Since the last halving occurred in April 2024, the model predicts the next peak will likely arrive in late 2025, consistent with Bitcoin’s familiar four-year cycle.

Although earlier cycles saw explosive growth, each new cycle has brought smaller percentage gains amid Bitcoin’s growing maturity and increasing institutional adoption. This trend has made the market more stable, but with a slower rate of growth.

Still, if the Diminishing Golden Curves model proves accurate once again, Bitcoin could rise as much as 79% from current levels of around $104,000.

Another Bitcoin Boom Signal

Another factor strengthening Bitcoin’s bullish outlook is the current liquidity setup. As The Crypto Basic reported on Tuesday, the Stablecoin Supply Ratio—which measures Bitcoin’s market cap relative to stablecoin reserves—has fallen to a level that has historically marked market bottoms.

Each time this has occurred, Bitcoin later experienced strong rallies as stablecoin capital flowed back into the market.

Data from Binance supports this view. It also shows rising stablecoin reserves and declining Bitcoin reserves, a sign that buying power is building and long-term holders are accumulating.

According to CryptoQuant analyst Moreno, with liquidity increasing and volatility remaining low, the current environment offers a favorable risk-reward setup, where downside risk is limited and upside potential remains strong.

thecryptobasic.com

thecryptobasic.com