TL;DR

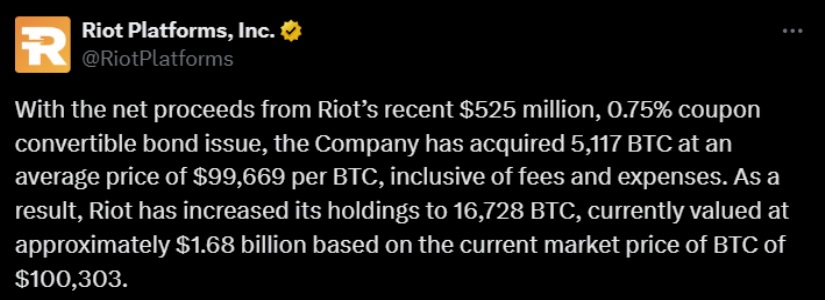

- Riot Platforms acquired 5,117 BTC for $510 million, increasing its reserves to 16,728 BTC, which is equivalent to $1.68 billion.

- With this purchase, it becomes the third-largest public holder of Bitcoin, behind MicroStrategy and MARA Holdings.

- The purchase was financed with the $525 million raised through the sale of convertible bonds, part of the company’s strategy to strengthen its presence in the crypto market.

Riot Platforms, a well-known Bitcoin mining company, has acquired 5,117 BTC for a total of $510 million. After the purchase, the company’s reserves amount to 16,728 BTC, which is approximately $1.68 billion.

Riot has established itself as one of the largest public holders of the cryptocurrency in the world. With this acquisition, it positions itself as the third-largest publicly listed company with the most BTC, just behind giants like MicroStrategy and MARA Holdings.

How Was Riot’s Purchase Financed?

The purchase was financed through the $525 million raised via the sale of convertible bonds, a financial strategy announced in early December. The goal is to reinforce Riot’s position in the crypto market, expanding its influence and presence in the industry. The acquisition of Bitcoin is part of the company’s strategy to accumulate cryptocurrencies at key moments. This trend has been followed by other major corporations that also see BTC as a way to strengthen their reserves.

The Company’s Evolution and MicroStrategy’s Example

Riot operates several mining facilities in the states of Texas and Kentucky, as well as electrical equipment manufacturing operations in Denver, Colorado. Throughout its history, the company has had to overcome various obstacles, especially during the crypto market downturn of 2022-2023, when many mining companies had to restructure due to shrinking profit margins. The miner also faced operational difficulties, such as the temporary shutdown of its mining facility in Rockdale, Texas, due to extreme weather that affected the infrastructure.

The new increase in Riot’s Bitcoin reserves allows it to solidify its position as a leader in cryptocurrency mining. With this move, it follows the example of MicroStrategy, which is currently the largest corporate Bitcoin holder with over 420,000 BTC in its possession.

crypto-economy.com

crypto-economy.com