- Recent 13F filings highlight Black Rock’s influence alongside other major institutions entering the Bitcoin ETF market.

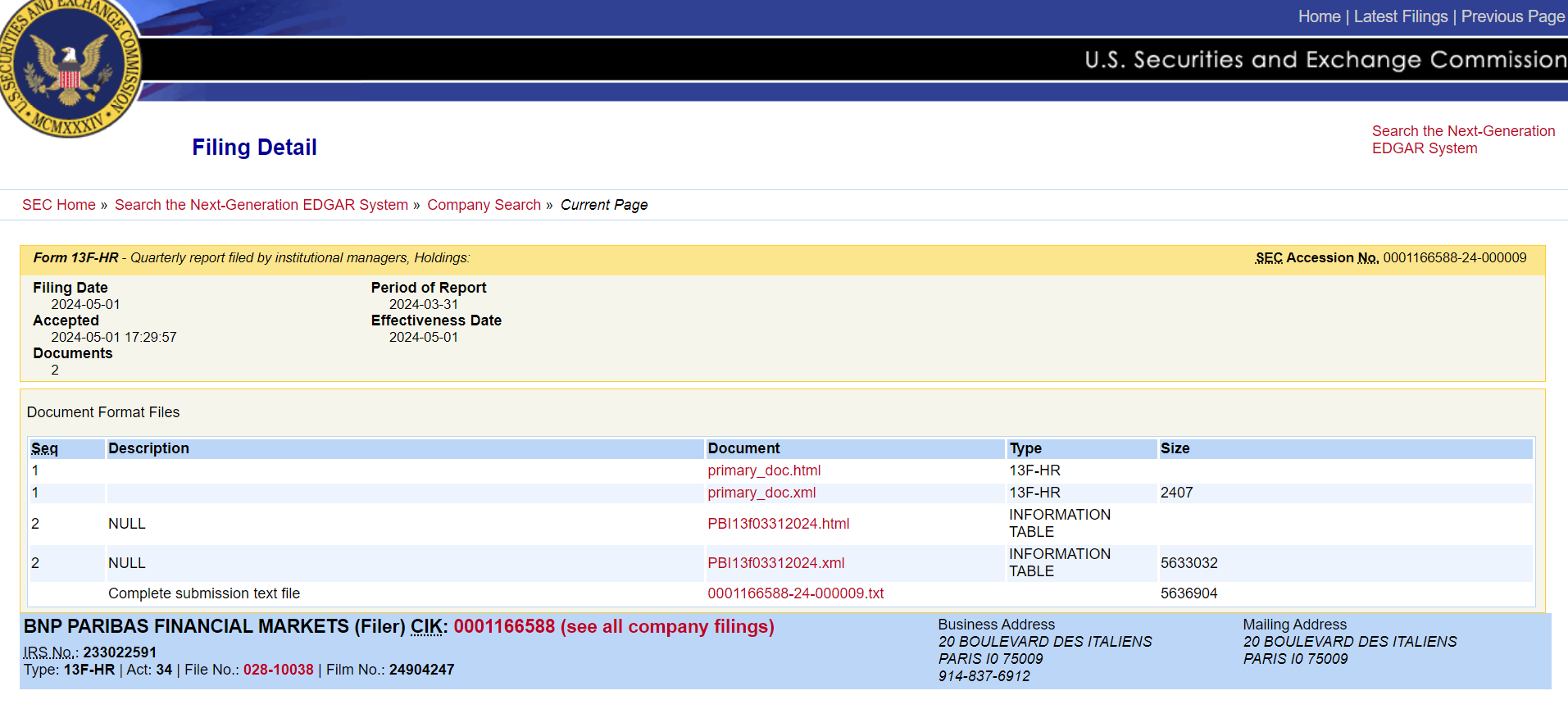

- BNP Paribas’ entry into Bitcoin ETFs underscores the broader trend of institutional adoption facilitated by players like Black Rock.

The buy of BlackRock’s Bitcoin ETF shares by BNP Paribas, endorsing BlackRock’s digital asset investment portfolio, reflects growing institutional interest in Bitcoin and solidifies BlackRock’s position as a leader in BTC investment opportunities.

In previous Q1 2024 filings, asset managers, family offices, and banks including Park Avenue Securities, Inscription Capital, Wedbush Private Capital, and American National Bank reported purchases.

Boom! 💥💰 Just in: @BNPParibas, Europe's second-largest bank, jumps on the #Bitcoin train with exposure to #BitcoinETF, as revealed in their 13F filings. The future is now! 🚀 pic.twitter.com/MNedlcWpeP

— Collin Brown (@CollinBrownXRP) May 2, 2024

As per regulations, institutional investors with assets over $100 million must disclose their quarterly holdings through 13F filings. Bitcoin investors awaited these filings to identify institutions investing in Bitcoin ETFs.

Related: BlackRock Bitcoin ETF records zero inflows for first time in 71 days

BNP Paribas’ purchase of BlackRock’s shares, as disclosed in a 13F filing with the SEC, reflects the bank’s conviction in Bitcoin’s potential as an asset class.

Despite the shares’ price exceeding $40 apiece, notably lower than the current individual Bitcoin price, BNP Paribas recognizes the value of investing in BlackRock’s Bitcoin ETF.

Read more: BlackRock clarifies its role in Hedera announcement: Tokenisation details revealed

Following the approval of Spot Bitcoin ETFs earlier this year, BlackRock’s IBIT has become a standout choice in the market.