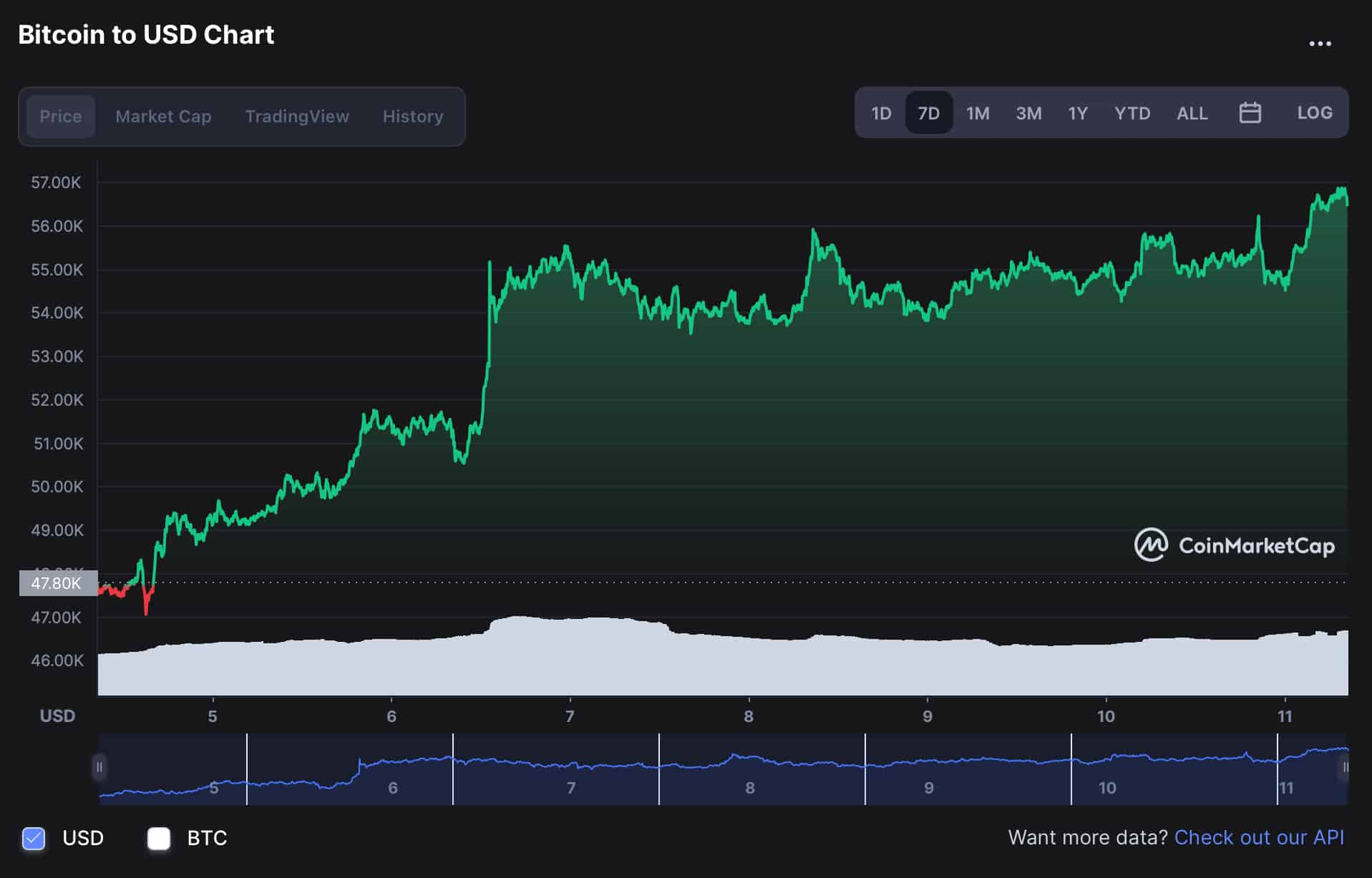

Bitcoin (BTC) is climbing on Monday following a weekend of stabilization; the leading cryptocurrency soared above $55,000 on Wednesday last week and has remained around that level since.

These price increases come after Bitcoin temporarily dropped below $30,000 at the end of July. Bitcoin is currently around $8,000 away from the all-time high of $64,863 it reached on April 14, 2021.

Currently, BTC is trading at $56,457, up 1.29% in the last 24 hours and up 18.08% over the previous seven days, according to CoinMarketCap.com.

In addition, prominent crypto trader, Michael van de Poppe, believes the next stage of the bull run for Bitcoin will see it rise to $61,000 and beyond.

Still standing behind this scenario on #Bitcoin. pic.twitter.com/Xw2GMZEKS2

— Michaël van de Poppe (@CryptoMichNL) October 11, 2021

Indeed, there has been a lot of positive momentum surrounding BTC recently. The digital asset total market cap surpasses $1 trillion taking over companies such as Facebook (NASDAQ: FB), whose capitalization stands at $928 billion, and Tesla (NASDAQ: TSLA), which is valued at $795 billion.

Whatsmore, an application for Bitcoin futures exchange-traded funds (ETFs) is currently pending clearance by the Securities and Exchange Commission (SEC). Furthermore, the end of October may see up to four Bitcoin futures ETFs listed on Wall Street, thus ending years of uncertainty for investors.

Ultimately for the $6.7 trillion ETF sector in the United States, approval would be seen as a welcomed development among the crypto community.

Investing in Bitcoin futures ETFs allows investors to get exposure to the leading cryptocurrency without having to own any Bitcoins directly.

Bitcoin is a hedge against inflation

It’s worth mentioning that Bitcoin significantly trails gold which has a market cap of $11 trillion. However, interestingly, J.P. Morgan Chase & Co, in a note, the bank said that:

“Institutional investors appear to be returning to Bitcoin, perhaps seeing it as a better inflation hedge than gold.”

Moreover, CEO and chairman of blockchain portfolio provider Immutable Holdings Jordan Fried, on Bitcoin declared the asset’s growth would see it exceed gold and more than double it in value, he stated:

“Bitcoin is “gold 2.0″ and will one day surpass gold’s market value of around $10 trillion. In fact, given that it is the next generation of gold, Bitcoin will likely double gold’s market value and hit $20 trillion or more, implying $1 million a coin if close to 21 million coins are mined.”

Major coins

Elsewhere, the second-largest cryptocurrency by market cap, Ethereum (ETH), is up 0.25% over the previous 24 hours to $3,606; meanwhile, over a seven-day trailing period, it has increased 7.48%.

Notably, on October 7, 2021, it was announced that Auto1 FT, a German financial partner in the automotive industry, is utilizing Ethereum smart contracts to allow financing for vehicle purchases for the first time in Europe.

By eliminating all paperwork, the company hopes to streamline its main business of car financing. In addition to lowering costs and errors, Auto1 FT will employ blockchain technology since it is impermeable and transparent and also will use smart contracts throughout the financing process.

On the other hand, memecoin Shiba Inu (SHIB), a decentralized token that has seen a spectacular increase in recent weeks, is still in the green today, up 3.26% on the day and up an astounding 223.77% in the past seven days.

Global crypto market

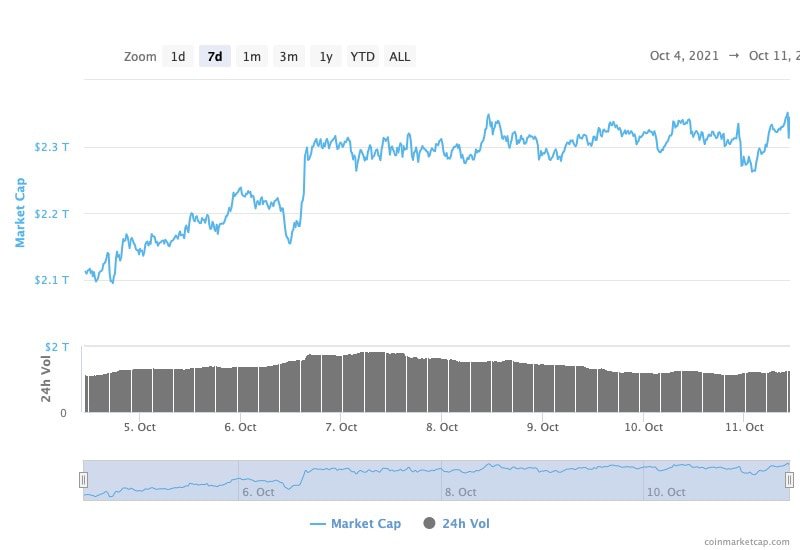

Finally, on Monday morning, the cryptocurrency market stayed in the green. Currently, the total value of the crypto market is $2.35 trillion, representing a 0.51% rise over the previous day.

Furthermore, the overall crypto market volume over the past 24 hours has increased by $103.13 billion, reflecting a 1.94% increase. Meanwhile, DeFi 24-hour volume is 11.56% of the overall crypto market volume at $11.92 billion, whereas all stable currencies’ combined volume is $82.18 billion, or 79.6%.

finbold.com

finbold.com