After a brief bullish rally, the general cryptocurrency market has again woken up in a sea of red, and Bitcoin (BTC) is down more than 2%, leading to less optimistic expectations of the crypto community about the future price of the maiden digital asset.

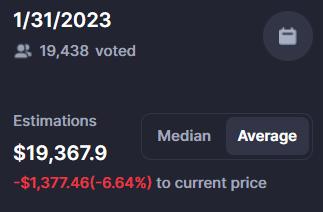

Indeed, the votes cast by the members of the crypto tracking platform CoinMarketCap project that Bitcoin will be changing hands at the average price of $19.368 on January 31, 2023, according to the data retrieved by Finbold on January 19.

Should the estimations of 19,438 member votes prove true, it would mean that the price of Bitcoin by the end of January will decline further by -6.64% or -$1,377 compared to its current value, which at press time stood at $20,745.

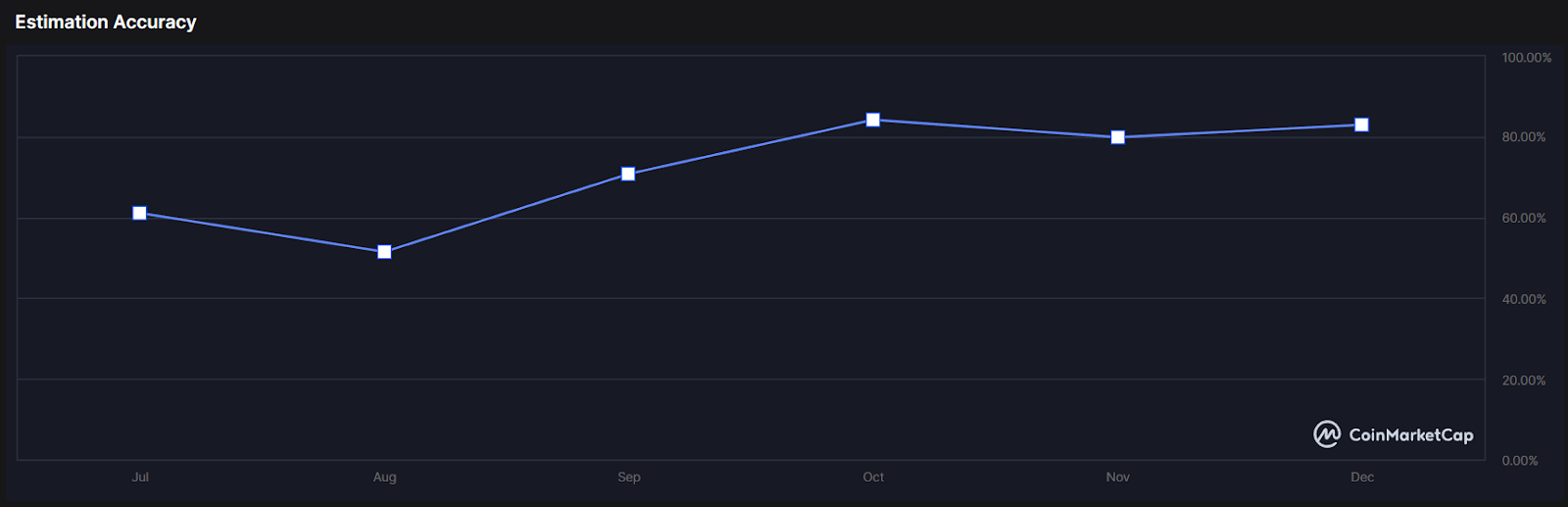

Taking into consideration the performance of the crypto community’s projections for the six previous months, it has historically set the price of the flagship decentralized finance (DeFi) token with an accuracy rate of 71.75%.

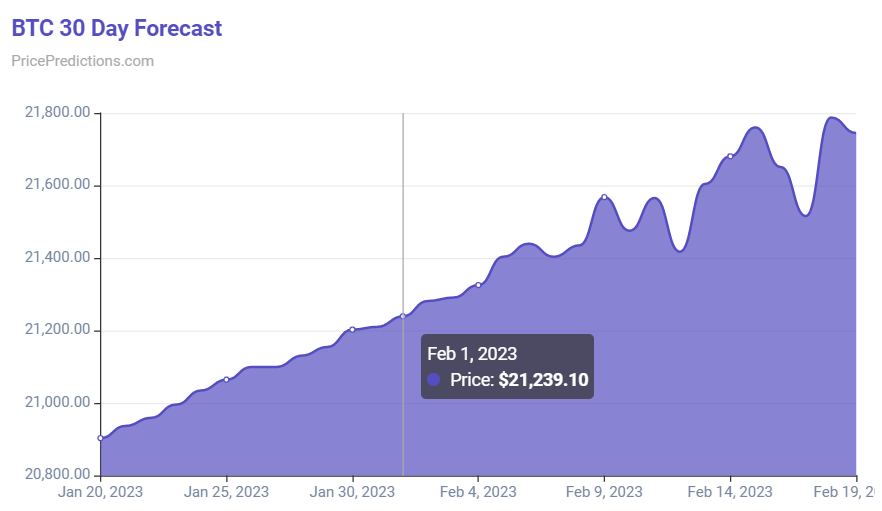

Meanwhile, the machine learning algorithms at PricePredictions have earlier projected that Bitcoin would likely climb to trade at $21,382 on February 1, 2023. Unlike the crypto community, the machine algorithm continues to be bullish, more recently setting the price at $21.239.

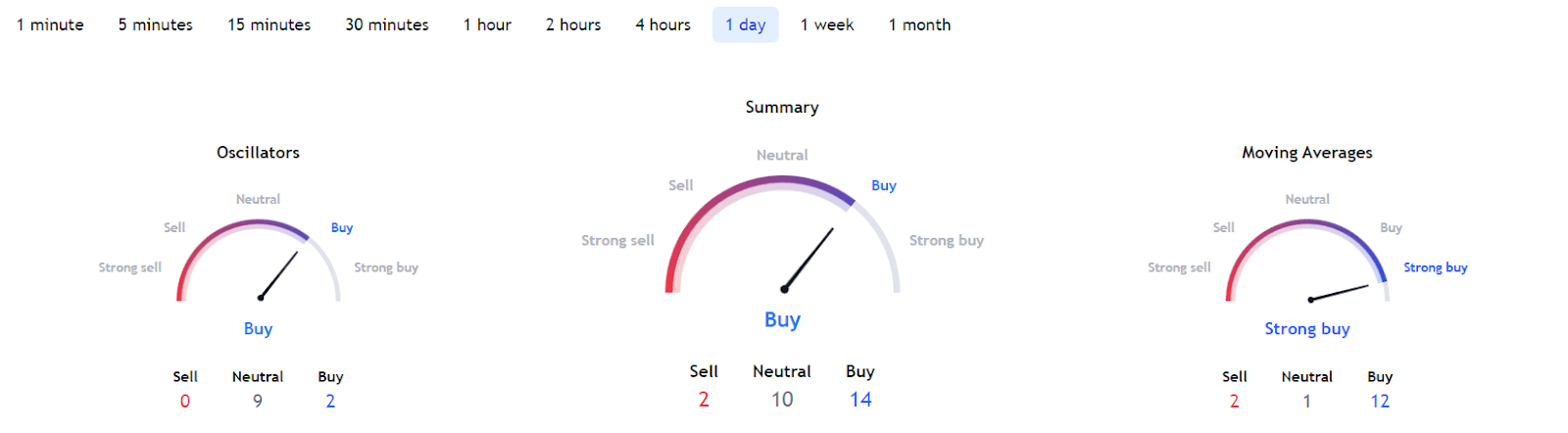

Furthermore, Bitcoin’s technical analysis (TA) on TradingView’s 1-day gauges remains positive, its summary aligning with the ‘buy’ sentiment at 14, which is the result of oscillators pointing at ‘buy’ at 2, and moving averages (MA) indicating a ‘strong buy’ at 12.

Bitcoin price analysis

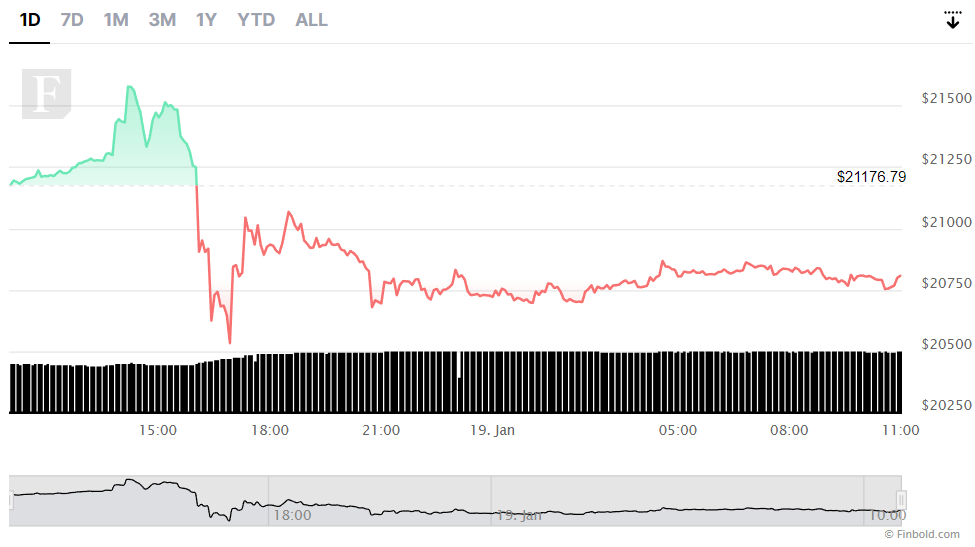

With the announced bankruptcy of crypto lender Genesis likely at fault for interrupting Bitcoin’s 2023 winning streak, the asset has now dropped 2.19% in the past 24 hours, although it is still recording an increase of 14.10% across the previous week and 23.33% on its monthly chart, as per the data retrieved by Finbold on January 19.

Notably, Bitcoin’s 24-hour trading volume has increased from $24.27 billion on January 12 to $29.68 billion at the time of publication, which means it has grown 21.79% in seven days, during which time its market capitalization received an influx of nearly $50 billion.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com