BTC/USD Volatility Elevated: Sally Ho’s Technical Analysis – 21 December 2022

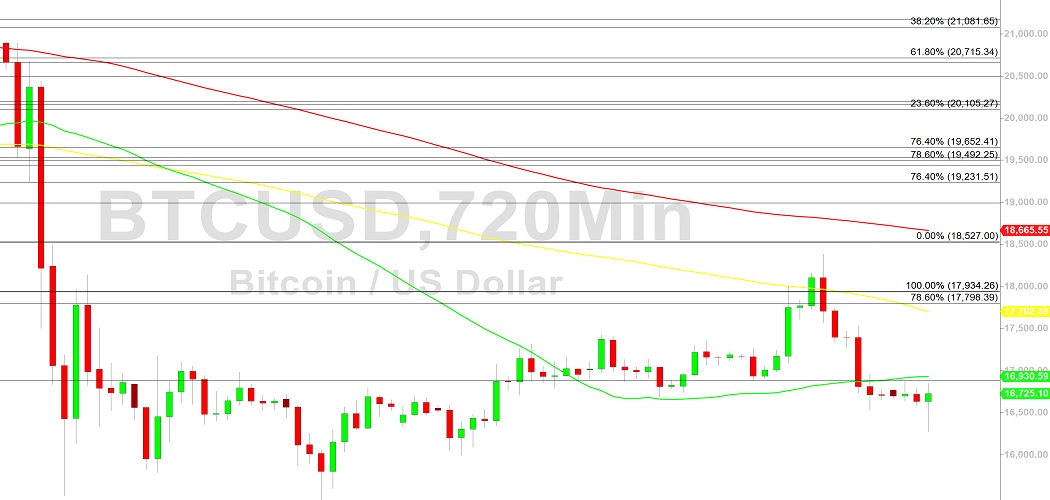

Bitcoin (BTC/USD) experienced elevated volatility early in the Asian session as the pair expanded its recent range that saw it recently orbit the 16880.44 area, a level that represents the 23.6% retracement of the depreciating range from 21478.80 to 15460. Stops were elected below the 16375.18 level during a move lower, an area that is a downside price objective technically related to selling pressure that recently emerged around the 18385.36 and 17525 levels. During the subsequent recovery, BTC/USD tested another price objective around the 16849.58 level that is also related to the same areas where selling pressure commenced. Additional related downside price objectives related to these areas of selling pressure include the 15900, 15313, and 14364 levels. If BTC/USD reclaims some upside momentum, additional technically significant upside retracement levels include the 18495, 19199, 20070, and 20201 levels.

Below current price activity, BTC/USD bears are eyeing a possible test of recent two-year lows around the 15460 area, established after Stops were elected below the 15512 area. Notably, the 15512 level represented an exact bearish price objective based on selling pressure that strengthened around the 21478.80 and 18495.50 areas. Below these areas, technically significant levels include the 14613, 14500.15, 13369, 10432.73, 10727, 9682, 8837, and 7538 levels. Traders are observing that the 50-bar MA (4-hourly) is bullishly indicating above the 200-bar MA (4-hourly) and above the 200-bar MA (4-hourly). Also, the 50-bar MA (hourly) is bearishly indicating below the 100-bar MA (hourly) and below the 200-bar MA (hourly).

Price activity is nearest the 200-bar MA (4-hourly) at 16817.63 and the 100-bar MA (Hourly) at 16876.31.

Technical Support is expected around 14500.15/ 13369.11/ 10727.75 with Stops expected below.

Technical Resistance is expected around 18495.40/ 19199.48/ 20070.64 with Stops expected above.

On 4-Hourly chart, SlowK is Bullishly above SlowD while MACD is Bullishly above MACDAverage.

On 60-minute chart, SlowK is Bullishly above SlowD while MACD is Bullishly above MACDAverage.

Disclaimer: Sally Ho’s Technical Analysis is provided by a third party, and for informational purposes only. It does not reflect the views of Crypto Daily, nor is it intended to be used as legal, tax, investment, or financial advice.

cryptodaily.co.uk

cryptodaily.co.uk