Bitcoin [BTC], the king of the cryptocurrency realm, has often been chided by several of its ‘siblings,’ for not being true to its principles of being a “peer to peer electronic cash system.” The top critic lampooning the top cryptocurrency with this jibe is Bitcoin Cash [BCH], the self-proclaimed “real Bitcoin,” currently holding under 6 percent of Bitcoin’s market cap.

Despite the fourth largest cryptocurrency surging by over 441 percent from its ATL and by 152 percent since the beginning of the year, a long-term perspective paints a telling picture from the price and volatility front.

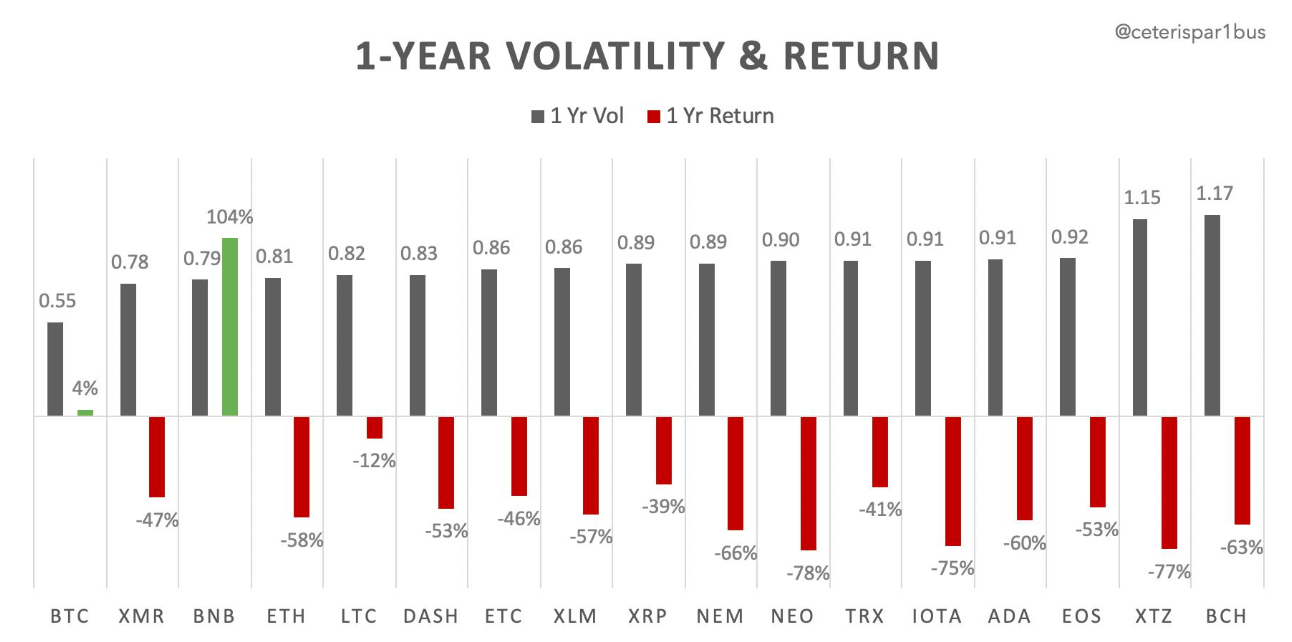

According to an analysis by Ceterius Paribus, Bitcoin remains the least volatile among seventeen of the top cryptocurrencies in the market, while Bitcoin Cash is on the opposite end of the spectrum. From the perspective of 1-year returns, the king coin comes in second to the bullish Binance Coin [BNB], which grew by over 104 percent on the back of several announcements and updates.

The one-year volatility of Bitcoin is valued at 0.5 and is the least among the coins, while Monero [XMR] was a close second with 0.78. Several prominent virtual currencies recorded volatility in the range of 0.8 – 0.9 including, Ethereum [ETH], XRP, Dash [DASH], Litecoin [LTC], Stellar Lumens, and Ethereum Classic [ETC].

Between 0.9 – 1.0, the more volatile cryptocurrencies were EOS [EOS], Tron [TRX], IOTA [MIOTA] and Cardano [ADA].

Ceteris Paribus tweeted,

“

$BTC significantly less volatile than all other cryptoassets & 2nd best performer -> safe haven within asset class during bear markets. “Flight-to-safety” provides buy support, reduces vol.”

Source: Twitter

In the list presented, the only cryptocurrencies to record volatility over 1.0 were Tezos [XTZ] and Bitcoin Cash, with values of 1.15 and 1.17, respectively. Bitcoin Cash began the year in sluggish fashion, trailing the likes of EOS and Litecoin. However, a slew of fortunate price movements, adoption announcements, and the community’s collective angst against its hardfork Bitcoin SV [BSV], led to BCH regaining the fourth spot and adding over $500 million in market cap between itself and Litecoin in fifth position, at press time.

Given the above, BCH proponents should be pleased with the market’s present movements. However, as Ceteris Paribus laid out in a later tweet, a myopic view doesn’t reveal the whole picture.

Both from a year-on-year perspective and an all-time-high perspective, the top cryptocurrency in the market has been showing better signs. Bitcoin is down by 61 percent from its high of just under $20,000, which it saw in December 2017. With respect to the same metric, Bitcoin Cash has fallen by over 91 percent. On the flipside, Bitcoin is up by 4 percent since June 2018, a notable figure when compared to Bitcoin Cash’s 64 percent price drop on a year-on-year basis.

ambcrypto.com

ambcrypto.com