Today the number of Bitcoin short positions have suddenly dropped by 40% to their yearly lows on Bitfinex, which has created the settings for a long squeeze.

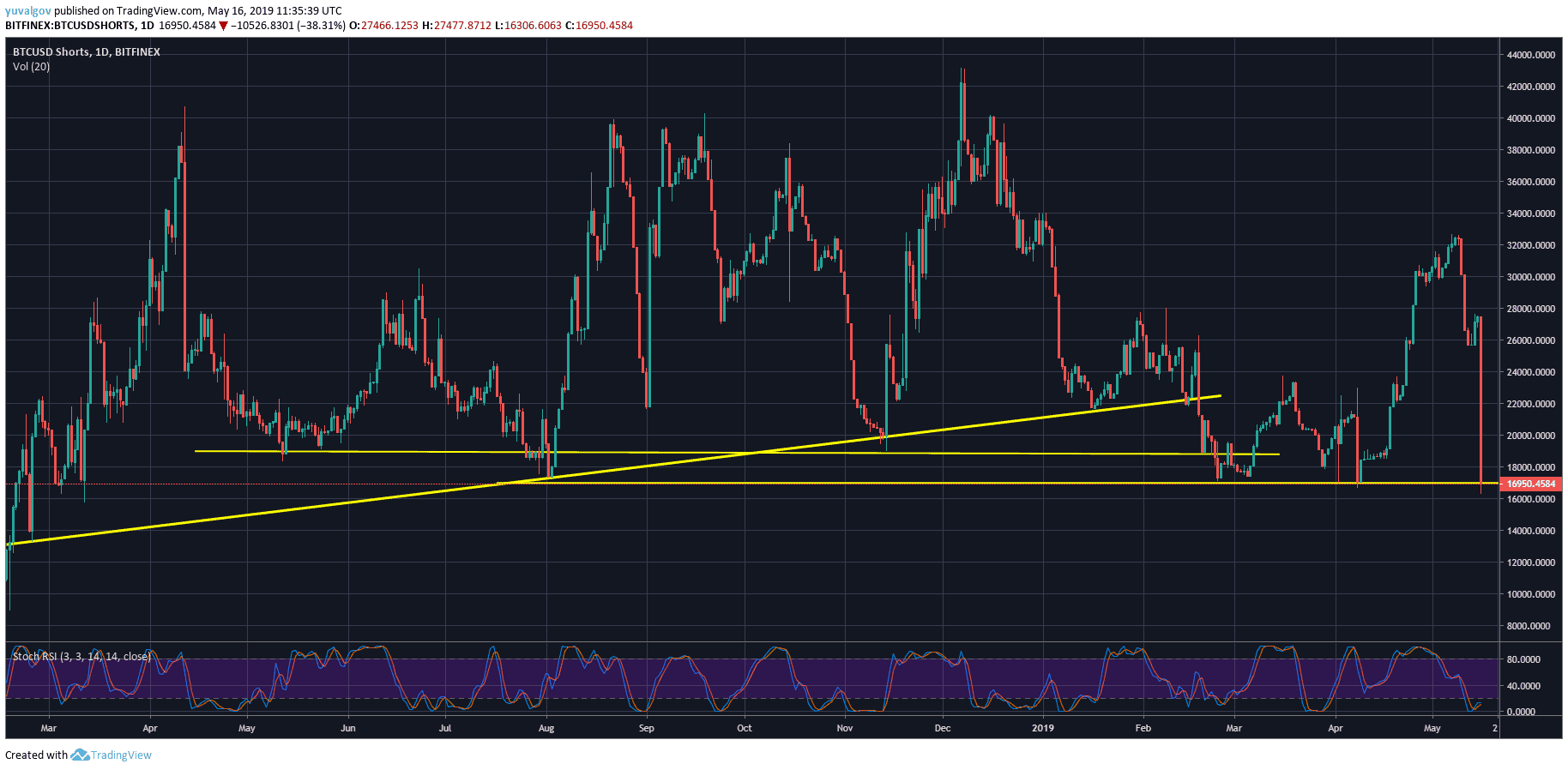

BTC shorts reaching this year’s low

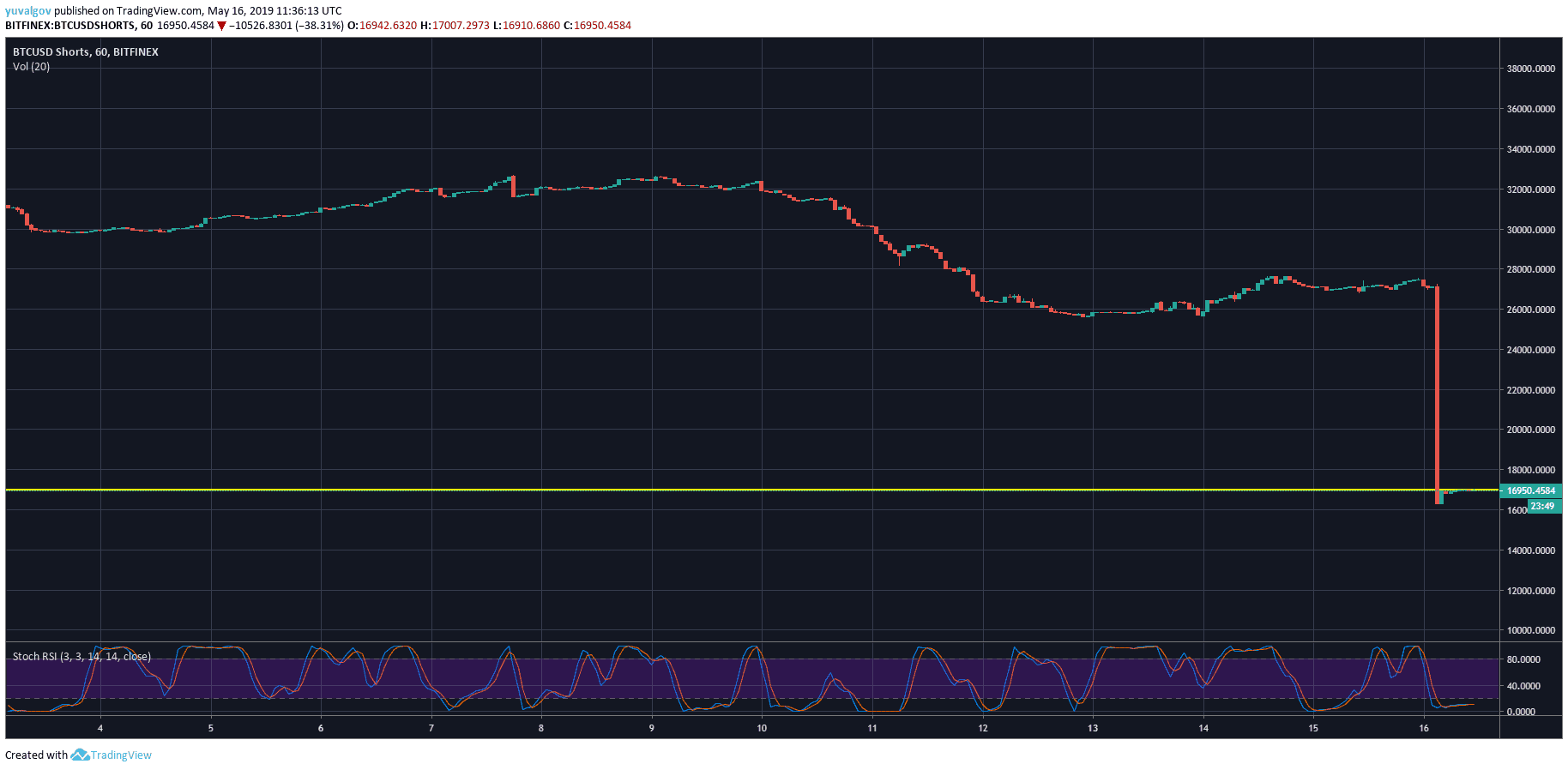

The number of open BTC short positions on Bitfinex were at 27,200 around 3:50 AM (UTC) today, which has suddenly dropped to 16,350 in the matter of a few minutes.

During the same time, the number of BTC long positions increased by less than 300 to 25,521 by 4:41 AM, then entered in a significant downtrend since then, decreasing its number by roughly 4%.

The number of open short positions on BitFinex reached an exceeded the this year’s low on April 8, 2019.

On that day, CryptoPotato has reported a similar event when BTC shorts have gone down by 20% on BitFinex while longs have gained momentum. Despite the sudden 20% drop, BTC’s price has remained relatively steady after the event at that time.

Another similar event happened in February, where CryptoPotato reported that long positions had gained momentum while the number of BTC shorts have gone down by 10%. Bitcoin was trading around $3600 on that day, but it didn’t take long and a week after the short squeeze took place as Bitcoin reached $4200.

Long squeeze already happening?

When the number of open shorts is low while the open longs number is high, the market usually is set for a long squeeze where the price of an asset experiences a sudden drop inciting further selling.

This could be the current case with Bitcoin as its price has started to drop during the recent hours after reaching $8390 (Bitstamp). Since then the price had recorded a low at $7746, before correcting to where it’s trading as of writing this.

While there’s no proof that this price decrease is the first sign of an ongoing long squeeze, there’s a chance that BTC’s price has been already affected by the sudden drop in the number of Bitcoin shorts, which has undoubtedly created the settings for a long squeeze.

cryptopotato.com

cryptopotato.com