If history is any indication, the biggest cryptocurrency in terms of market capitalization, Bitcoin, may be bracing for a volatility spike and a lurch lower. In recent months, Bitcoin — which is well known for its volatility — has been relatively calm, oscillating in a rather narrow range around the $20,000 level after it touched lows of $17,600 in June.

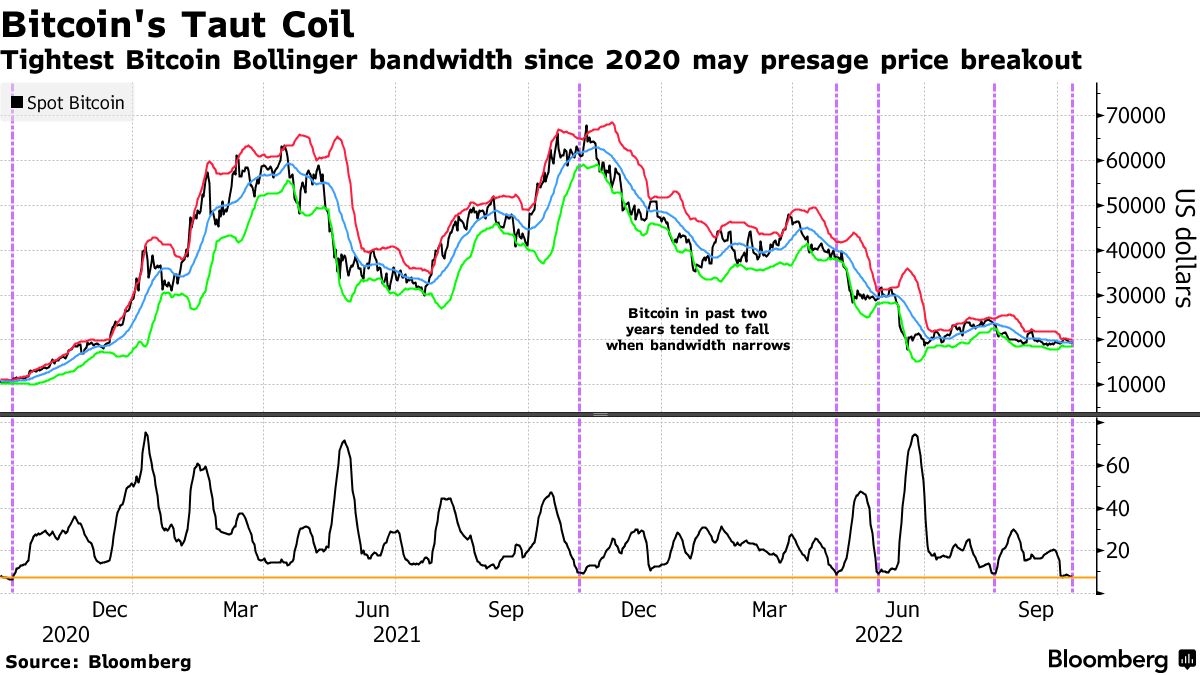

According to Bloomberg analysis, the Bollinger Bandwidth, a potentially ominous signal, has now shrunk to its narrowest since 2020. The bandwidth in a Bollinger analysis, a common method of determining volatility, is the distance between the upper and lower bands.

As a result, some analysts see the narrow Bollinger Bandwidth as a sign that Bitcoin price volatility might spike and, thus, reduce its price.

A nearly 60% decline in the price of Bitcoin this year resulted from a global wave of monetary tightening to combat inflation. Since touching a $3 trillion peak in November 2021, cryptocurrencies have lost around $2 trillion, which has forced regulators to tighten control.

Additionally, the world markets are anticipating Thursday's U.S. inflation data. A strong result might fuel expectations of additional Federal Reserve interest-rate increases, shaking up a variety of assets, while a significant slowdown might have the opposite effect. Market observers anticipate Bitcoin being largely macro-driven in the near term.

Bitcoin must sustain above $19K

#Bitcoin | Losing the $19,000 support level can spell trouble! https://t.co/U81bjTS2bE

— Ali (@ali_charts) October 10, 2022

Crypto analyst Ali claims that Bitcoin needs to hold the $19K support level to avoid a sharp decline. At this price level, 1.3 million addresses have purchased more than 680,000 BTC, and on-chain data indicates that there is little-to-no support below it.

At the time of publication, BTC was trading marginally down at $19,334.

On-chain analytics firm Glassnode reports that the on-chain cost basis for Bitcoin short-term holders has crossed below that of long-term holders. This might imply that buyers of BTC over the last five months now have a superior cost basis to those who "HODLed" through all the volatility of the 2020–2022 cycle.

u.today

u.today