PlanB, the infamous creator of the stock-to-flow (S2F) model for Bitcoin, has seemingly abandoned the HODL strategy in favor of “quant investing” through ByBit.

In a tweet Friday, he announced a “copy my trade” partnership with ByBit that “outperforms buy&hold 100x.” An article detailing the strategy was released Monday via PlanB’s website.

The article on quant investing is almost ready. It includes a trading rule that outperforms buy&hold 100x. You can copy my trade here (signup + deposit): https://t.co/8OI2agrLDD pic.twitter.com/jgW8AmCjlc

— PlanB (@100trillionUSD) August 5, 2022

PlanB and the Stock-to-Flow model

The S2F creator has amassed a large following online after he created the methodology by which many investors speculate on the future price of Bitcoin.

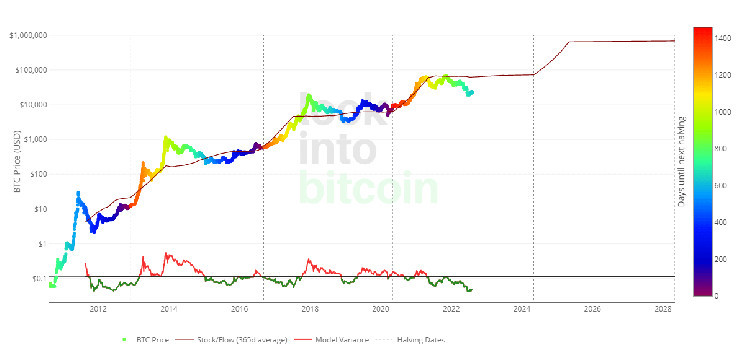

The model is based on the fixed supply of Bitcoin and its predefined release schedule tied to Bitcoin halvings. According to the stock-to-flow model, the price of Bitcoin will reach close to $1 million by 2026.

Historically, the S2F model has been surprisingly accurate; however, during the recent bull run, there has been an increased number of crypto natives who have renounced the theory’s legitimacy.

As far back as June 2021, Ethereum Founder Vitalik Buterin described those who believe in the model as deserving “all the mockery they get.”

Stock-to-flow is really not looking good now.

I know it's impolite to gloat and all that, but I think financial models that give people a false sense of certainty and predestination that number-will-go-up are harmful and deserve all the mockery they get. https://t.co/hOzHjVb1oq pic.twitter.com/glMKQDfSbU

— vitalik.eth (@VitalikButerin) June 21, 2022

The methodology affirms that buying and holding Bitcoin offers the safest method to invest in Bitcoin due to the assumption that it will continue to follow the predicted price in a given timeframe. The price can deviate from the model over a set period, but it will eventually return to the stock-to-flow line due to the fixed supply and distribution of coins.

Criticism of S2F has grown during the bear market as the price of Bitcoin is now well below the model’s prediction and has been since December 2021.

Quant trading and 100x returns

PlanB appears to have taken the opportunity to deviate from the “buy&hold” philosophy to promote a new trading system in conjunction with ByBit. His strategy allegedly will beat a HODL approach by “100x” and is available to copy via ByBit now that his new article on “quant investing” has been released.

He claims he is receiving “the same reactions as when I published the S2F article in March 2019.” Still, most of the criticism comes from those questioning the move away from HODLing and towards copy trading, whereby PlanB will indeed receive a kickback from ByBit. The copy trading page of ByBit’s website states that principal traders can receive “up to 30% commission and 500 USDT in bonuses.”

Funny to see the same reactions as when I published S2F article in Mar2019 when BTC<$4K and I was calling for $55K. "scammer" "demand is not in the model" "$55K impossible".

Now people can not imagine 100x B&H outperformance in 10y and hate exchanges. Let's wait for the article. https://t.co/tjDpqnA2Nx— PlanB (@100trillionUSD) August 6, 2022

The quant trading strategy is outlined in full in PlanB’s article entitled Quant Investing 101.” The core philosophy appears to be based on trading the RSI levels of Bitcoin backtested over the past ten years.

The trading rule PlanB is using for the strategy is detailed below.

“IF (RSI was above 90% last six months AND drops below 65%) THEN sell,

IF (RSI was below 50% last six months AND jumps +2% from the low) THEN buy, ELSE hold.”

For further details on how ITM options are used to optimize returns, see the full article on PlanB’s website.

Responsible strategies for “influencers.”

Hodlonaut, the author of the Bitcoin Zine, Citadel21, tweeted their dismay at the concept of PlanB partnering with what they call a “leverage shitcoin casino” and reneging on “buy and hold.”

Wait, am I understanding this correctly? PlanB is telling people to sign up with a leverage shitcoin casino so they can copy his trades and get 100x more btc than if they just buy and hold?

I must be misunderstanding something, right?

Right?

— hodlonaut 🌮⚡🔑 🐝 (@hodlonaut) August 7, 2022

Cory Kilppsten of Swan Bitcoin, one of the first to identify issues at Celsius, went as far as to call PlanB a “scammer.”

PlanBrandolini @100trillionusd is such a charlatan scumbag. What an absolute joke. pic.twitter.com/9sbMgakoQ1

— Cory Klippsten (@coryklippsten) August 6, 2022

Crypto trader, Eric Wall, extended the sentiment that PlanB is no longer relevant within the industry, claiming “Bitcoin maxis did not defend this charlatan.”

Thankfully Bitcoin maxis did not defend this charlatan… Saifedean, Adam Back, Caitlin Long, Vijay Boyapati, Pierre Rochard, Bitstein, Preston Pysh & a bunch of others of the Swan-advisors, plus almost all Bitcoin podcasts were an irrelevant minority in the grand scheme of things

— Eric Wall (@ercwl) August 7, 2022

Further, PlanB’s article on quant investing raises an interesting problem as it states that

“nothing in this article is financial advice. All content is for informational and educational purposes only.”

However, the article has been identified as a precursor to his copy trading strategy on ByBit. So, while PlanB may be stating that he is not giving investment advice, he is then promoting users to follow this strategy by copying his “quant investing” trades.

PlanB claims to be offering the information on his trades for free on Twitter, allowing for a “DIY” option. Further, he confirms that he is trading only 10% of his portfolio “mainly because of credit risk.”

cryptoslate.com

cryptoslate.com