Bitcoin, the largest cryptocurrency according to market capitalization, has often been under a lot of criticism for its limited block sizes on their blockchain. The disagreement even led to a hard fork within the cryptocurrency, which subsequently led to the birth of two new crypto assets, Bitcoin Cash and Bitcoin SV.

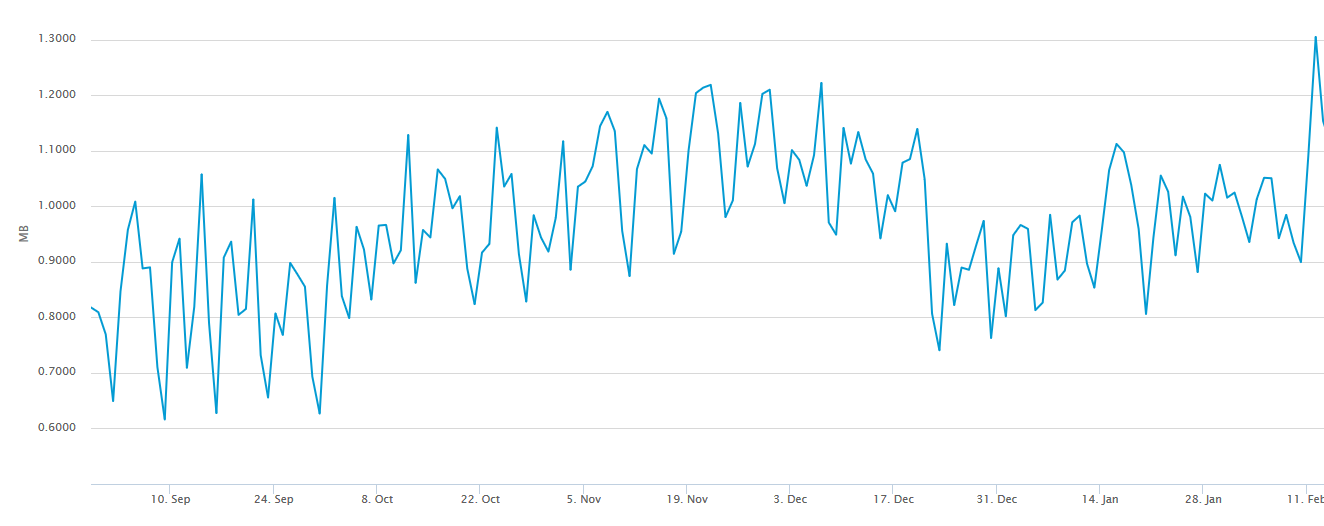

However, according to recent data from blockchain.com, Bitcoin’s daily average block size has reached 1.3 MB, an all-time high.

The blocks of a blockchain act as a digital record book where all the transactions are stored. The independent units are organized into a linear sequence over time as new transactions are constantly being processed and added by miners and the length of the blockchain increases. The higher the number of blocks gets buried in the blockchain, the more difficult it is to remove and make changes in the blockchain, contributing to the irreversibility of Bitcoin’s blockchain.

Average Block size graph | Source: Twitter

According to the chart, the rate of the average block size has been gradually increasing since the turn of the year, after dipping to around 0.80 MB in December 2018.

The blocks mined at press time, which is approximately every 10 minutes, is marginally larger than the previous limit of 1MB which was put in place by the Bitcoin network. The improved block size can be attributed to the introduction of Segregated Witness [SegWit] in August 2017.

Since the introduction of SegWit, the concept of ‘block size’ has been slightly updated to ‘block weight,’ allowing block capacity to be raised up to 4 MB in capacity. In the current Bitcoin network, around 40 percent of all Bitcoin transactions are using the concept of Segwit.

The implementation of SegWit has also opened the possibility for off-chain scaling of which the Lightning Network is the prime example. The Bitcoin Lightning Network is currently growing at a rapid pace due to the involvement and support of crypto users and high-profile personalities.

Moreover, according to blockchain.com, the implementation of SegWit might have also affected transaction fees and transaction rates on the Bitcoin network as they have approached their all-time low and all-time high respectively.

ambcrypto.com

ambcrypto.com