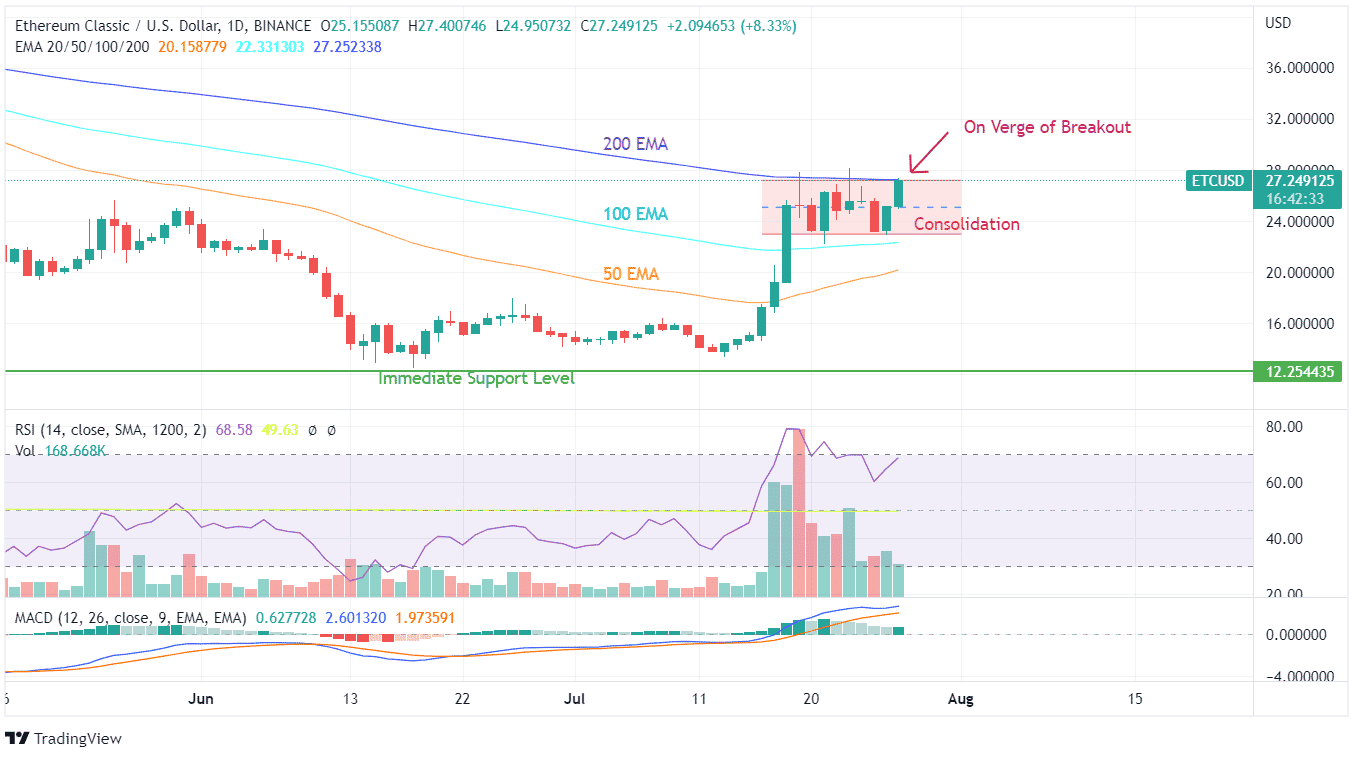

Ethereum Classic has turned into a rocket after its sudden spike and strength in holding the resistance zones. The subsequent gains made in July so far were defended in three instances, showcasing a strong belief of buyers in ETC’s price trajectory, changing the expectations from consolidation to breakout scenario.

At $27, while ETC has reached its 200 EMA, further upside movement would be taken as a breakout creating a FOMO (Fear Of Missing Out) amongst the possible buyers. The gains made in this month have already breached the 50 and 100 days exponential moving average while facing trouble near the 200 EMA curve. As the 200 EMA curves turn straight, the change in dynamics indicates a breakout and bull run.

Ethereum Classic holds the #21 market position with a capitalization of $3,684,714,765 with 65% token circulation. The overall gains made in recent weeks are a clear result of speculative buying, which could bring bigger troubles despite its positive movement. On weekly charts, the positivity has been maintained in the last four weeks with the current week being close to a breakout forming a pin bar candle that signifies buying strength at lower levels.

After two previous rejections, the strength displayed in the third attempt to breach $27 is praiseworthy. Technically the charts are showcasing a breakout point after the significant upside movement since June 13 lows. Check out Ethereum Classic price prediction for a detailed perspective on how the token may perform in the future!

ETC token has taken a huge leap in value from $12 to $27, resulting from alternative side effects of the Ethereum blockchain. Despite the ETC and ETH tokens having similar origins, ETH is yet to move on towards its Proof of Stake validation process to reduce transaction costs. Ethereum Classic, even at this date, costs significantly less for an average transaction fee than ETH.

Since Decentralized Applications working on the Ethereum blockchain can also be operated on Ethereum Classic’s blockchain, this logical thinking has created a huge demand for ETC tokens. As a result, it has gained great value recently.

Expectations from ETC could backfire since the security element offered at ETH is much higher owing to its higher market capitalization. Hence, the price momentum we are witnessing may be a result of speculation.

Speculation could bring in profits for holders but can also destroy them completely as there is no concrete evidence that ETH transaction costs will remain high. On the technical indications, RSI is trading at overbought zones close to 70 while MACD continues to move in the positive axis, preventing the expected bearish crossover. Current price actions could turn into a trap if buyers plan to book profits after inciting higher transactions at the Ethereum Classic blockchain.

cryptonewsz.com

cryptonewsz.com