BAT and 1INCH prices are steadying above key support lines. BAT/USDT may float to $0.95 while the uptrend is valid if INCH/USDT holds above $2.2.

Basic Attention Token (BAT)

BAT is for rewarding attention. Launching from Ethereum, the Basic Attention Token platform aims to disrupt advertising while preserving surfer’s privacy.

Past Performance of BAT

In roughly seven weeks, since mid-May 2021, BAT prices are trending below the 20-day moving average, signaling bears.

There might be confidence that crypto markets could recover.

However, reading from the daily chart, bears are still firm, successfully unwinding bulls’ attempts.

At press time, BAT is up four percent against the USD, BTC, and ETH.

Day-Ahead and What to Expect

There has been confirmation of the double-bar bullish reversal of June 21 and 22 amid decent trading volumes.

Still, BAT bulls found resistance at $0.60 after bouncing from May and June 2021 lows of around $0.50. A breakout above $0.60 will tilt price action in favor of buyers.

BAT/USDT Technical Analysis

By June 2021, BAT was down over 75 percent from 2021 peaks.

Technically, BAT bulls may buy the dips as long as prices are above $0.50.

However, a more unmistakable trend will emerge once bulls close above $0.60, reading from price action in the daily chart.

In such a case, the immediate target for BAT stands at $0.95—April 2021 lows.

1Inch Exchange (1INCH)

The aggregating platform operates from Ethereum and the Binance Smart Chain (BSC). 1INCH is native to the dApp, useful in governance.

Past Performance of 1INCH

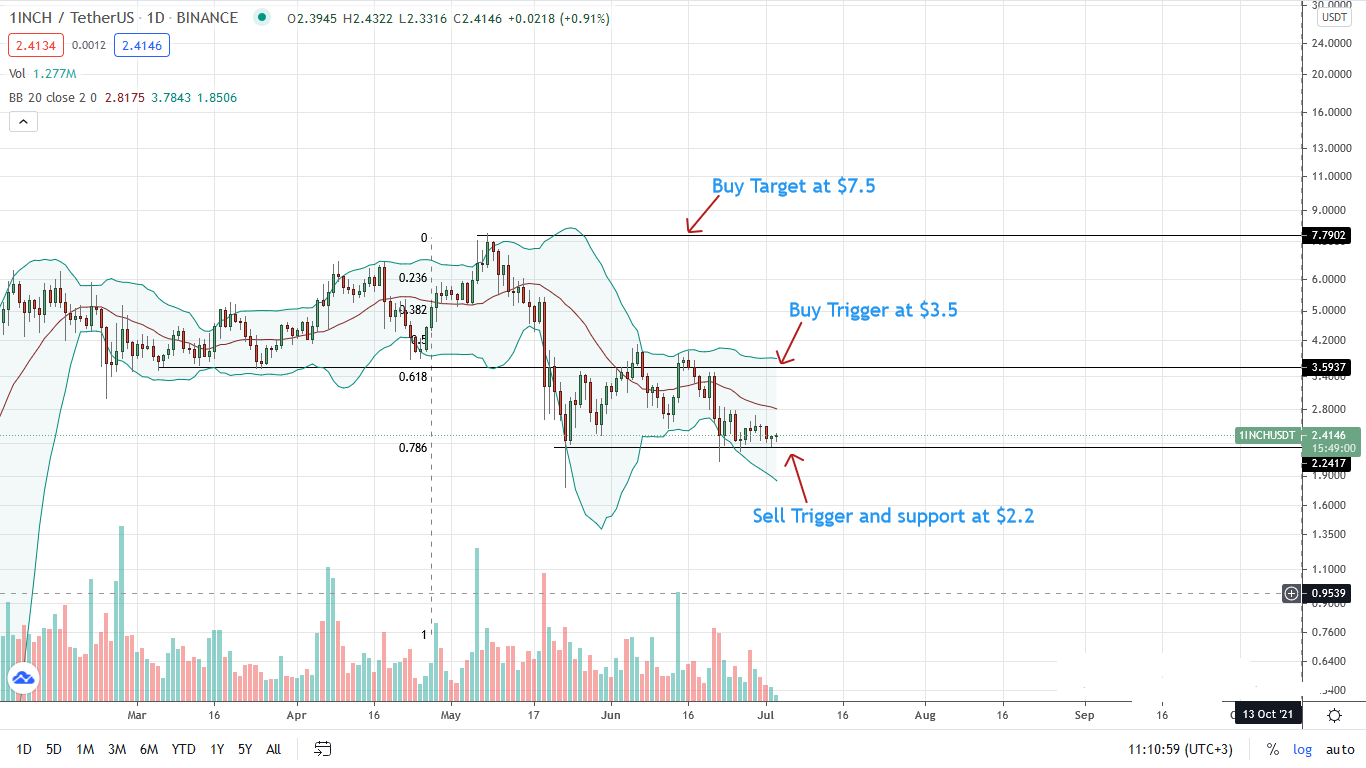

Prices range within a $1.3 zone with support and resistance at $2.2 and $3.5, respectively.

At the time of writing, 1INCH is up four percent, bouncing from $2.2 with light trading volumes.

In all, 1INCH/USDT prices are flat-lining within a tight intra-day range.

Day-Ahead and what to Expect

For buyers to be in control, $2.2 must hold firm.

In that case, a gradual expansion is welcomed in a possible accumulation after deep losses in May and June 2021.

Buyers will be back in contention if there is a break above $3.5. If not, losses below $2.2 may push 1INCH towards $0.75.

1INCH/USDT Technical Analysis

Sellers are in control as per price action in the last two months.

Still, there is hope for 1INCH bulls.

A close above $3.5 may see trend continuation to $7.5—a retest—as 1INCH/USDT reverses from the 78.6 percent Fibonacci retracement level.

Bears will flow back if there is a breakout below $2.2.

cryptoknowmics.com

cryptoknowmics.com