Key highlights:

- COIN is up around 20% from last week’s ATL of $210

- The stock distributed by the largest exchange is still down around 40% from the ATH price at $430

- The stock has been in a consistent downtrend since being listed on the Nasdaq on April 14th

Coinbase conducted its IPO in mid-April, and its stock is down around 40% from its opening price as it trades around $255 per share. The immediate downtrend was largely attributed to the fact that Coinbase went public through a direct listing, putting no restrictions on early investors to sell their shares on the first day of trading. Additionally, the fact that BTC is down from the $62,000 highs has also had an impact on sentiment around Coinbase.

The world’s leading cryptocurrency exchange still is in the driving seat as it continues to innovate. Alongside serving retail customers, the exchange also has an institutional arm to serve institutions.

According to an estimate from Trefis published on Forbes, Coinbase's sales are projected to quadruple to $6 billion in 2021, and net profits could hit as high as $2 billion.

Unfortunately, the exchange is still very sensitive to overall market movements and, therefore, has an impact on their profit. In a bear market, typically, there are fewer traders, which results in fewer exchange fees being generated.

Roughly 90% of the company’s revenues are from transaction fees, with the other 10% coming from sales of its own crypto assets to customers.

In recent news, Coinbase Germany received a license to custody and trade crypto assets in Germany. The German financial regulator, BaFin, provided the license this week, making Coinbase the first company to receive the license. This license will now allow Coinbase to continue operating inside Germany whilst being fully compliant and regulated.

The current market cap of Coinbase is now at $53.19 billion. This puts it in the top 300 ranked companies in the world according to market cap.

Let us take a quick look at the markets and see where we might be heading.

COIN price analysis

What has been going on?

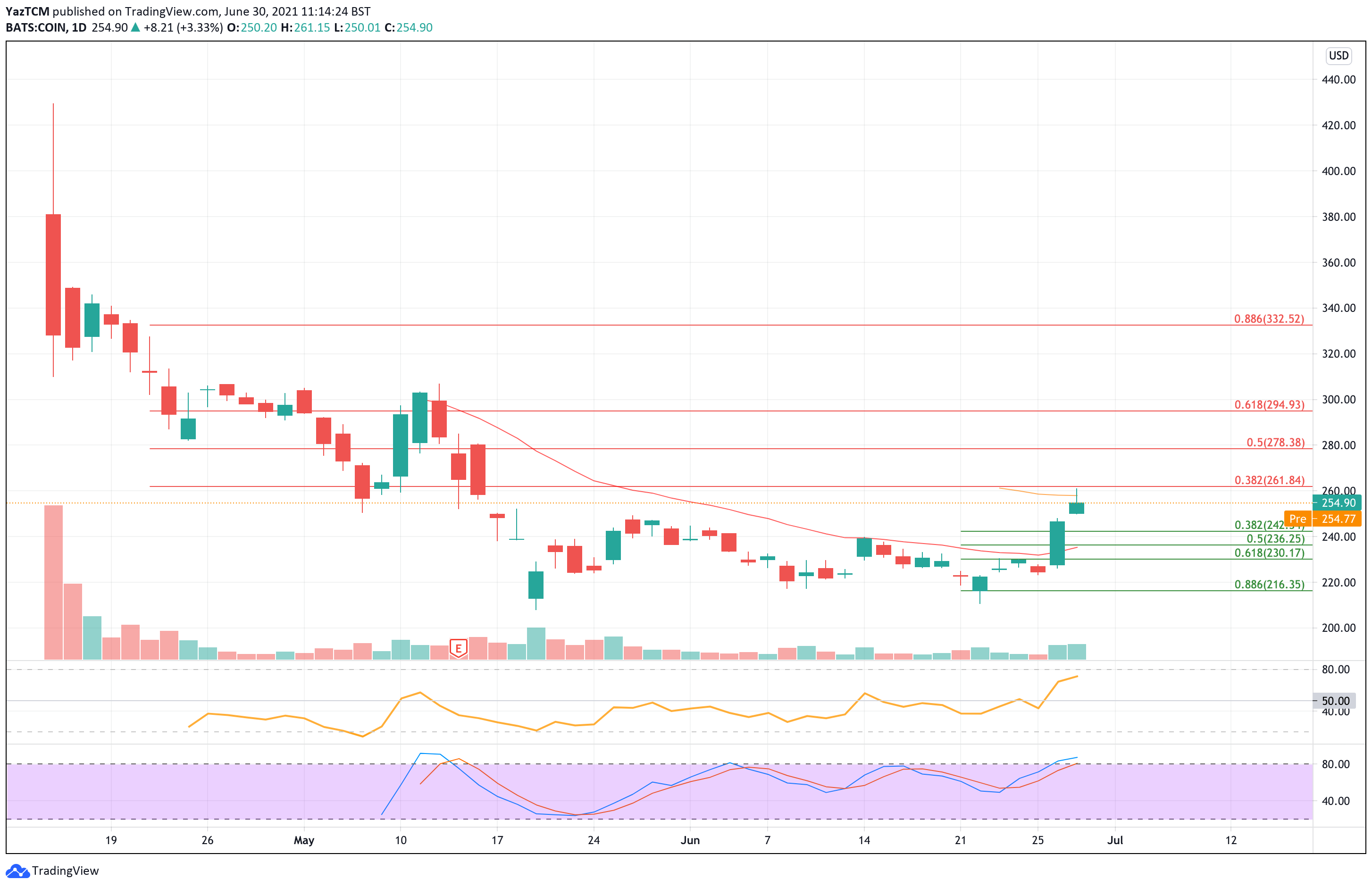

Looking at the chart above for COIN, the ticker for the Coinbase stock, we can clearly see that the direct IPO sale had quite an impact from day one. COIN launched with a price above $400, and it quickly started to fall as early investors sold off their stocks.

In May, COIN only managed to briefly climb above $300 before it started to dip further again and hit an ATH low of around $208 during the mid-May market capitulation. Since then, it traded within a range between $250 and $200 and only managed to break this range yesterday with a push higher above $250.

Yesterday, COIN managed to continue to climb as it hit resistance at $261.85, provided by a bearish .382 Fib Retracement level.

The breakout of the current range could be a signal that the bearish trend for COIN has come to an end, and the bulls might be ready to push the market higher again.

COIN price short-term prediction: Neutral

After breaking above the previous range, COIN is still considered to be neutral right now. It would need to break above the May highs at around $300 to start to turn bullish in the short term. On the other side, a break beneath $220 would likely send the stock into a bearish spiral again.

If the sellers do push lower again, the first support lies at $250. This is followed by support at $242 (.382 Fib Retracement), $236 (.5 Fib Retracement & 20-day MA), $230 (.618 Fib Retracement), and $220.

Where is the resistance toward the upside?

On the other side, the first resistance lies at $261.85 (bearish .382 Fib Retracement). Above this, resistance is expected at $278.38 (bearish .5 Fib Retracement), $395 (bearish .618 Fib Retracement), and $300.

If the bulls can continue to press beyond $300, resistance lies at $320, $332 (bearish .886 Fib Retracement), $350.

coincodex.com

coincodex.com