Market intelligence firm Glassnode is assessing a trio of crypto assets as the markets seek to end the week on a positive note.

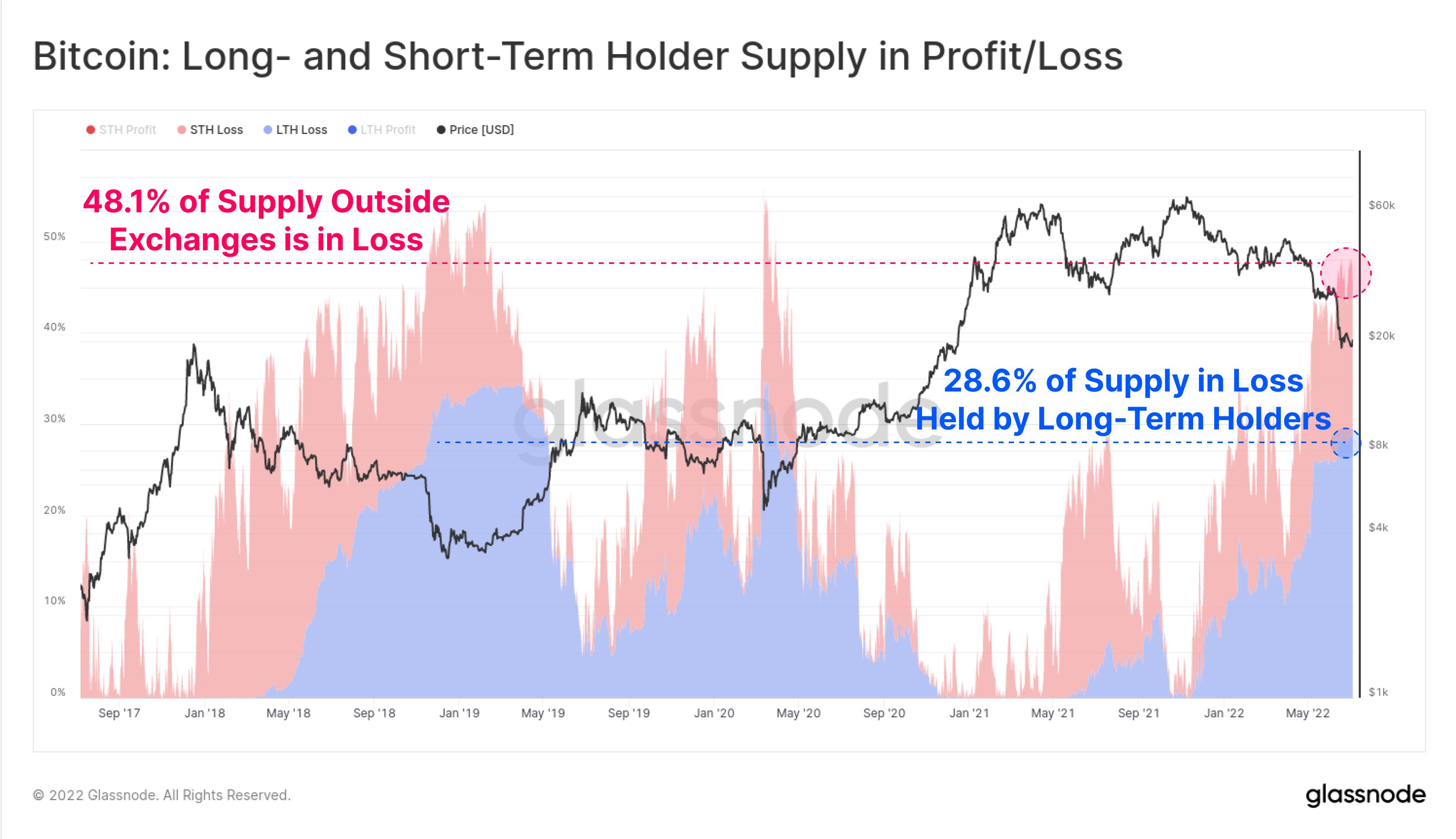

In its latest analysis, Glassnode says nearly half of the Bitcoin (BTC) located in non-exchange wallets are sitting on unrealized losses.

According to Glassnode, nearly 60% of those owners are considered long-term holders, mirroring the past two capitulation events.

“The proportion of Bitcoin supply in loss has hit 48.1% of all coins held outside exchanges.

Of these BTC in loss, almost 60% of them are held by long-term holders (28.6% of total).

Both metrics are at similar levels to the November-December 2018, and March 2020 capitulation phases.”

Bitcoin is rallying today, up 5.19% over the last 24 hours, trading for $21,705.

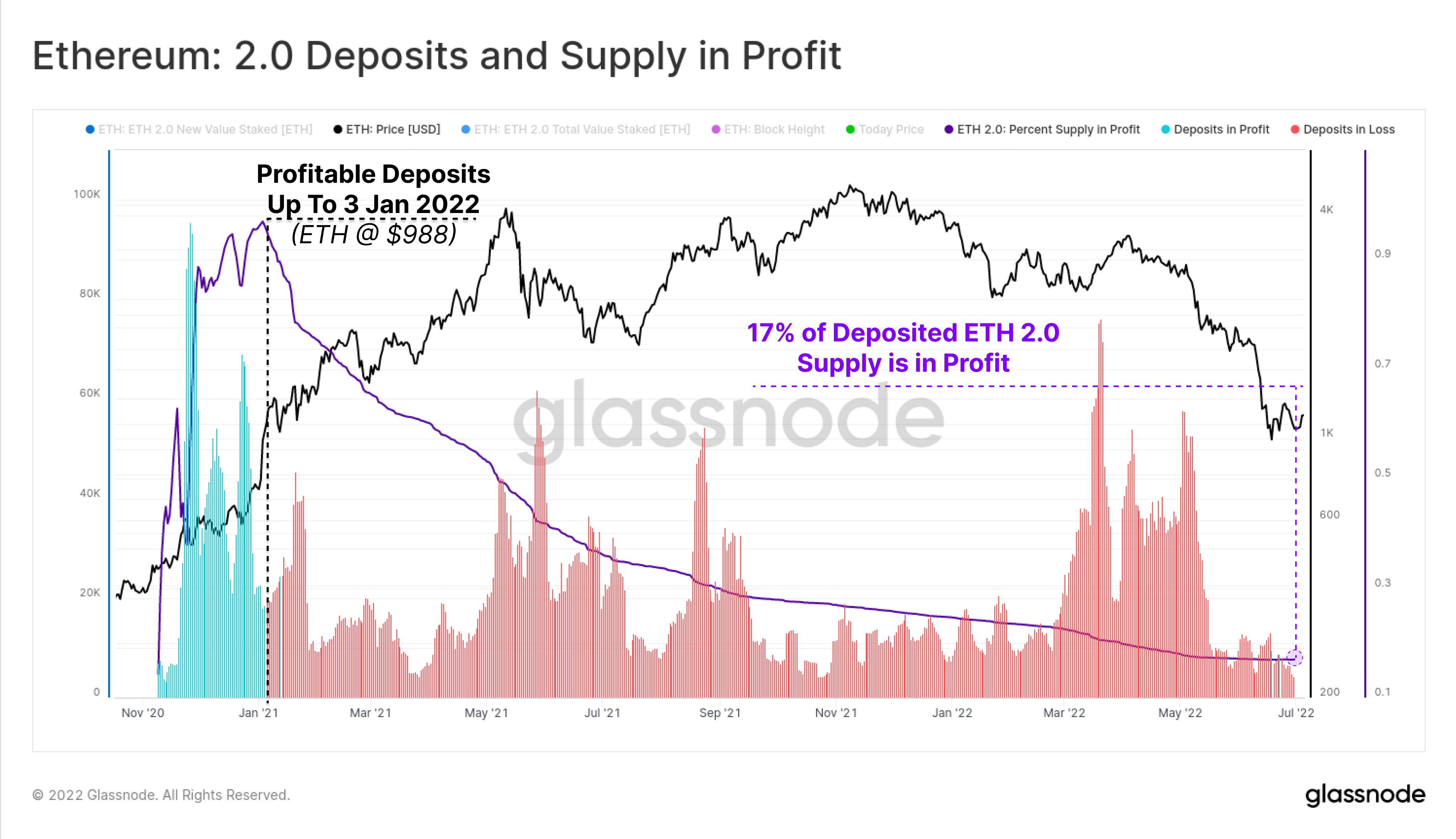

Moving onto Ethereum (ETH), the analytics firm observes the vast majority of stakers on ETH 2.0 are in the red because ETH has collapsed by over 75% since November of 2021 and staked tokens will remain locked until the upcoming Shanghai hard fork is complete.

“Ethereum 2.0 stakers have deposited over 12.98 million ETH, with 62% of it flowing in before the November [all-time high].

However, with ETH prices collapsing over 78%, and coins unable to be withdrawn, only 17% of staked ETH is now in profit.”

Ethereum is changing hands for $1,221 at time of writing.

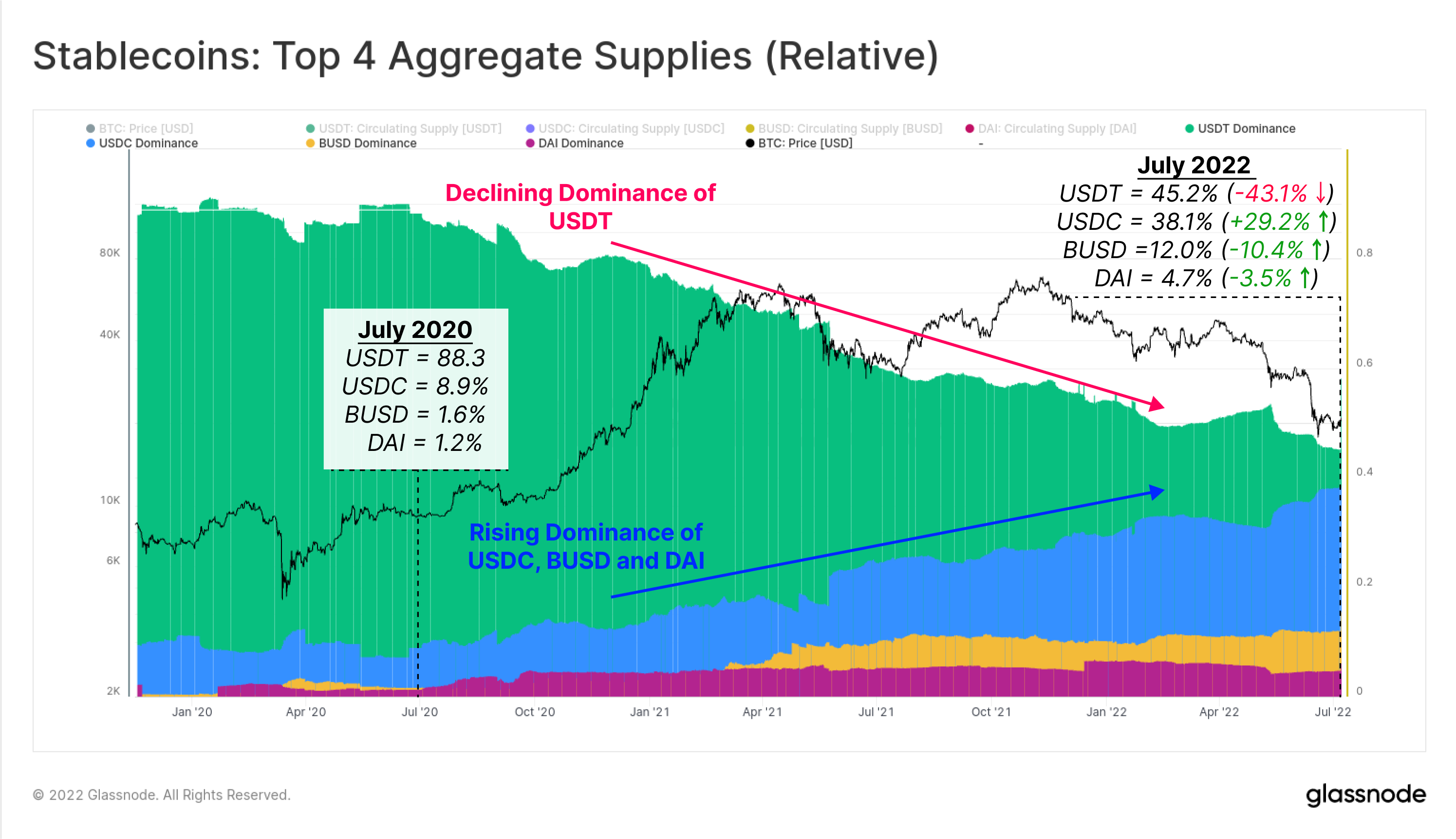

Glassnode then analyzes the changing stablecoin landscape. The US dollar-pegged Tether (USDT) dominated the niche up until two years ago but has since declined in popularity by nearly 50%.

The firm highlights three other stablecoins which have gained market share, including US Dollar Coin (USDC) at 38.1%, Binance USD (BUSD) at 12.0% and Dai (DAI) at 4.7%.

“Over the last two years, the dominance of Tether has been in macro decline.

USDT has fallen from 88.3% of the stablecoin market to 45.2% today, now less than half of the market.

USDC dominance has grown 4.2x, BUSD by 7.5x, and DAI by 3.9x over the same 2-year time frame.”

dailyhodl.com

dailyhodl.com