Cosmos blockchain targets to replace bitter rivalry amongst cryptocurrencies with acceptance and collaboration. It enables blockchains to interact with one another, adding to the existing level of scalable interoperability. It uses a unique consensus mechanism named Tendermint, created by one of Cosmos’ co-founders. Cosmos can handle 10,000 transactions per second, which offers decent scalability.

Cosmos adds a cap on the number of existing validators, which could be a blow to complete decentralization. But the network can connect Proof of Stake and Proof of Work blockchains through its nomenclature of zones and hubs. Just one Cosmos hub can get the job done, and of course, Cosmos also has a native token called ATOM, which makes it possible to stake, pay for transactions, and be involved in the governance process.

ATOM tokens are earned via staking, which has a circulating supply of 286,370,297.00 ATOM without a declared total supply. ATOM currently has a market capitalization of $2,582,526,805, ranking it at the 25th position in the crypto world based on its size.

Cosmos (ATOM) cryptocurrency has initiated the trend reversal signals, making it among the top trending tokens. Surpassing the previous rejection near the 50 EMA could prove to be a turning point in the price projection of the ATOM token. Check our ATOM price prediction to know when the token will cross the 50 EMA level.

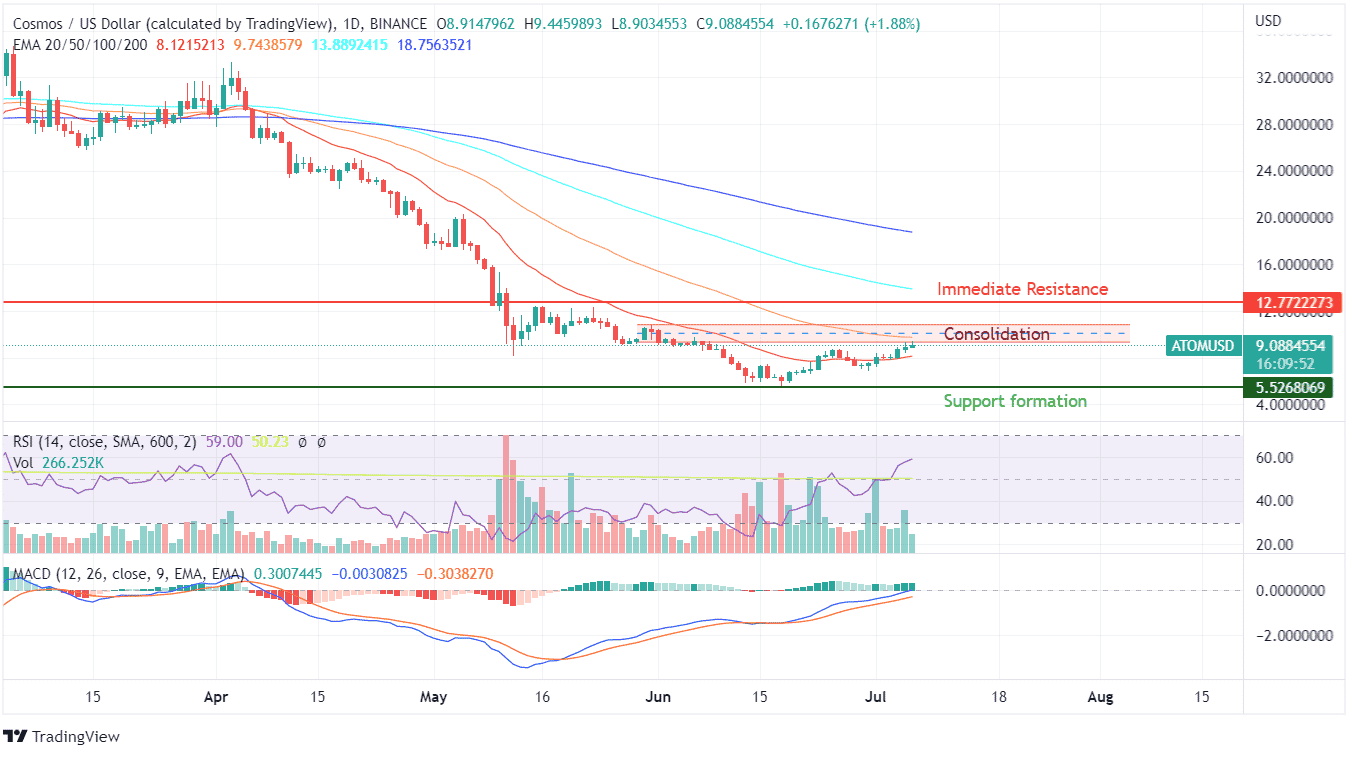

Since April 2022, the ATOM token showed a clear downtrend without signs of stopping by breaching back-to-back short-term support levels. The collapse of the previous set lower limit in May 2022 was merely a signal for a further downtrend that pushed ATOM below $8.1 to test the patience and strength of buyers by dipping to $5.52 in June 2022.

The collapsing market values dented the price but buying sentiment, and transaction volumes suddenly jumped. Market sentiments have again improved by a slight margin as clearly negative, and seller-dominated markets entered positive buying sentiment on the short-term charts.

At the same time, ATOM is a consolidating crypto asset on daily and weekly candlestick charts. Immediate support for the short term should be able to hold off the selling sentiment. $9.08 to $12.7 will be testing the strength of buyers since markets have reversed from these levels on the previous two occasions.

Hence, overcoming the $12 mark would be an extreme bullish sentiment for the long-term price trend of the ATOM token. Immediate resistance is active at the $12.7 mark on the daily charts.

Exponential moving averages of 50 days at $9.74 and 100 days at $13.88, with the RSI indicator trending at the 59 mark, are a fairly positive zone considering the rising token value. The MACD indicator is holding off the bearish sentiment indicating the possibility of this short-term bullish trend continuing.

cryptonewsz.com

cryptonewsz.com