A popular crypto analyst warns the strength of the US Dollar Index (DXY) spells bad news for both digital assets and the stock market.

Crypto trader Justin Bennett tells his 101,900 Twitter followers that DXY’s current surge points to Bitcoin (BTC), Ethereum (ETH) and the stock market remaining down for at least a year.

“Many won’t like this but…

The DXY closed above a significant multi-year level in June, and today we’re seeing new 20-year highs from the dollar index.

All signs point to 120, suggesting another 12-20 months of suppressed movement from stocks and crypto.”

The trader says that the stark warning comes with a silver lining for crypto bulls.

“Here’s the silver lining…

This is the monthly chart, and 12-20 months is a long time. So it’s very likely that we will see several relief rallies from crypto during this time.

Just because the DXY is trending higher doesn’t mean risk assets can’t stabilize or even rally.”

Assessing Bitcoin specifically, Bennett warns his traders not to trust sudden weekend or holiday price action, as BTC has now canceled out its move over the last several days.

“This is why you don’t trust weekend moves and/or those during US holidays when cash markets are closed.

BTC right back below $19,800 on the last 4 hour close.”

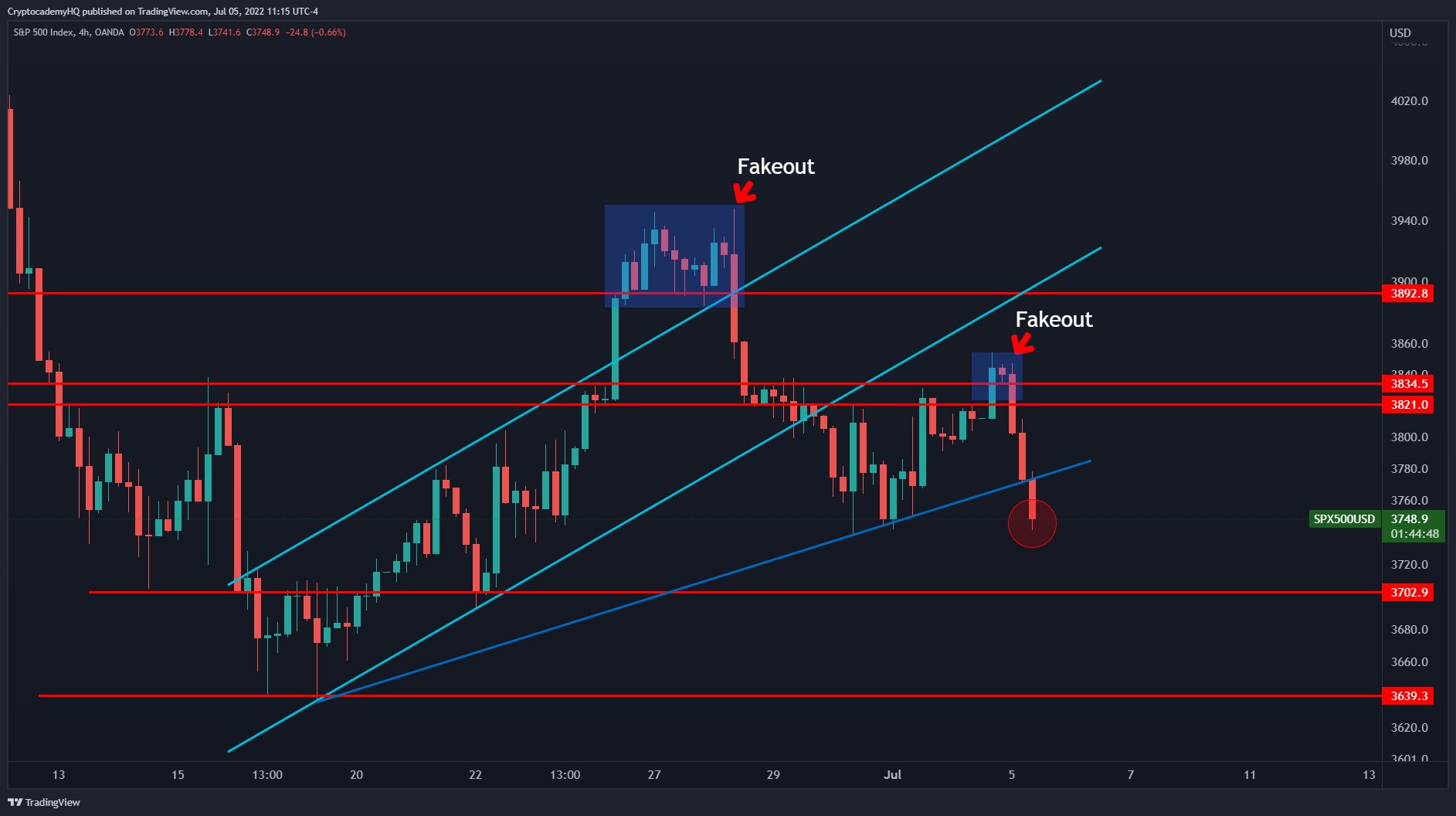

Looking at the stock market which often trades in tandem with crypto, Bennet says the S&P 500 Index’s recent price action is hinting at further pain to come after a big fakeout.

“Second fakeout from the S&P 500 since late June. This one was above that $3,820/40 area.

$3,700 and $3,640 are the next key supports. But I think the S&P is on its way to the 3,400 pre-COVID high.”

dailyhodl.com

dailyhodl.com