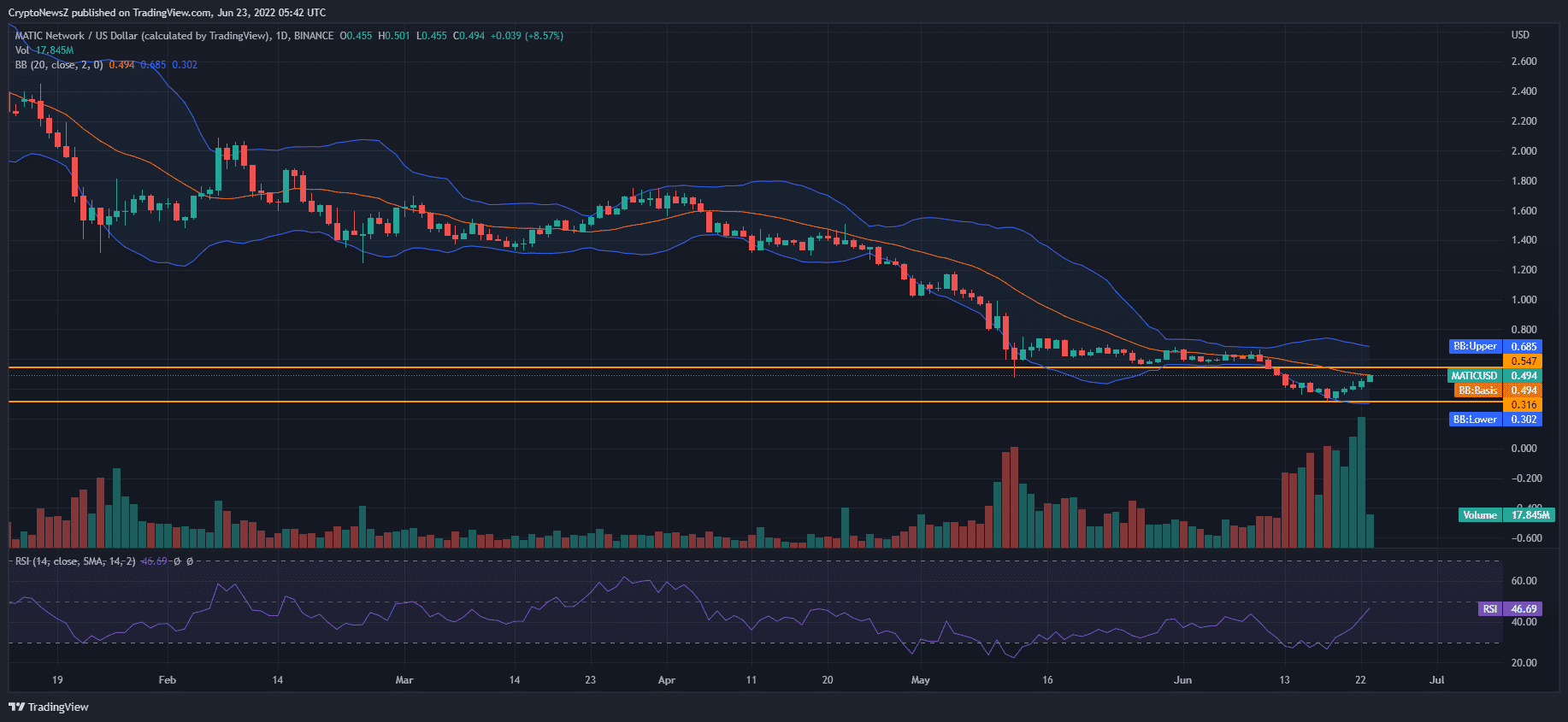

MATIC token entered into a lower band trading zone in the first week of April 2022 and since then has failed to trade above the standard moving average levels. While the shift towards a negative trend was quick, the consolidation after May 2022 creation of fresh lows initially provided some confidence that crypto values would spike again. But the onslaught of LUNA failure added to the negative trend pushing new lows again.

The MATIC token has so far failed to trade in the upper band zone of Bollinger bands which indicates the overall negative sentiment that is pushing enthusiastic buyers away from this token. While transactional volumes hit a fresh high during the last week’s creation of fresh lows, the prices are again attempting to consolidate. In the present scenario, the MATIC token has shown some bounce-back potential. Still, until the value manages to touch the upper band of the Bollinger indicator, one should maintain their distance from this negatively biased token.

With 80% of its MATIC tokens already in circulation, MATIC holds the 18th spot based on its market capitalization, which is nearly $3.3 billion. In the last year-to-date timeline, the Polygon crypto has shown a dip of 84% (calculated on its last trading value of $0.40085).

MATIC Price Analysis

On one-day candlesticks, the MATIC token has shown some pushback from buyers during the May 12, 2022 crash that enabled the day to end with a lower wick. Repetition of a similar price trend within just a month is an alarming situation. Since MATIC is gaining in terms of community investors and developers, the probability of its long-term sustainability cannot be questioned. Investors and traders should explore price projections to get more information regarding the future of Polygon crypto.

Investors might see red on the portfolio, but MATIC is amongst a few promising projects that address real-life problems. The recent June 18 crash also got similar buying from lower levels and even sustained bullish movement on the three consecutive days. Facing resistance again from its median moving average can push the price of Polygon towards the upper trading band again.

RSI indicator is currently moving upwards towards level 50 from 46 with a resultant upside movement. Prolonged consolidation near this level would benefit the crypto in the long term since sellers would have calmed down. Sudden upside movement creates the ambient environment for others to sell MATIC tokens and book immediate profits. Widening Bollinger bands can only indicate a movement towards either a positive or negative direction. Higher wicks and higher volumes during recent days are indications of further recovery, and one should identify such indications for predicting values in the short term.

cryptonewsz.com

cryptonewsz.com