Polkadot price analysis shows that the bulls have taken control of the market in the short term as DOT steps closer to the $9.35 mark. The coin is facing resistance at $9.48, but if it can break above this level, we could see further upside potential towards $9.90 and possibly even $10. The Polkadot price has been on a bearish run over the past few hours a day or so, losing around 8% of its value. However, in the past few hours, we have seen some strong bullish momentum develop that has allowed DOT to reclaim the $9.35 level and step closer to the resistance at $9.48.

The current market dynamics point towards a slightly bullish trend in DOT prices. The bulls have been able to take control of the market and push prices up from the opening levels. The support for DOT/USD prices is present at $9.17, which is likely to provide some buying pressure in the near term. The Polkadot price analysis shows that the digital asset has made a slight bullish run in the past few hours.

Polkadot price analysis on a 1-day price chart: DOT/USD upgrades to $9.35 after bullish efforts

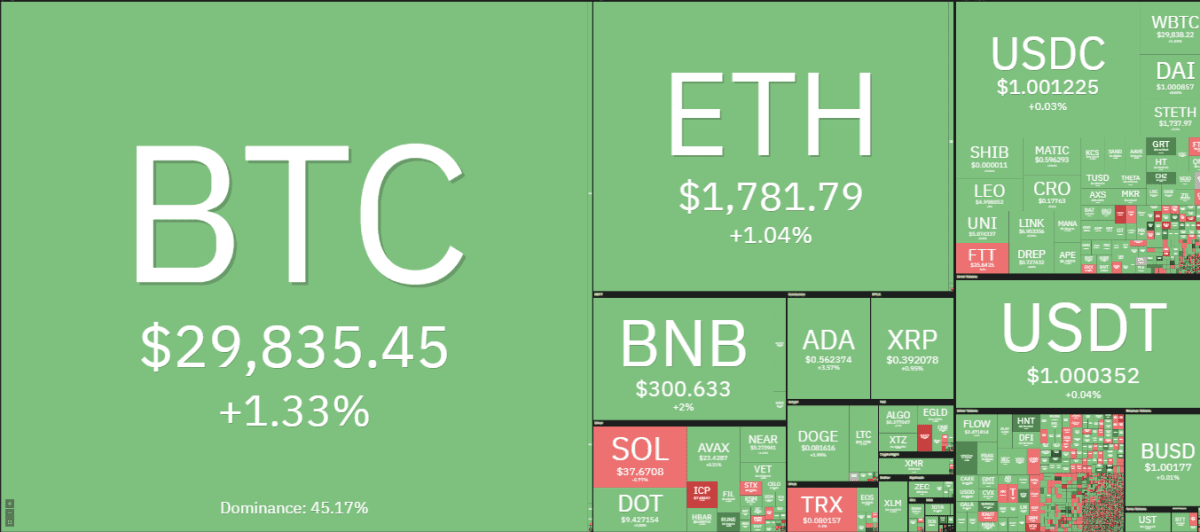

The 1-day Polkadot price analysis chart shows that DOT started the day on a bearish note as it fell from $9.48 to test the support at $9.17. After bouncing back up from this level, we have seen some strong bullish momentum develop that has allowed DOT to reclaim the $9.35 level and step closer to the resistance at $9.48. The market cap on 24-hour trading volume has increased by $9,236,539,287 and the volume market has increased by $306,839,872.

The market volatility is currently high, which is indicative of a bullish trend in prices. The market looks set to consolidate around the current levels as bulls look to take control. The technical indicators are currently giving mixed signals as the RSI is trading close to the overbought levels, which could mean that we could see some bearish momentum develop in the market in the near term.

The MACD is currently trading in positive territory, but it looks like it is about to crossover into bearish territory. This could signal a bearish trend in the market, but it is important to wait for a confirmed crossover before taking any short-term positions. The DOT/USD pair is currently trading at $9.35 and is showing signs of further upside potential. The MA 50 is trading at $9.38 and the MA 200 is trading at $9.35, which shows that the market has some room to move higher in the near term.

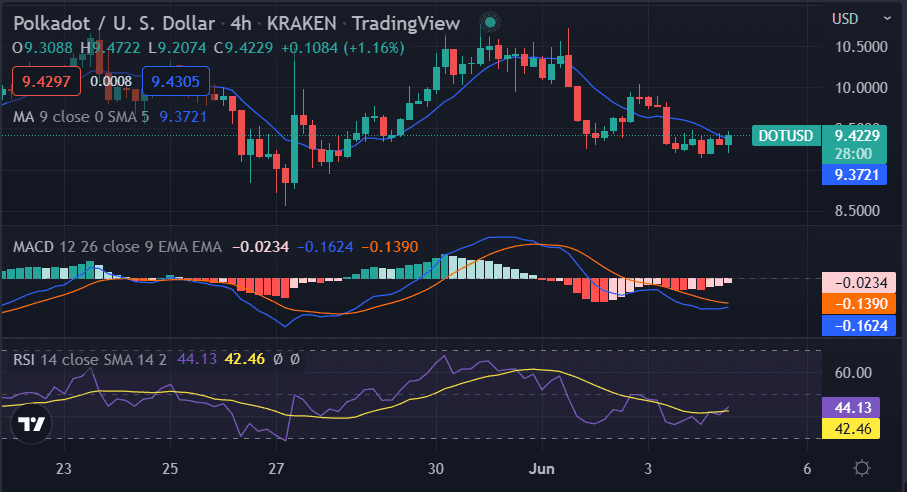

DOT/USD 4-hour price analysis: Recent updates

On 4-hour Polkadot price analysis shows that the price is currently consolidating around the $9.35 level as the bulls look to take control of the market. The prices are in a consolidating state as the market looks to find its next direction. The market is currently facing some buying pressure at the $9.48 level, which is likely to provide some support in the near term. The market looks to be in a slightly bullish trend as prices have been trading above the $9.17 support level.

The MA 50 is currently above the MA 200, which shows that the market has some bullish momentum in the short term. The MACD indicator is currently moving above the signal line, which is a bullish sign. The RSI indicator is currently trading at 56.1, which shows that there is some room for further upside potential in the market.

Polkadot price analysis conclusion

The one-day and four-hour Polkadot price analysis suggests an upward trend for the cryptocurrency as bulls are in the leading position. The bulls have managed to enhance the coin value to a $9.35 high point. The hourly price chart displays green candlesticks for the price function of DOT/USD, which has increased during the past four hours as well.

Disclaimer. The information provided is not trading advice. Cryptopolitan.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

cryptopolitan.com

cryptopolitan.com