Avalanche price analysis shows that the market is in a bearish trend as the price has been on a constant decline in recent days. The market has formed a bearish pennant, which is a continuation pattern, indicating that the downtrend will continue. The market is currently facing strong rejection at the $24.62 resistance level as it attempts to move higher. A downtrend has been observed today as well, as the price has come down to $22.77, which is the support level for AVAX prices.

The market is expected to continue its downtrend as the bearish pennant pattern remains intact. The next support level for AVAX prices is set at $21.61, and a break below this level could see the price decline further to $20.50.The digital asset is currently trading at $24.26 and is down by 1.50% in the last 24 hours. The market cap is increasing and is currently at $6,842,144,545, while the 24-hour trading volume is decreasing and is currently at $673,856,288 the market has been in a downtrend since the beginning of this month as the price has fallen from $35 to its current level.

AVAX/USD 1-day price analysis: Bears increase their steps as the market momentum favors them

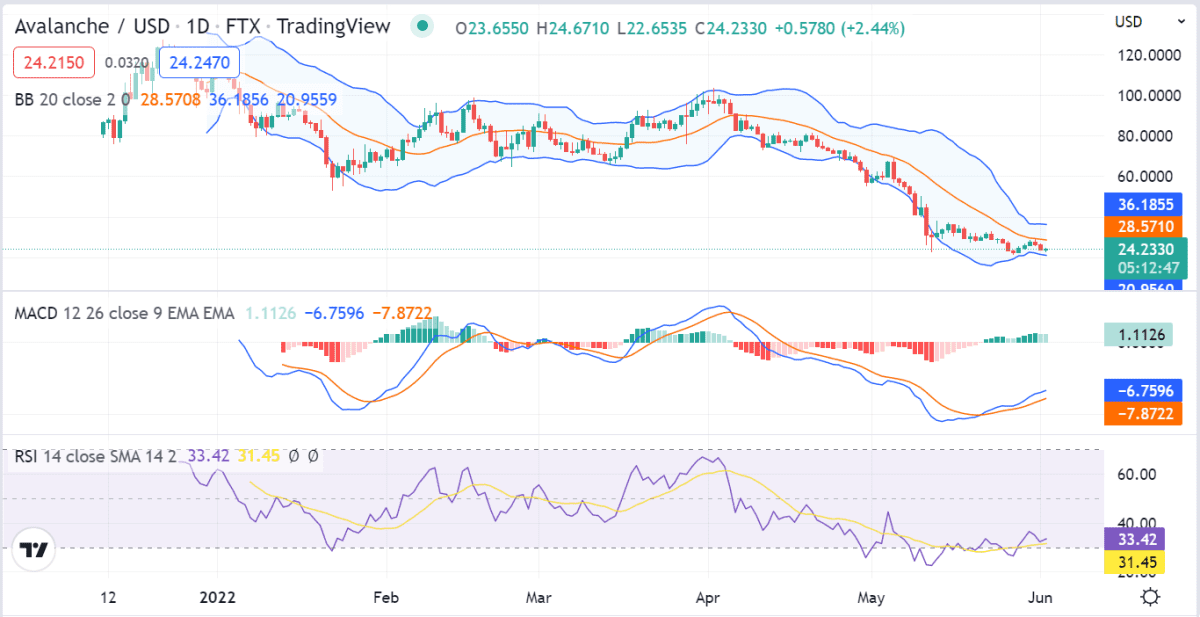

The 1-day price chart for Avalanche price analysis shows that the market is currently in a downtrend as it has formed lower lows and lower highs. The price is currently facing rejection at the $24.62 resistance level as it attempts to move higher. A bearish pennant pattern has also been formed, which is a continuation pattern and indicates that the market will continue its downtrend. The next support level for the market is set at $22.77, and a break below this level could lead to a further decline toward $21.61.

The market momentum favors the bears as the MACD line is currently above the signal line, indicating that the price is likely to continue its downward trend. The Relative Strength Index is currently at 38.46, which indicates that the market is in the oversold region and is likely to see some upward correction in the near future. The Bollinger band indicator shows that the market is currently in a bearish trend as the price is trading below the moving averages.

Avalanche price analysis on a 4-hour price chart: Bulls emerge as the market corrects

The 4-hour price chart for Avalanche price shows that the market is currently in a bullish trend as it has formed higher lows and higher highs. The market is currently facing rejection at the $24.62 resistance level as it attempts to move higher. Bulls have emerged in the market as it corrects from their recent lows.

The market momentum favors the bulls as the MACD line is currently above the signal line, indicating that the price is likely to continue its upward trend. The Relative Strength Index is currently at 46.78, which indicates that the market is in the overbought region and is likely to see some upward correction in the near future.

The Bollinger band indicator shows that the market is currently in a bullish trend as the price is the signal line, indicating that the price is likely to continue its upward trend. The market is expected to continue its upward trend as the bulls remain in control.

Avalanche price analysis conclusion

Avalanche price analysis shows a bearish trend in the 1-day price chart and Bulls have seen to be taking control in the 4-hour price chart. The market is expected to see some upward correction in the near future as the bulls remain in control. The market momentum is favoring the bulls, and the next resistance level for the market is set at $25.The traders are advised to wait for the market to correct itself before taking any position.

Disclaimer. The information provided is not trading advice. Cryptopolitan.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

cryptopolitan.com

cryptopolitan.com