Litecoin price analysis for May 27, 2022, shows the meme cryptocurrency to be following a massive increasing movement for the last 48 hours. The price rose from $61.16 to $63.65 on May 28, 2021. Litecoin continued a rising movement the next day and significantly decreased its value. Today the cryptocurrency continues a bullish movement and is at $63.65 at the time of writing.

Litecoin has been up 0.49% in the last 24 hours with a trading volume of $524,383,121 and a live market cap of $4,466,369,222, and LTC currently ranks at #19. However, the cryptocurrency shows potential for a reversal as the recent price analysis indicates the cost of LTC is moving upwards toward the resistance.

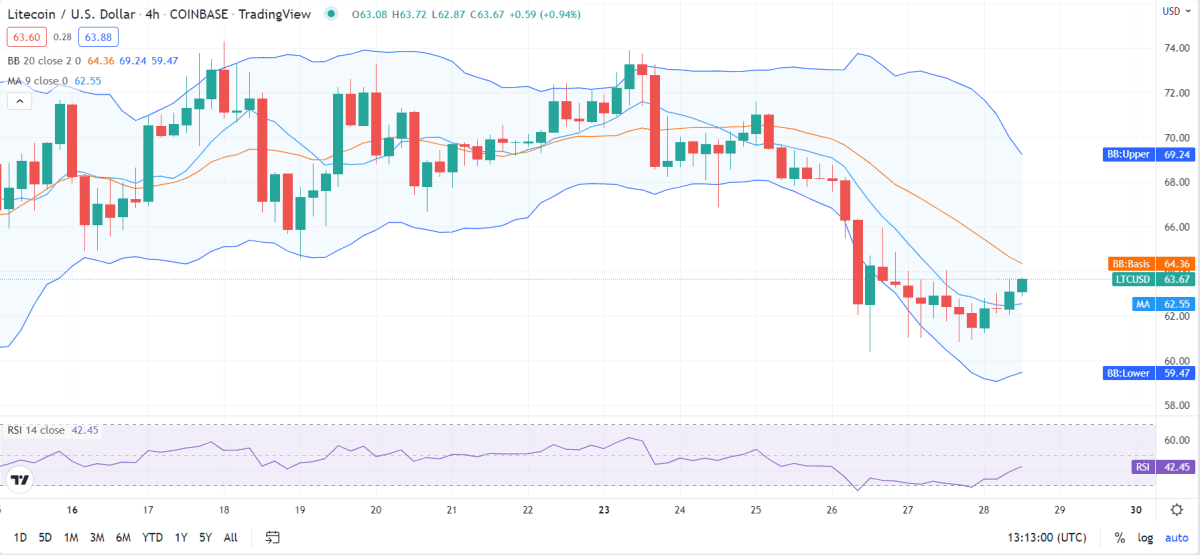

LTC/USD 4-hour price analysis: Recent developments

Litecoin price analysis seems to show the market following a positive movement with the market’s volatility entering a declining movement, consequently closing the market. This makes the cryptocurrency price less prone to experience volatile change on either extreme. As a result, the Bollinger’s band upper limit is present at $69.24, representing the strongest resistance for LTC. Conversely, the lower limit of the Bollinger’s band is present at $59.47, expressing the strongest support for the meme cryptocurrency.

The LTC/USD appears to cross over the curve of the Moving Average, indicating a bullish movement. The price seems to move upwards towards the resistance, attempting to break it. As the volatility happens to close, this could be in favor of the bulls, as a breakout would explode the volatility providing more room to the bulls for further activity.

The Relative Strength Index (RSI) is present at 42, indicating a stable value for LTC, falling in the lower neutral region. The RSI score appears to move significantly upwards, indicating a massively increasing market and dominance of buying activity. The cryptocurrency has entered the stable region and is now looking for a stable place to anchor itself.

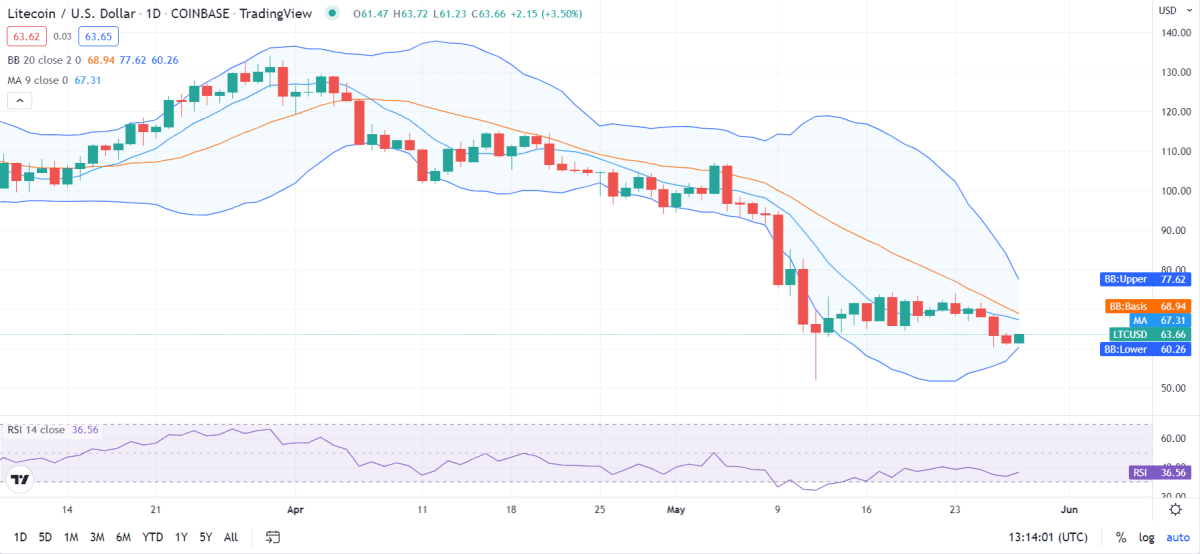

Litecoin price analysis for 24 hours: Bulls dominate LTC

Litecoin price analysis shows the market to be following a declining movement, with its volatility on the down-low. The market appears to be undergoing a squeeze which may indicate future volatility bursts. This makes the LTC price less prone to undergo change on either extreme. The upper limit of the Bollinger’s band exists at $77.62, serving as the strongest resistance of LTC. The lower limit of the Bollinger’s band is present at $60.26, which represents the strongest support for LTC.

Litecoin appears to follow a bearish movement with the LTC/USD price crossing under the curve of the Moving Average. However, the upward movement indicates an increasing market for Litecoin. The price attempts to meet the Moving Average. If they happen to meet, the market will enter an utterly bullish dominion and will cause the price of Litecoin to skyrocket.

Litecoin price analysis reveals the Relative Strength Index (RSI) score to be 36, signifying the low value of the cryptocurrency. Litecoin falls under the lower neutral region, following an upwards movement. The increment in the RSI score represents the dominance of the buying activity and movement towards stability.

Litecoin Price Analysis Conclusion

Litecoin price analysis reveals the cryptocurrency following a shaky bearish movement, showing massive bullish potential. The market shows colossal potential for a reversal in the coming days. If the bulls manage to use it to their advantage, they might engulf the market and help raise the price of Litecoin beyond expectations.

Disclaimer. The information provided is not trading advice. Cryptopolitan.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

cryptopolitan.com

cryptopolitan.com