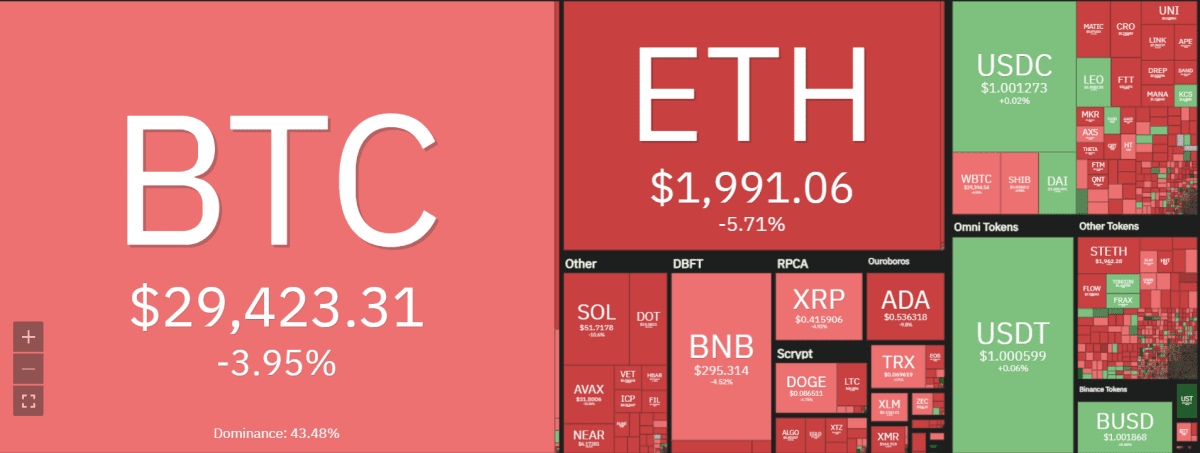

Solana price analysis shows complete bearish momentum with room for further bearish activities. Bears have a firm grip on the SOL market, and they are expected to continue to grow in influence. In addition, because of the recent decrease in price, the bears now believe that another devaluation is coming soon. Because of this, the bears appear to have good footing and may soon engulf the market. Similarly, the price of SOL has dropped from $58 to $42,69, and it’s been stuck there ever since.

The market shows the price of Solana’s negative movement at the $50 mark. Solana continues a bearish movement. SOL currently trades at $42,69; SOL has been down 7.82% in the last 24 hours with a trading volume of $1,703,331,928.40 and a live market cap of$17,852,287,001.50. SOL currently ranks at #9 in the cryptocurrency rankings.

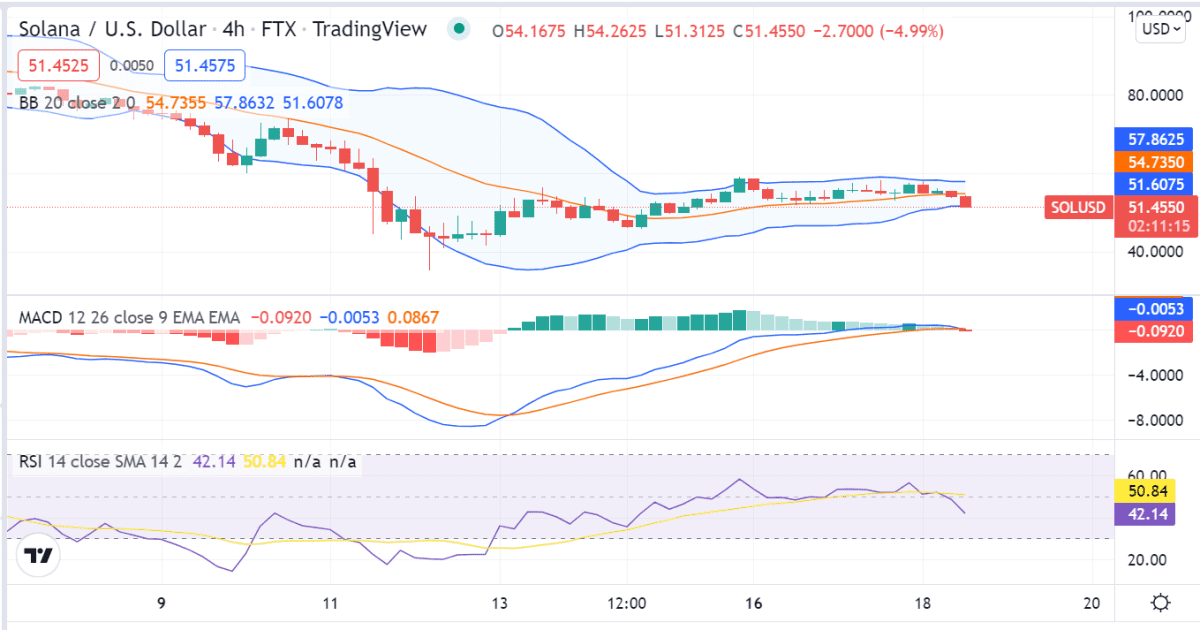

SOL/USD 4-hour price analysis: Latest developments

Solana price analysis illustrates that the present condition of the market demonstrates positive potential as the price moves downward. Moreover, since the market’s volatility follows a slight closing movement, cryptocurrencies are less likely to experience significant changes on either end. As a result, the Bollinger Band’s upper limit is set at $60, with this as the main barrier for SOL. Conversely, the lower limit of the Bollinger’s band is present at $40, serving as a support point for SOL.

The SOL/USD price travels under the Moving Average curve, indicating the market is following a bearish movement. However, as the market experiences declining volatility today. In addition, the SOL/USD price seems to move towards the support, signifying a possible reversal movement, which could possibly break the bearish momentum.

A look at Solana price analysis shows that the Relative Strength Index (RSI) score is 39, indicating a stable cryptocurrency that has fallen into the lower neutral region. Traders will want to look for buy signals if the RSI score rises slightly, signaling that buying activity outweighs selling activity and is moving in a favorable direction.

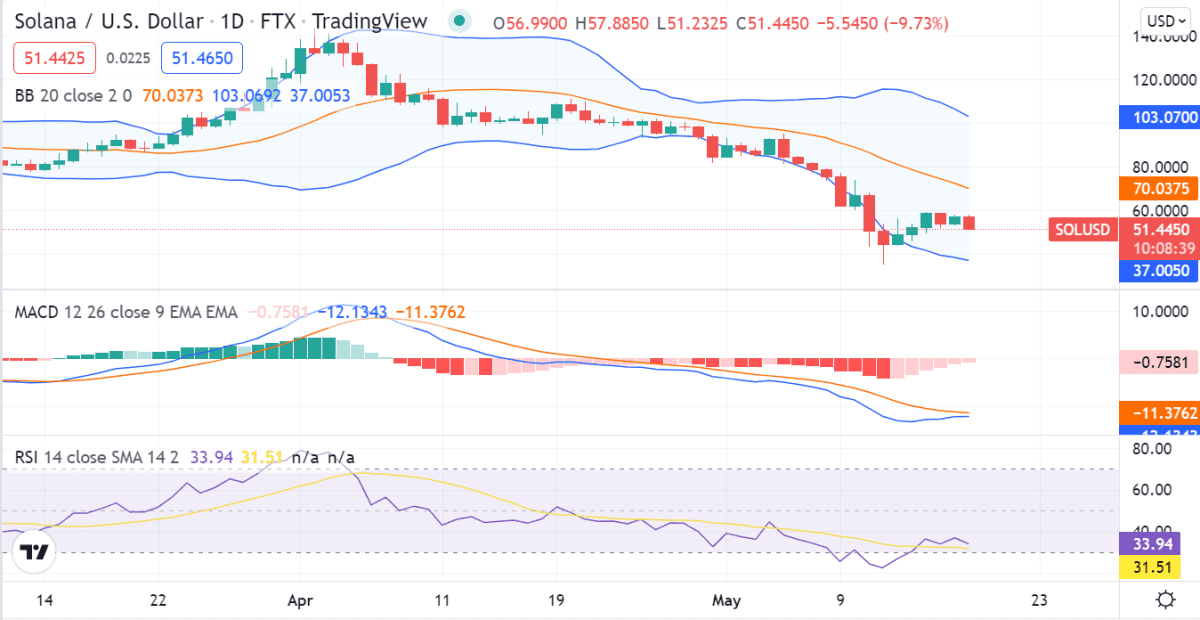

Solana price analysis for 24-hours: SOL market likely to decline further

The market situation for SOL is not favorable as the price action has been bearish for some time now. In addition, there is a lot of negative pressure on the market, which could lead to further downside. Furthermore, the market looks like it is heading towards the $40 mark, which is a key support level. If this level is breached, it could lead to further downside.

The market conditions for SOL are not favorable as the price action has been bearish for some time now. In addition, there is a lot of negative pressure on the market, which could lead to further downside. The volatility opens, and the value of the cryptocurrency moves with a volatile change; the price is more prone to variable change in this instance. As a result, the upper limit of the Bollinger’s band rests at $114.4, serving as the most substantial resistance for SOL. The lower bound, on the other hand, is set at $42, which is where the Bollinger’s band provides its greatest support for SOL.

The Relative Strength Index (RSI) score appears to be in the middle of the pack at 50, showing that neither buyers nor sellers have the upper hand. However, as the market conditions are not favorable, it is likely that the RSI score will move towards the lower neutral region. The Moving Average Convergence Divergence (MACD) line is over the signal line, indicating a bearish market. Furthermore, the MACD histogram is trending downward, which is another bearish sign.

Solana price analysis conclusion

According to our Solana price analysis, Solana’s price is in a bearish trend and has the potential for significant drops in the near future. The main support level is at $40, and if this level is breached, it could lead to further downside. The market has been taken by the bears. If the bulls don’t respond soon, the bears will gradually take control of the market. However, since the bears have such a large potential, they can take the market entirely if the price breaks through support. Then, in the bulls’ favor, market dynamics may be altered.

Disclaimer. The information provided is not trading advice. Cryptopolitan.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

cryptopolitan.com

cryptopolitan.com