Bitcoin is having a quiet weekend, with it not moving much after $42,000 held, at least for now.

That’s even while one of the G20 economy, Russia, selectively defaults. S&P Global, the rating agency, said ruble payments made this Monday on dollar denominated bonds amounts to Russia breaching its obligations.

“We currently don’t expect that investors will be able to convert those ruble payments into dollars equivalent to the originally due amounts, or that the government will convert those payments within a 30-day grace period,” S&P said.

Russia tried to make the payment of $649 million in dollars from their frozen foreign currency reserves, but it was blocked by the US treasury.

“This would be a purely artificial situation,” Kremlin spokesperson Dmitry Peskov said on Wednesday. “There are no grounds for a real default.”

Why was the payment not made in dollars then? Analysts say Russia can afford to make these payments as they receive foreign currency through their oil and gas sales, but some $300 billion in foreign reserves have been frozen.

That raises the question whether Russia can realistically make these payments with any non frozen foreign currency reserves which they might need to procure for the army and other imports that may take priority over making these bond payments.

A question that is a bit academic because they’re not paying in dollars and therefore they have defaulted, although there is a 30 days grace period.

This may trigger next month credit default swaps, which are an insurance of sorts on default risks. Then specialists in distressed assets may scoop up these bonds based on estimates of what they can recover, including by the repossession of assets that the Russian government and state companies may have outside their jurisdiction.

They can also just accept these rubles, but Russia has prohibited Russians – or anyone else in Russia – from exchanging rubles into dollars, so who exactly will buy these rubles from these bond holders?

Accepting them would mean having to do business in Russia by investing them there, something politically very fraught currently as Russia might just seize these assets.

US and European investors in addition have now been prohibited from buying Russian bonds. Making this worse than a junk market for foreign investors, down to basically default from an investment grade BBB rating with a stable outlook just two months ago.

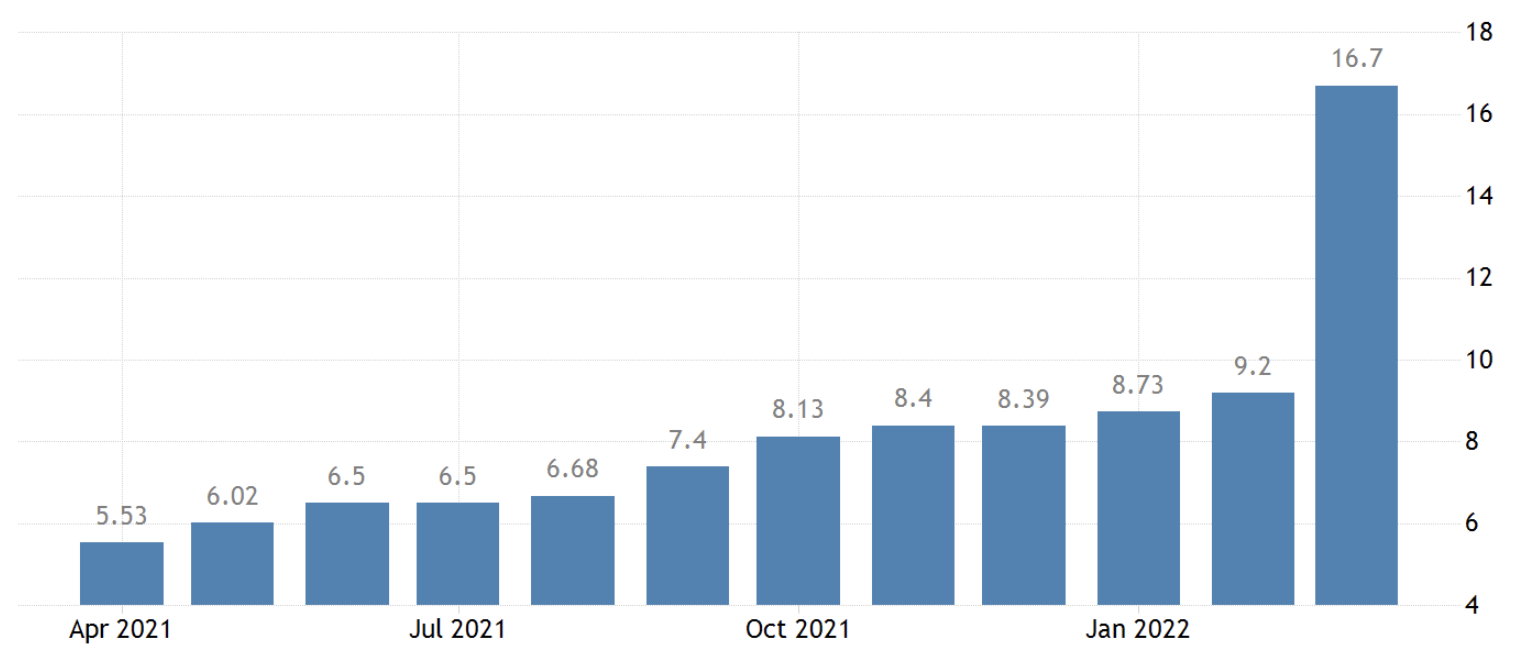

This drying up of foreign investment is already showing up in data with inflation more than trippling since last year while nearly doubling since February.

March saw inflation in Russia jump to 16.7% from 9.2%. Food has been hit the most, with basics like pasta seeing an increase of 25% last month. Butter is up 22%, sugar has spiked by 70% while fruits and vegetables saw an increase of 35%.

Electronics jumped 40% with building materials seeing an increase of 32% just a month into Russia’s invasion of Ukraine.

GDP data are not out yet. For the first quarter you’d expect them to be skewed a bit as January and February should have seen some economic growth with March negative.

This quarter however which is to end in June may be one of their worst when there’s still yet worse to come as Europe moves to secure new suppliers in oil and gas.

Some estimate their economy may go down by 10%. Seeing what happened after 2014 however when Russia occupied Crimea, it may go down as much as 50%.

That’s especially in light of China having some economic troubles of its own with a very full plate even before Ukraine’s invasion, which may mean China won’t help Russia much at all.

In this sort of situation, you’d expect bitcoin to move, but the crypto tends to lag as raw demand makes its way towards clearing out speculator bets.

trustnodes.com

trustnodes.com