Binance Coin (BNB) almost reached $150 mark in a major upswing, outperforming even Bitcoin along the way. What’s the reason for this price surge and should you buy some BNB now?

Fundamental analysis: influx of Binance traders caused BNB to skyrocket

The now seventh-largest cryptocurrency by market capitalization skyrocketed in recent days on extraordinary volume. Binance Coin gained 120% in just three days of trading. The reason for this amazing surge was simple: users flocked to the exchange after the Tesla $1.5 BTC investment announcement. Binance, along with many other exchanges, experienced several outages due to their platform being overloaded with users. When it comes to BNB, the more users trade on Binance, the more it gets used, and the more its price rises.

Fact is, the systems will experience some issues here and there as we scale up exponentially. Nothing we can’t fix quickly, but not going to be a perfect smooth ride.

Changpeng Zhao, CEO of Binance

An increase in demand accompanied by a major Q4 2020 BNB token burn and an increasing basket of Binance products all brought BNB to its new all-time high of $148.118.

Binance Coin posted week-over-week gains of 150.77%, outperforming both Bitcoin’s 25.92% gain and Ethereum‘s 12.22% gain. The seventh-largest cryptocurrency by market cap currently boasts a market value of $19.57 billion.

At the time of writing, BNB is trading for $131, which represents a price increase of 172.11% when compared to the previous month’s value.

BNB/USD technical analysis: BNB fails to break $150, pulls back

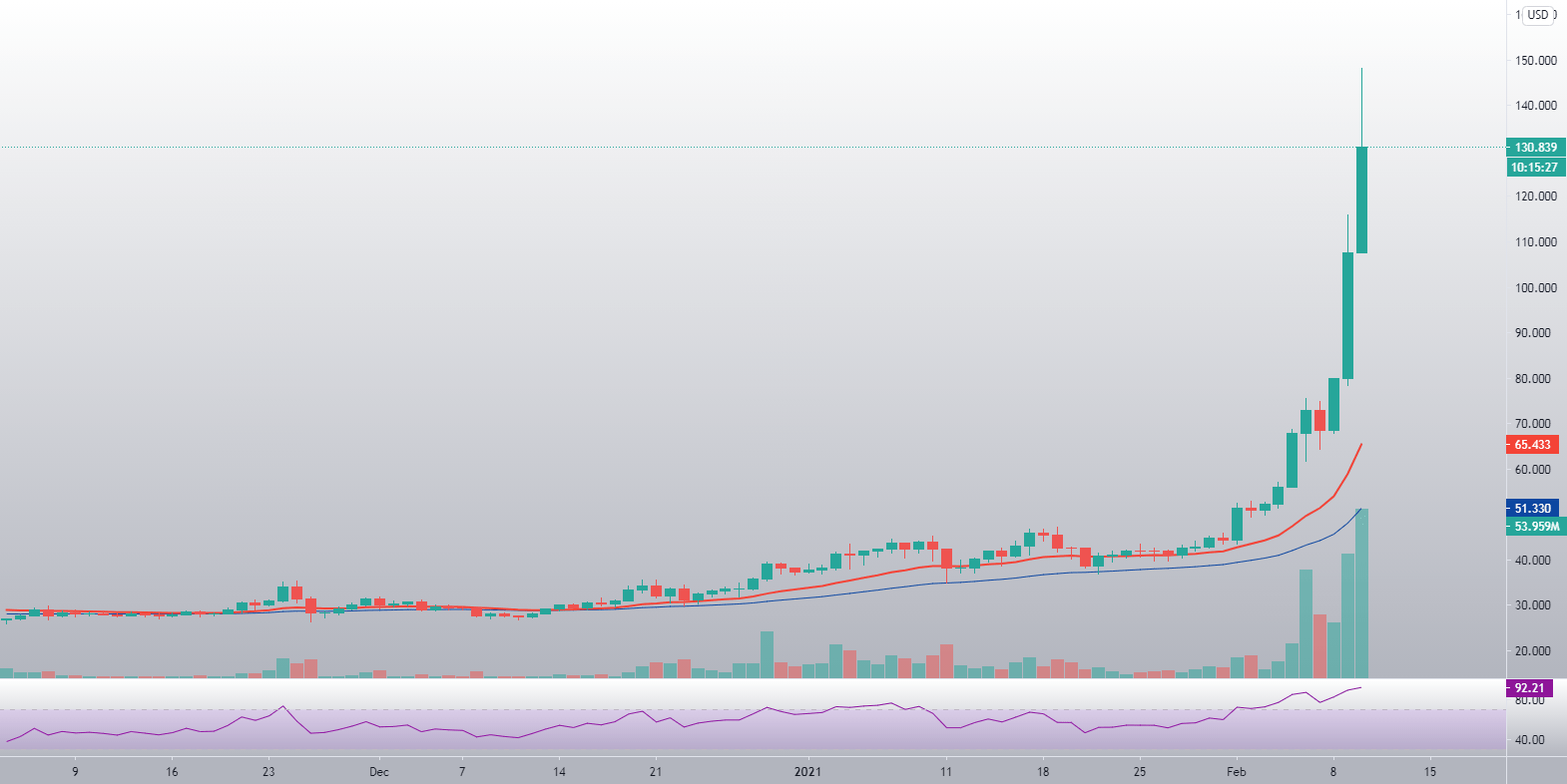

The seventh-largest cryptocurrency by market cap is in a major uptrend, with the last 3 days of trading bringing over 120% gain. Binance Coin has “flippened” numerous cryptocurrencies along the way to the 7th place of the market cap top10, including Chainlink and Litecoin. While the daily chart is currently not showing it as vividly as smaller time-frames, BNB has entered a slight correction move after failing to break the $150 mark.

While the cryptocurrency doesn’t have many strong and tested support levels nearby, we can expect it to react to the 21-hour and 5-hour EMAs, as well as the zone around $108.

BNB’s RSI on the daily time-frame is extremely deep into the overbought territory, with its current value sitting at 92.21.

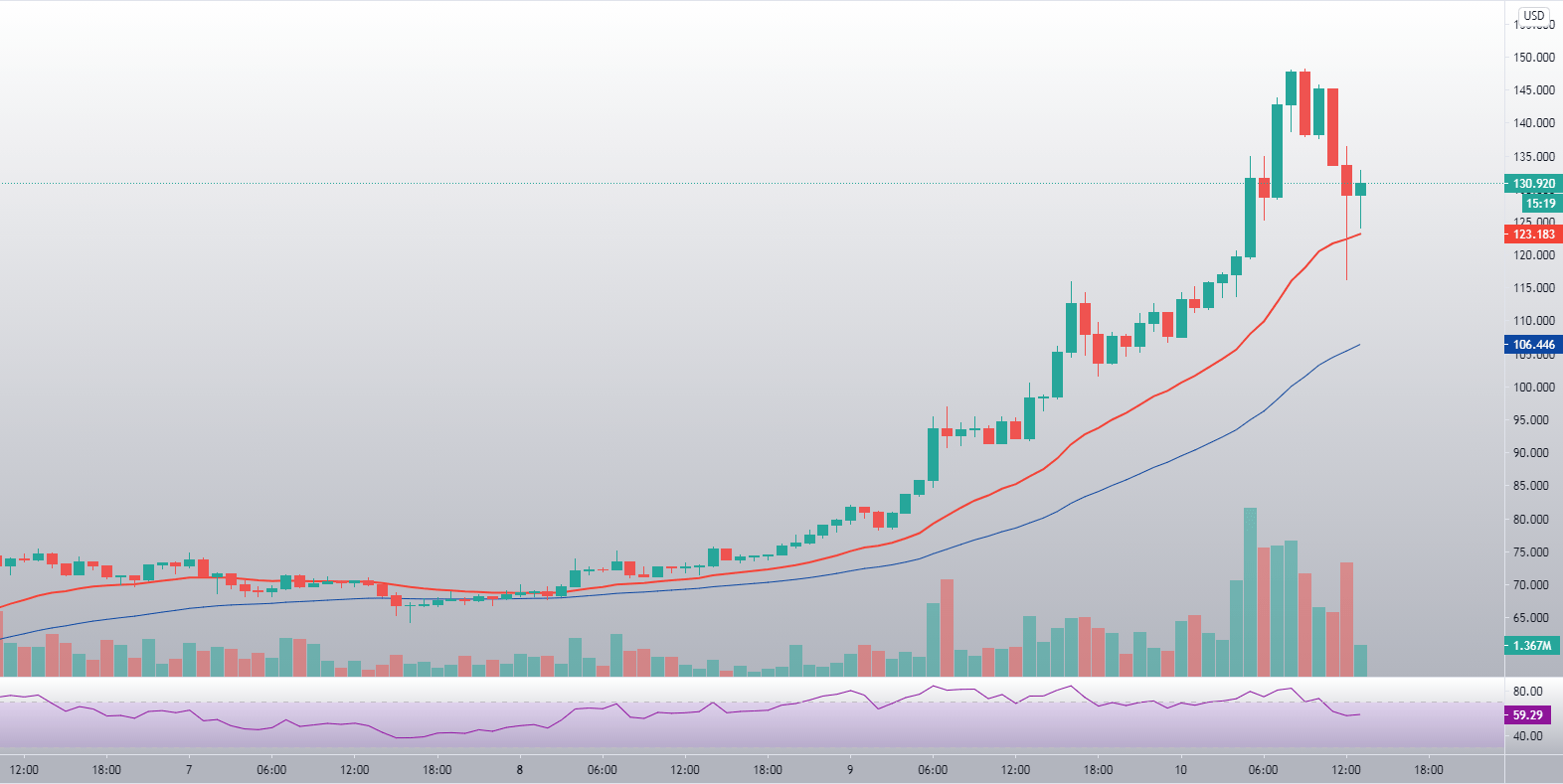

Zooming in to the hourly time-frame, we can see BNB’s skyrocketing volume during its price increase. The 21-hour EMA has followed the cryptocurrency on its way up, and is currently posing as support during the pullback wave BNB is currently in.

Binance Coin’s RSI on the hourly time-frame finally left the overbought area, and is returning to normal. Its volume is also slowly descending, but is still on extremely high levels. With that being said, it is unlikely that BNB will reach past $150 unless new Tesla-like news hits the market.

invezz.com

invezz.com