- Chainlink price closed the Wednesday session with an impressive 7% gain.

- Bulls attempted to extend the Wednesday rally but were handily rejected by sellers.

- Upside potential remains substantial, while downside risks are more limited.

Chainlink price has experienced some major swing over the past two trading days. Bulls were unable to repeat Wednesday’s performance but, at the same time, kept LINK’s Thursday losses to a minimum. Most importantly, from an Ichimoku perspective, bulls were able to keep the daily close above the Tenkan-Sen and the Kijun-Sen, creating a fantastic base for higher moves.

Chainlink price develops bullish support structure, but follow-through needed to prevent a continued downtrend

Chainlink price completed several major bullish events on Wednesday’s close. Wednesday’s close confirmed a breakout above the falling wedge as well as the Tenkan-Sen and Kijun-Sen. But the price action and resistance zones ahead could be choppy, despite the bullish close.

LINK/USDT Daily Ichimoku Kinko Hyo Chart

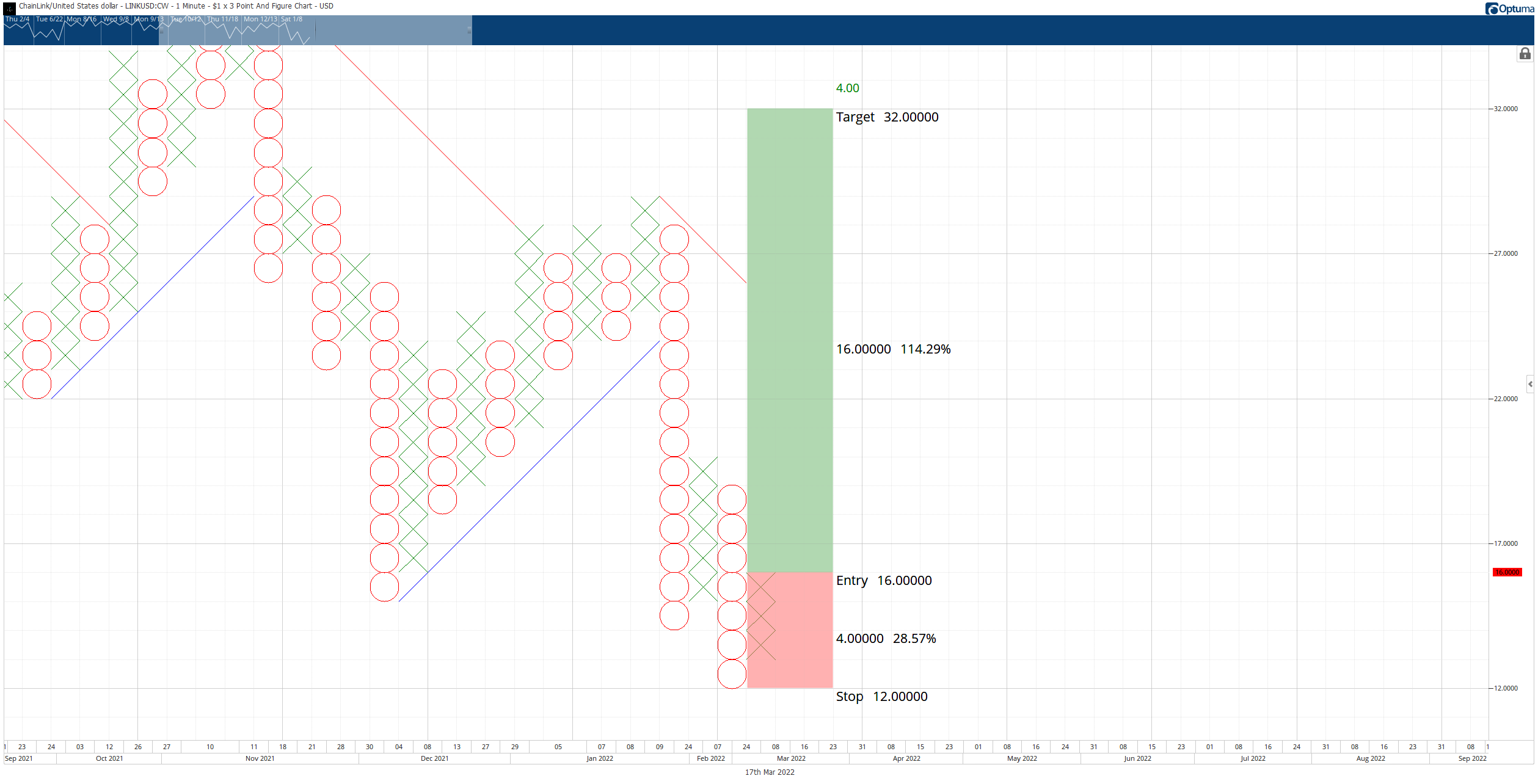

As a result, the $1/3-box Point and Figure chart sheds a little more light and clarifies where the candlestick chart can’t – a potential buying opportunity is now present for Chainlink price.

The hypothetical long opportunity for Chainlink price is a buy stop at $16, a stop loss at $12, and a profit target at $32. However, while the profit target at $32 is derived from Point and Figure analysis, LINK is more likely to halt at the $25 value area. $25 is a naturally powerful psychological number, but it also contains the 50% Fibonacci retracement and the Kijun-Sen.

LINK/USDT $1.00/3-box Reversal Point and Figure Chart

The long idea represents a 4:1 reward for the risk setup. A trailing stop of two to three boxes would help protect any implied profit made post entry. The setup is invalidated if Chainlink price drops to $11. Additionally, Point and Figure does not use volume or time – just price – so a time limit or expectation of ‘when’ is moot.

fxstreet.com

fxstreet.com