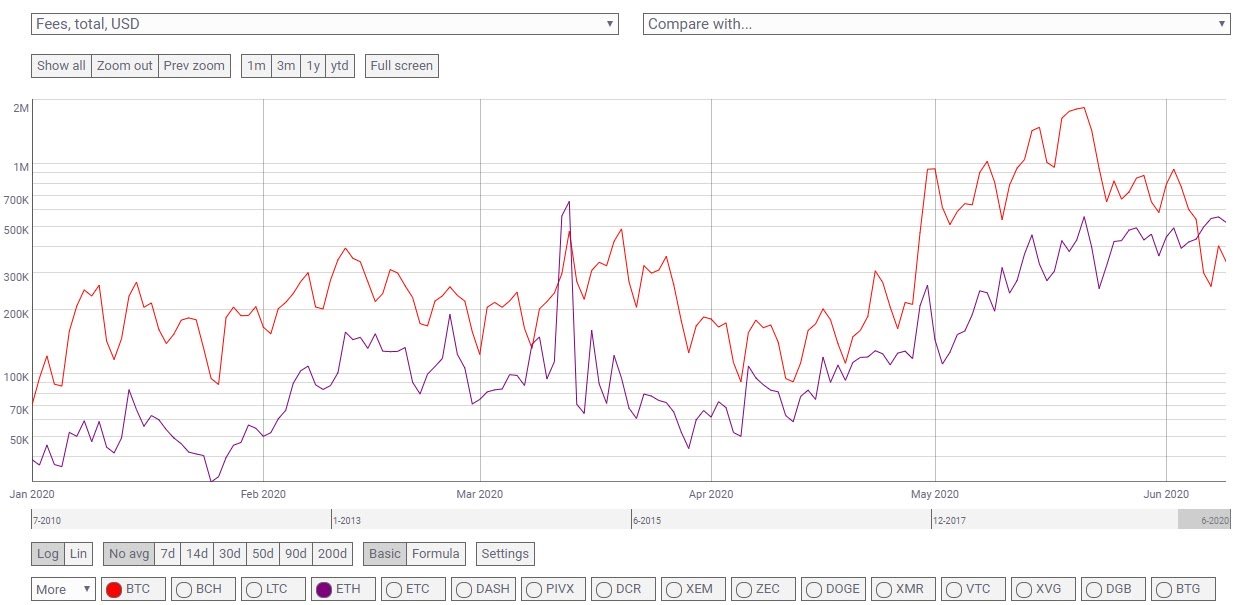

In the recent period, Ethereum (ETH) users have been experiencing a sustained increase in the cost of transactions, the so-called fees, and looking at the charts, it is clear that the situation on the ETH blockchain is becoming unsustainable compared to what is happening on Bitcoin (BTC).

How do fees work on Ethereum

Before delving into the graph, it is important to recall how the fee system on Ethereum (ETH) works. The so-called GAS is the computational unit of the work that needs to be done to send a transaction: each bytecode instruction must use a minimum amount of gas to be executed.

There is also a gas limit, which is the maximum amount of gas that a user is willing to pay for a transaction to avoid paying too many fees.

The gas price is measured in Ether: the higher the gas, the sooner the transaction will be processed. For example, 1 Gwei is equal to 10-9 ether and, for a transaction to be valid, the balance of the person making the transaction must be greater than the product between gas limit and gas price.

To get an idea of how disproportionate ETH fees are now, take a look at the gas price history, measured in Gwei, and note that until April the average was around 12 Gwei, so about $0.06, while now it’s an average of over 30 Gwei, so about $0.1, which may be little but these data refer to a single transaction, while in the case of a smart contract that calls more instructions it is necessary to calculate 10 times as much.

One of the contracts that requires a lot of fees is that of Tether (USDT) which requires an average of about 42.2 Gwei, while the World United Coins requires 87.3 Gwei, a really unsustainable cost for a simple token transfer.

This certainly affects a blockchain that is achieving significant numbers such as that of the total number of unique addresses that has exceeded 100 million.

Moving instead to Bitcoin (BTC), the situation has calmed down thanks to the adjustment of the difficulty that occurred a couple of days ago and so the fees have dropped by 90% compared to the days of the bitcoin halving.

Is the Ethereum blockchain doomed?

Although this situation is unsustainable for the blockchain, especially for small users who pay too much to transfer a token or make a transaction, it is also true that the launch of ETH 2.0 is imminent, i.e. the transition from PoW (Proof of Work) to PoS (Proof of Stake).

This has the aim of making the system leaner, starting from the scalability of transactions, which now follow the mempool system and hence those that pay more fees than the others are processed first.

Ethereum and DeFi

In addition, this can be detrimental to decentralized finance (DeFi) because many protocols are based on lending and therefore on receiving interest for the funds that are put into the various pools.

But if the cost of fees for both entering and exiting is higher than the profit, then many users will not enter and will look for other solutions to invest their capital, such as the EOS blockchain, where the staking possibilities are growing, with the advantage of being devoid of the transaction cost.

en.cryptonomist.ch

en.cryptonomist.ch