New insights from crypto analysts highlight that ETH is undervalued, indicating the crypto asset is primed for significant price appreciation soon.

Fundamentals Shine as Network Activity Surges

As the native asset of the Ethereum blockchain, ETH stands to gain the most from an escalation of on-chain activity. Several data points, when put together, make a clear-cut case for ETH’s low valuation.

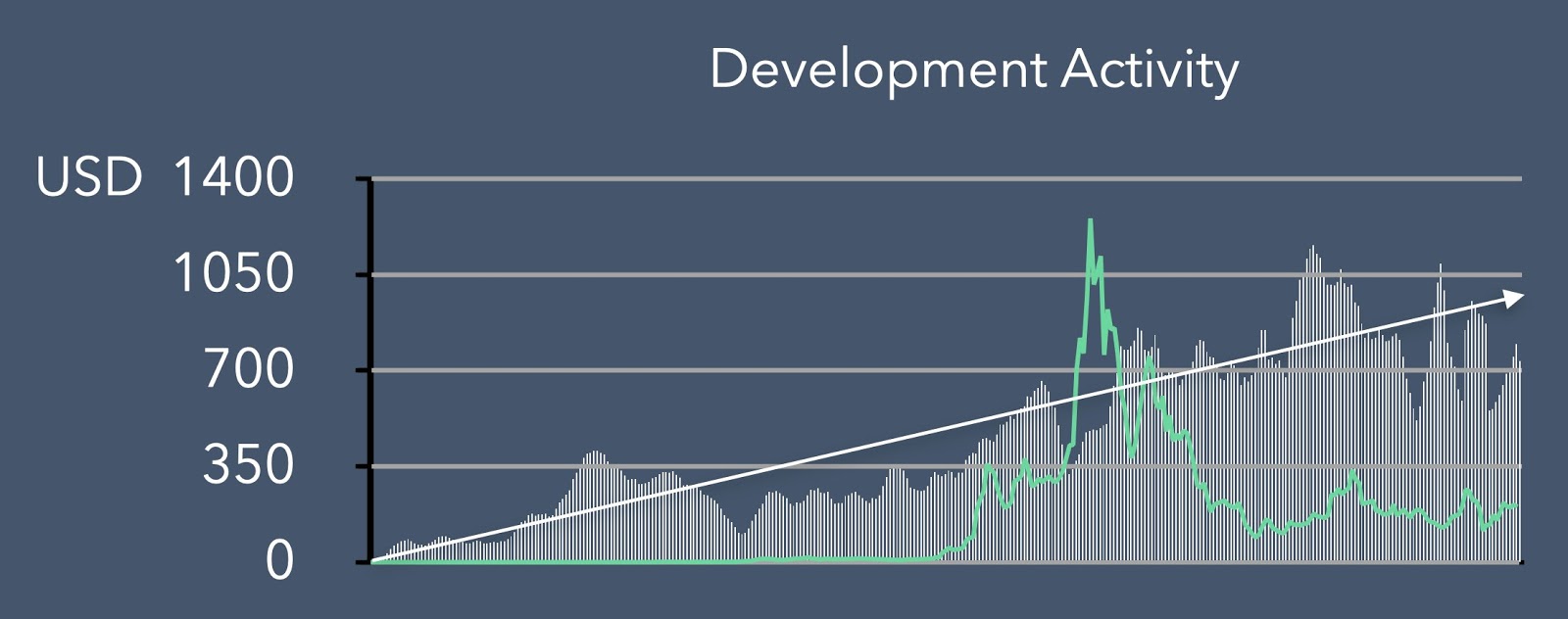

Blockfyre, a cryptocurrency research firm, notes that Ethereum has seen active development since the network’s inception in 2014. Ethereum’s edge over rivals is its thriving developer community. Other networks that boast greater scalability and other technical advantages have failed to attract the same demographic.

Despite criticism for tardy protocol upgrades, Ethereum developers have steadily progressed irrespective of price movements. This progress is in part thanks to coherent treasury management by the Ethereum Foundation

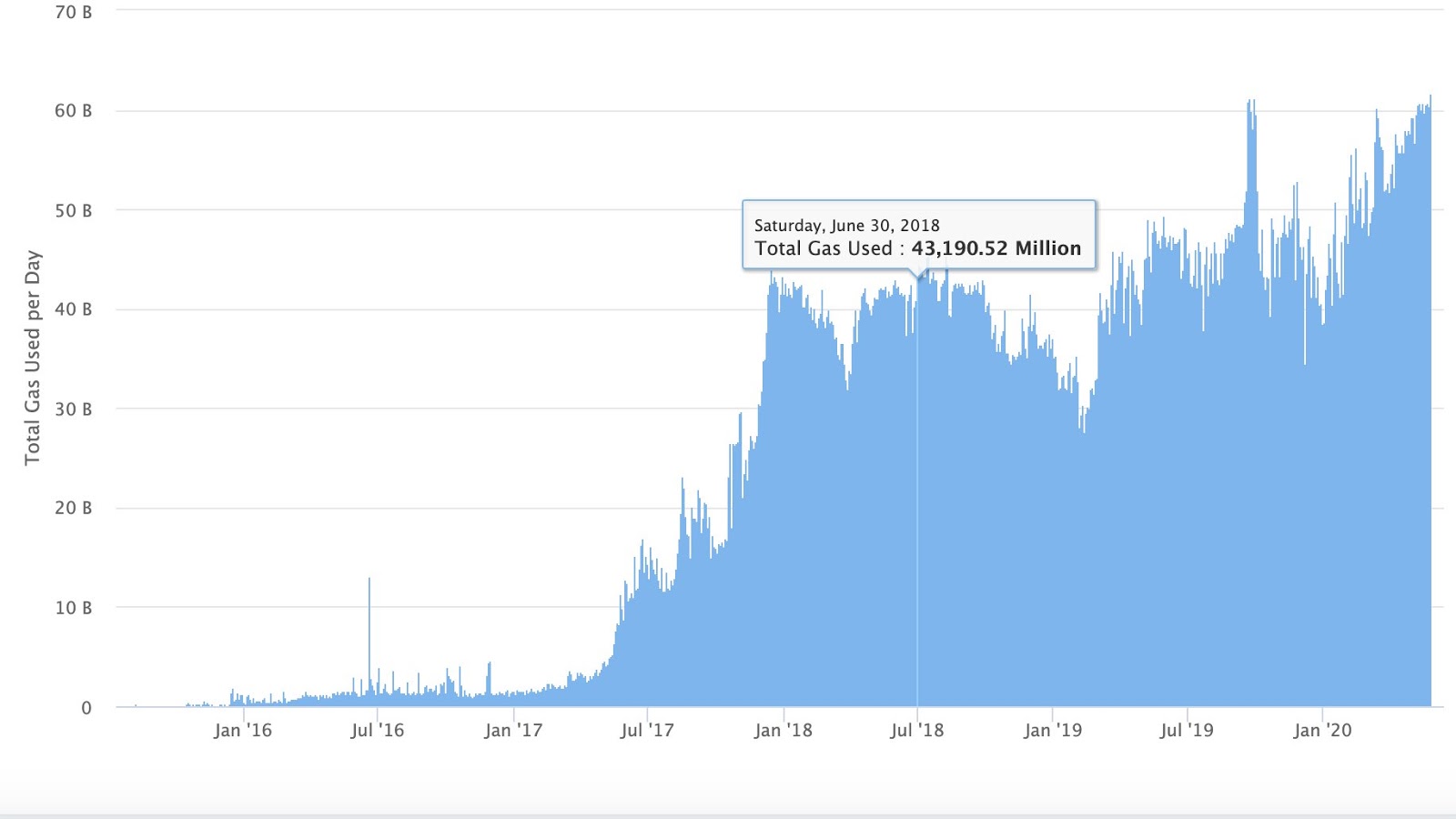

Gas consumed over the network hit an all-time high this week, and daily consumption has continuously been more than 60 billion gas. This data indicates actual usage.

Unfortunately, four out of the top six consumers of gas are confirmed Ponzi schemes.

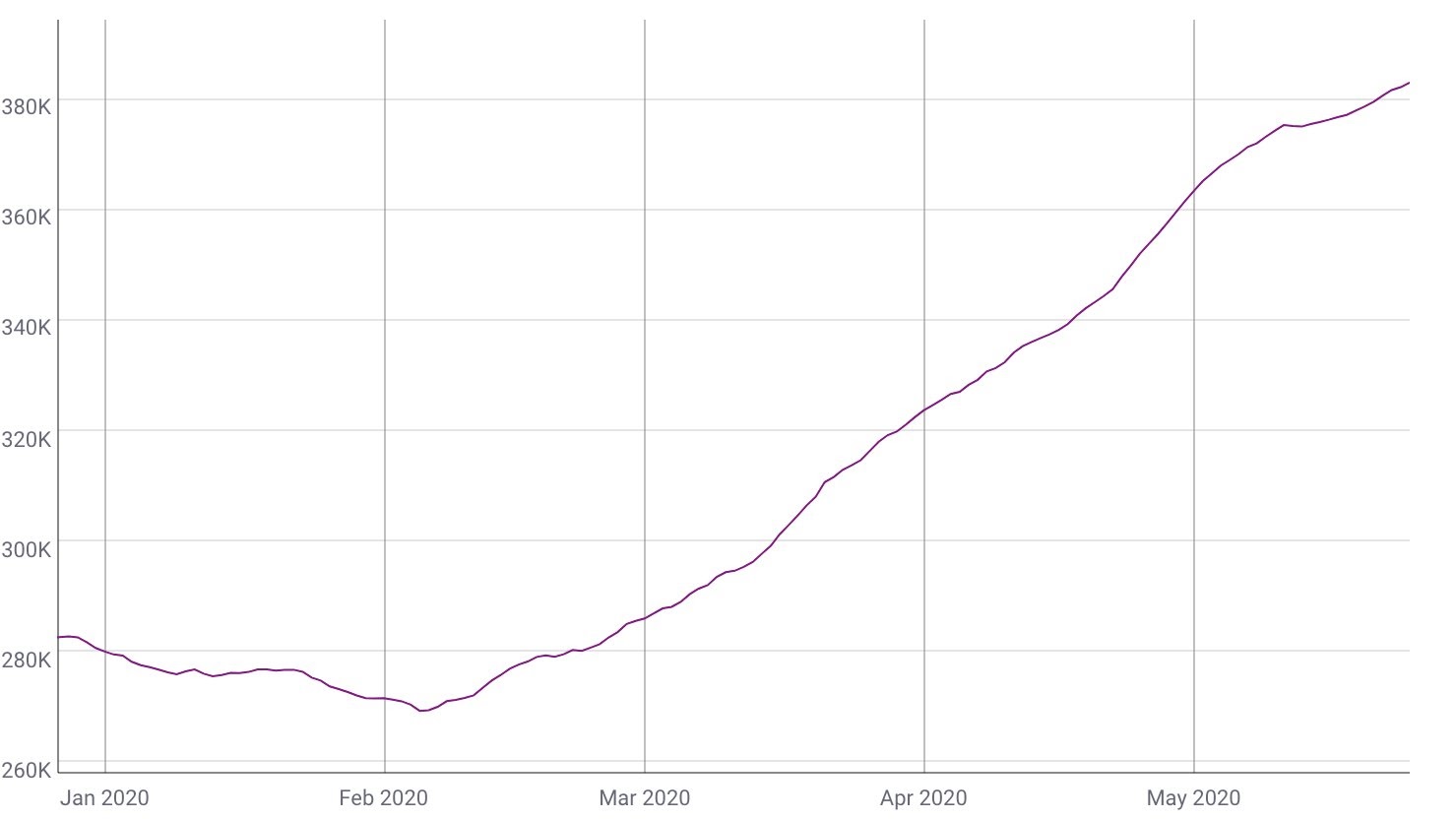

Further signaling usage is the number of active addresses on Ethereum, highlighted by Spencer Noon, founder of DTCC Capital.

The 90-day moving average for addresses using Ethereum is currently near 380,000 – a threshold not seen since 2018.

Ethereum’s DeFi ecosystem has likely fueled this growth in active addresses, with the number of users doubling over the last five months.

Last but not least is the rise of stablecoins. During the previous three months, over $4 billion of stablecoins were issued on Ethereum alone. These assets have quickly become one of Ethereum’s moat, overpowering ETH as the primary medium of exchange in DeFi.

The final barrier for Ethereum is achieving higher throughput and efficiently serving an even larger batch of users.

Investors Are Confident in Ethereum

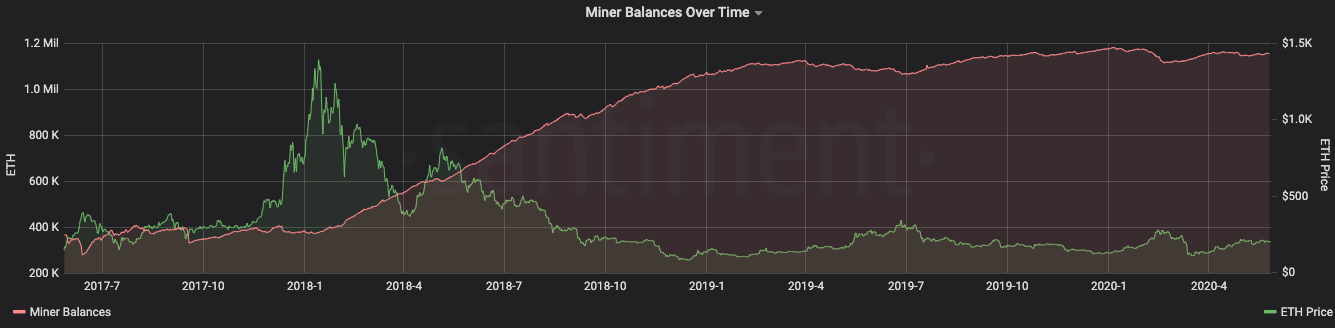

Miners, who are an integral part of any blockchain network, have displayed their bullish outlook by hoarding coins like never before.

Since Jan. 1, 2018, ETH held by miners has risen 3x from 384,000 to 1.16 million ETH.

Miners’ confidence has been strengthened by the network’s ability to provide them with adequate incentives.

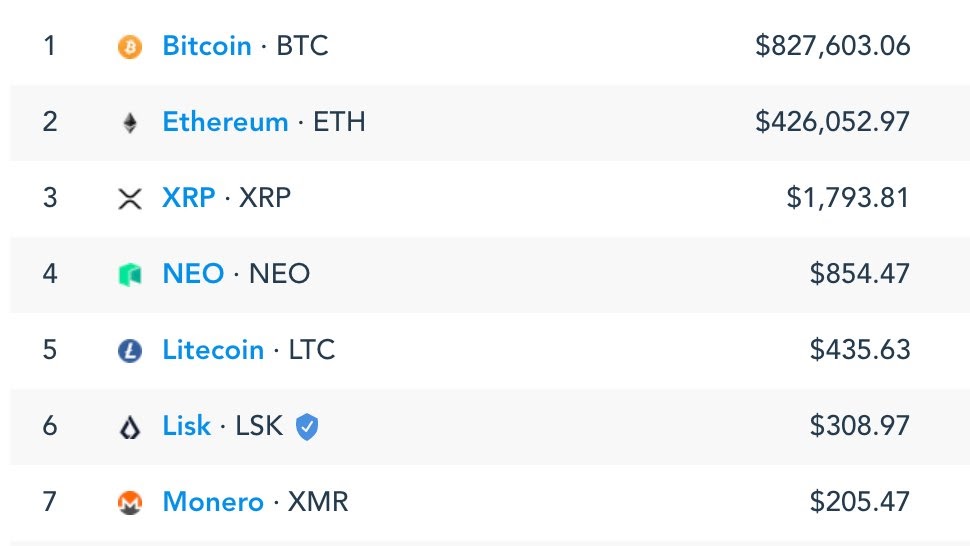

Ethereum’s daily security budget of $426,000 (block rewards + transaction fees) is second only to Bitcoin’s $828,000. The nearest competitor is Ripple, with a meager $1,800 paid to miners daily.

Institutions bear a similar aura. Grayscale’s ETH Trust has seen roughly a million dollars of inflow per day for the last three weeks.

More so, the market price for a share in the trust is $105 at the time of press. With each share only representing a claim on 0.09 ETH, one ETH of exposure costs $1,170 through Grayscale while the market price for ETH is just $204 per unit.

Institutional investors are effectively buying ETH at a 570% premium to avoid using a native crypto exchange and being held responsible for asset custody.

With developers, users, and investors all aligned, Ethereum is well-positioned to lead the smart contracts market for the foreseeable future.

cryptobriefing.com

cryptobriefing.com