This article provides an overview of how Bitcoin (BTC), Ethereum (ETH), XRP, and Chainlink (LINK) have been doing over the past 24-hour period, covers recent news that might have affected their prices (or might do so in the future), and looks at interesting tweets about these cryptoassets from prominent members of the crypto community.

To give you a rough idea of how well the crypto markets are doing today, 10 out of the top 20 cryptoassets (by market cap) are currently in the red (against the dollar).

All market data used in this article was taken from CryptoCompare around 15:50 UTC on 16 May 2020.

Bitcoin (BTC)

Bitcoin is currently trading at $9,355, which means that it is down 0.92% in the past 24-hour period:

According to data from CryptoCompare, since Halving Day (i.e. May 11), Bitcoin's price has gone up from an intraday low of $8,488 on that day to $9,355, where it is now, which means an increase of 10.21%.

As for Bitcoin's hash rate, per data from BitInfoCharts, although it reached an estimated high of 137.57 EH/s on Halving Day (prior to the halving event, which occurred around 19:23 UTC), since then, it has fallen to 101.90 EH/s, which means a decrease of 25.92%.

What this third having event means for miners is that the total block mining reward per day, i.e. the amount of new bitcoin minted each day, is now 900 BTC rather than 1800 BTC, which is probably why some miners who using inefficient hardware or not having access to super cheap electricity are being forced to stop their mining operations, which is why Bitcoin's hash rate has gone down.

This mean we should expect an increase in Bitcoin's mining difficulty (which is programmatically/automatically adjusted every 2,016 blocks, i.e. roughly every two weeks) on Monday (May 18), after which more miners will come, thereby boosting Bitcoin's hash rate (although we don't know how much higher it will go).

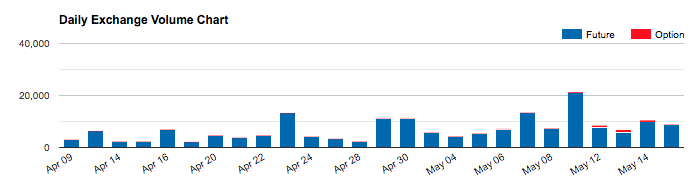

Bitcoin's Halving Day was good for business at the CME Group, where 21,001 Bitcoin futures contracts (each BTC futures contract is equivalent to five bitcoins) and 380 option on Bitcoin Futures contracts were traded.

After Bitcoin's third halving on Monday, the next most interesting Bitcoin-related news came on Friday (May 15). As CryptoGlobe reported yesterday, this is when one of the world's most successful novelists, J.K. Rowling, who is the creator of the Harry Potter fantasy series, asked Coindesk reporter Leigh Cuen to explain to her what Bitcoin is.

Well, needless to say, not only Cuen replied to her, but so did pretty much everyone else in CryptoTwitter. Several hours and a huge number of explanations later, we found out from Rowling that her initially inquiry started as a joke (while she was in a slightly drunken state), and so not everyone in the community was pleased about being trolled by her. Rowling also admitted that she has a difficult time in general with technology, and that she had not really understood any of the explanations offered to her.

Ethereum (ETH)

Ethereum is currently trading at $200.37, which means that it is up 1.38% in the past 24-hour period:

In the year-to-date period, Ethereum, the second-most valuable cryptoasset by market cap, has gone up from $128.91 to $200.37, which means an impressive 55.43% (against USD) increase in value.

Yesterday (May 15), Ethereum Foundation researcher Justin Drake said that Ethereum 2.0 could have been launched a year or two sooner had the team decided to make things easier for themselves, e.g. by going through fewer design iterations:

We made Eth2 hard for ourselves:

— Justin Ðrake (@drakefjustin) May 15, 2020

* many design iterations

* many community clients vs one EF-led client

* libp2p vs devp2p; BLS12-381 vs BN254

We could have launched a year or two earlier the easy way. It was painful but it was right. Our investments will pay off for decades :)

When Drake was asked to give a few examples of the design decisions he was referring to, this was his reply:

Three big compounding improvements:

— Justin Ðrake (@drakefjustin) May 15, 2020

* (robustness) unifying PoS and sharding

* (scalability) committees and signature aggregation

* (usability) fewer shards with faster crosslinks

None of these were obvious at the time. Every time we simplified the design.

XRP

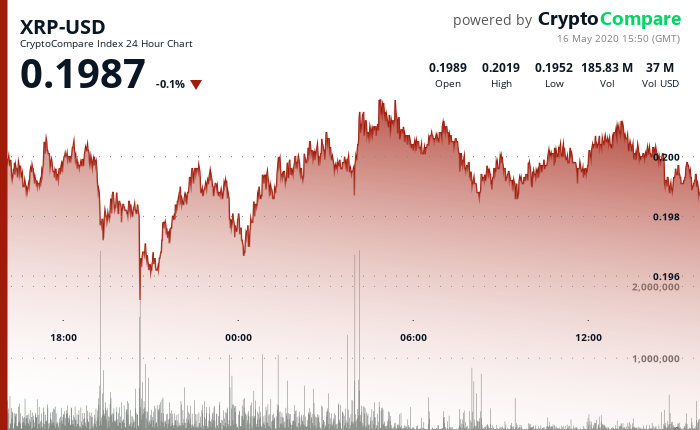

XRP is currently trading at $0.1987, which means that it is down 0.10% in the past 24-hour period:

In the year-to-date period, XRP, the fourth-most valuable cryptoasset by market cap, has gone up from $0.1927 to $0.1987, which means a 3.11% (against USD) increase in value, which does not sound too impressive until you consider that during the same period the S&P 500 has gone down 12.07%.

Chainlink (LINK)

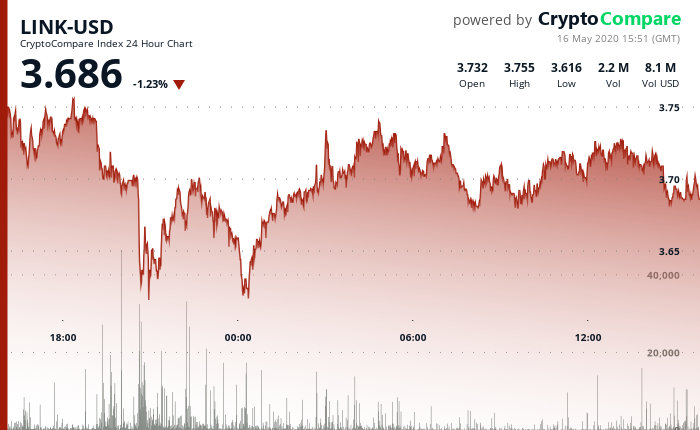

Chainlink's LINK token is currently trading at $3.686, which means that it is down 1.23% in the past 24-hour period:

In the year-to-date period, Chainlink, the 12th most valuable cryptoasset by market cap, has gone up from $1.76 to $3.686, which means an incredible 109.43% (against USD) increase of value.

Yesterday (May 15), the team behind Cryptoraves, a decentralized Twitter tipping bot, announced an integration with Chainlink that will "enable Cryptoraves to remove a layer of centralization from its platform by employing Chainlink’s secure and reliable oracles to validate Twitter data."

Using Chainlink's oracles in this way also "solves the vexing regulatory issue of custody" as explained below:

"By offloading transaction data validation to Chainlink’s decentralized network, Cryptoraves drastically reduces its regulatory risk.

"This also enables Cryptoraves to add higher risk exchange-listed tokens such as ETH, DAI, or even LINK to their Twitter tipping platform."

cryptoglobe.com

cryptoglobe.com