- Price has been reduced up to $339.06.

- Bitcoin Cash price analysis shows downturn.

- Support is quite stable at $261.88.

The most recent Bitcoin Cash price analysis predicts a downtrend for the cryptocurrency today, as a downside was experienced due to a bearish drop. The bearish upset interrupted the upward wave, as now the bears are in the leading position. The selling trend is growing, and the coin value recedes to $339.06. Further chances of decline in cryptocurrency value seem close as the sellers are trying to rule the market again.

BCH/USD 1-day price chart: Bulls face rejection near $339 after bearish takeover

The daily Bitcoin Cash price analysis gives a bearish indication for the day as the sellers try to control the market. The selling activity is on the rise, which is why the coin value plunged to $339.06 in the past 24-hours. This was a huge shock for the cryptocurrency buyers, as they were aiming to cross the $352 boundary soon. Discussing the moving average (MA) value for the day, it settles on the $326.5 mark in the 1-day price chart.

The Bollinger bands are expanding as the volatility rises, which means that the future price trends might turn out in favor of the bears again. At the same time, the upper Bollinger band value has now moved towards the $352.3 position, while the lower Bollinger band value is now $262. The Relative Strength Index (RSI) score declined up to 53.17 during the day.

Bitcoin Cash price analysis: Bulls manage to rescue price back to $338 high

The hourly price prediction for BCH/USD confirms a bullish turnover as the bulls made a return on the price chart. Green candlestick is signaling a recovery in coin value as it just heightened up to $338.61 high. Although the bears have been in the dominating position, the current scenario is going in favor of the sellers. The moving average value is still quite high compared to the current price, i.e., $344.43.

The short-term trending line is moving descendingly as in the preceding hours; the bears had an advantage of leading the market. The Bollinger bands indicator displays the following upper and lower values; the upper band shows $355.05, whereas the lower band shows $326.35 of value. The RSI curve is moving high, and the score has increased up to 51.27 points in the past four hours.

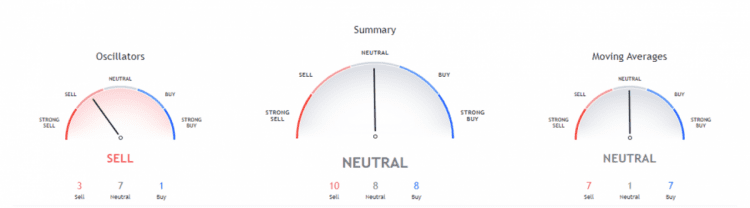

A neutral sign is being given by the BCH/USD technical indicators chart because of the ongoing competition in the market. Both the bulls and the bears are determined to secure their winning seat on the price chart. Currently, ten indicators are settling on the selling position, whereas eight indicators are on the buying position and the neutral position.

The Moving Averages indicator gives a neutral hint as well. We can see that seven indicators occupy both of the selling and buying positions while only one indicator is there on the neutral position. The Oscillators are predicting a selling trend regarding the current market situation. Seven oscillators are on the neutral edge; three sell, while only one indicator is on the buying edge.

Bitcoin Cash price analysis conclusion

The above one-day and four-hour Bitcoin Cash price analysis shows a bearish trend for the cryptocurrency because of the rise in selling activity. The bears managed to escape the bullish wave by reducing the coin value to $339.06 extreme. On the other side, the hourly price analysis is going slightly bullish because of the recovery in price in the past few hours.

Disclaimer. The information provided is not trading advice. Cryptopolitan.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

cryptopolitan.com

cryptopolitan.com