Ethereum loves rollups. As of late, “based” rollups are in vogue.

What makes based rollups special? Its sequencer.

Layer-2s today use a trusted centralized sequencer to order users’ transactions before they are posted down to the layer-1 for settlement, but based rollups defer those execution duties to Ethereum layer-1 validators. This is otherwise known as “based sequencing.”

There are two primary reasons this is preferable: censorship resistance and interoperability.

Using the layer-1 as a sequencer ensures the same liveness guarantees as Ethereum layer-1 blocks, and avoids the major complaints of potential censorship surrounding trusted centralized sequencers.

Read more: MagicBlock open sources a16z-backed ‘ephemeral rollup’ tech

The second advantage of based rollups is better interoperability. Based rollup proponents such as Justin Drake have in recent months touted this benefit as “synchronous composability,” where transactions in Ethereum are sequenced (or bridged) across different layer-2s at the same time.

Simply put, smart contracts on based rollups will be able to call any other contract on the layer-1 in near-instant finality within the same block — as if they were all on the same chain.

This composability and “money legos” is not exactly new; it was always one of the core properties sold with the original vision of Ethereum.

Read more: Rethinking Ethereum consensus with Beam Chain

But the fragmented state of rollups today means an Arbitrum transaction is asynchronous with an Optimism transaction, which creates problems of fee uncertainty. Fee uncertainty arises because gas fees are calculated in different slot times, as opposed to within the same 12-second slot time of one Ethereum block.

In addition to making Ethereum seamlessly interoperable again, there are also different kinds of significant cost savings, Ahmad Mazen Bitar, technical product lead at Nethermind and Ethereum ACD developer, explains.

“A user may want to swap his token on the [layer-1] but wants to take advantage of a deep liquidity pool on a [layer-2]. With synchronous composability, they would be able to push a singular transaction from the [layer-1] to the [layer-2], execute it, then bring it back to the [layer-1].”

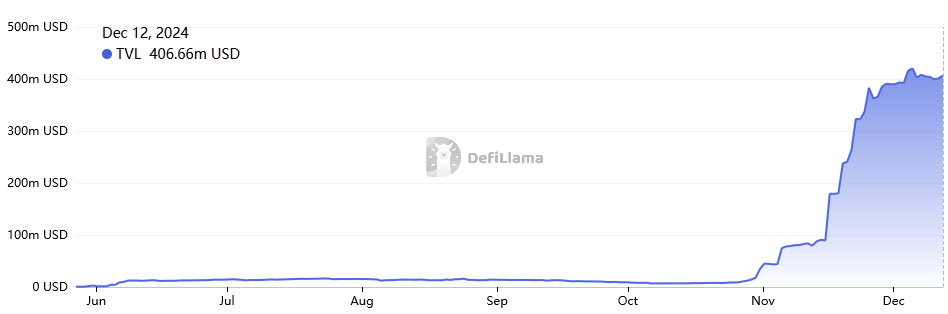

The first and largest existing based rollup in live production today is Taiko, which recently saw a burst in TVL and daily transactions this month.

Other early based rollups are also in early production, such as Surge by the Nethermind team, and UniFi by the Puffer Finance team. Both are forks of Taiko.

Based rollups don’t come without its own drawbacks, however. Since execution (i.e. sequencing duties) is now being relegated back to layer-1 block validators, that means based rollups are constrained by the layer-1’s 12-second block time.

Hence, the purported benefits of based rollups, like synchronous composability, may be easier said than done. Based rollups would require real-time proving within the latency of one 12-second slot, without which based rollups cannot execute composable transactions speedily.

To have that kind of fast proof generation in turn brings another technological dependency into the mix, but Brecht Devos, co-founder and chief technology officer of Taiko, remains confident the tech is catching up.

It’s why Taiko recently enabled two zk proofs on its rollup by Risc Zero and Succinct Labs, on top of Intel’s SGX trusted execution environment (TEE). This made it the first multi-proof based rollup in production without reliance on one trusted party.

“Provers are improving quickly with more TEEs, faster and cheaper zkVMs and AVSs that can be used. We think the zk development is going very well and the sub-slot latency for proving is not far off,” Devos told Blockworks.

One other believed disadvantage of based rollups is a loss of MEV as a key “revenue” stream, due to the lack of a centralized sequencer. Yet there are nifty workarounds available, Devos said.

On Taiko, “MEV can also be captured by auctioning “execution tickets” to layer-1 block proposers,” Devos told Blockworks.

As such, while based rollups by default give up sequencing rights to layer-1 validators, it doesn’t necessarily have to be the case.

Matthew Edelen, co-founder of Spire Labs, a based rollup infrastructure provider, shares a similar view. As he explained on a recent Bell Curve podcast: “Auctions don’t have to be the only way to distribute sequencing rights. You could distribute 99% of sequencing rights through an auction and give the last 1% to friends or solo stakers to look good on L2Beat.”

Finally, MEV may not even be such a big deal in the long run. This idea centres on a simple cost benefit analysis: Today, the bulk of blockchain revenues are coming from congestion fees, dwarfing a far smaller share of MEV revenues that is diminishing over time due to better MEV solutions.

As such, the smarter rollup revenue model for rollups is one that banks on the greater network effects of congestion fees coming from synchronous composability, rather than MEV fees.

As Justin Drake explained on the The Rollup podcast:

“Congestion fees against contention fees is roughly at an 80:20 ratio today. 80% of the income on the [layer-1] comes from congestion fees — about 3200 eth per day since EIP-1559. MEV is about 800 ETH daily since the Merge. My thesis is that this ratio is becoming more extreme, going from 80:20 to something like 99:1.”

In conclusion, the benefits of based rollups bring the user experience of Ethereum back full circle.

There’s a sense of irony here, considering that these benefits were what blockchains already had from day one. Synchronous composability and layer-1 sequencing transactions have been the norm for all blockchains since the Bitcoin network’s genesis.

This deviation of execution layer duties only happened due to the rollup-centric roadmap (or the multichain path in Polkadot, Cosmos and Avalanche) as of the last few years. Based rollups are ready to run it back.

blockworks.co

blockworks.co