Yesterday, as I sat down to write this, the crypto markets and DeFi were puking their guts out. When it seemed like everyone and their dogs wanted out at any cost, there was in fact one thing mooning: gas prices.

The sky rocketing price of gas is—like everything else going on this week—not a good thing for the fabulous world of DeFi.

How "gas" fuels Ethereum transactions

You know what gas prices are, of course. Ethereum transactions incur a fee, which is paid to miners. There are two variables for calculating the total fee paid. The first is in units of gas, which are based on the complexity of a transaction (how many moving parts). The second is the price you pay for that gas (ultimately into ETH). You can think of this simply with the amount of gas being the number of liters (or gallons if you still haven’t learned to use proper measurements), multiplied by the price you paid (in dollars).

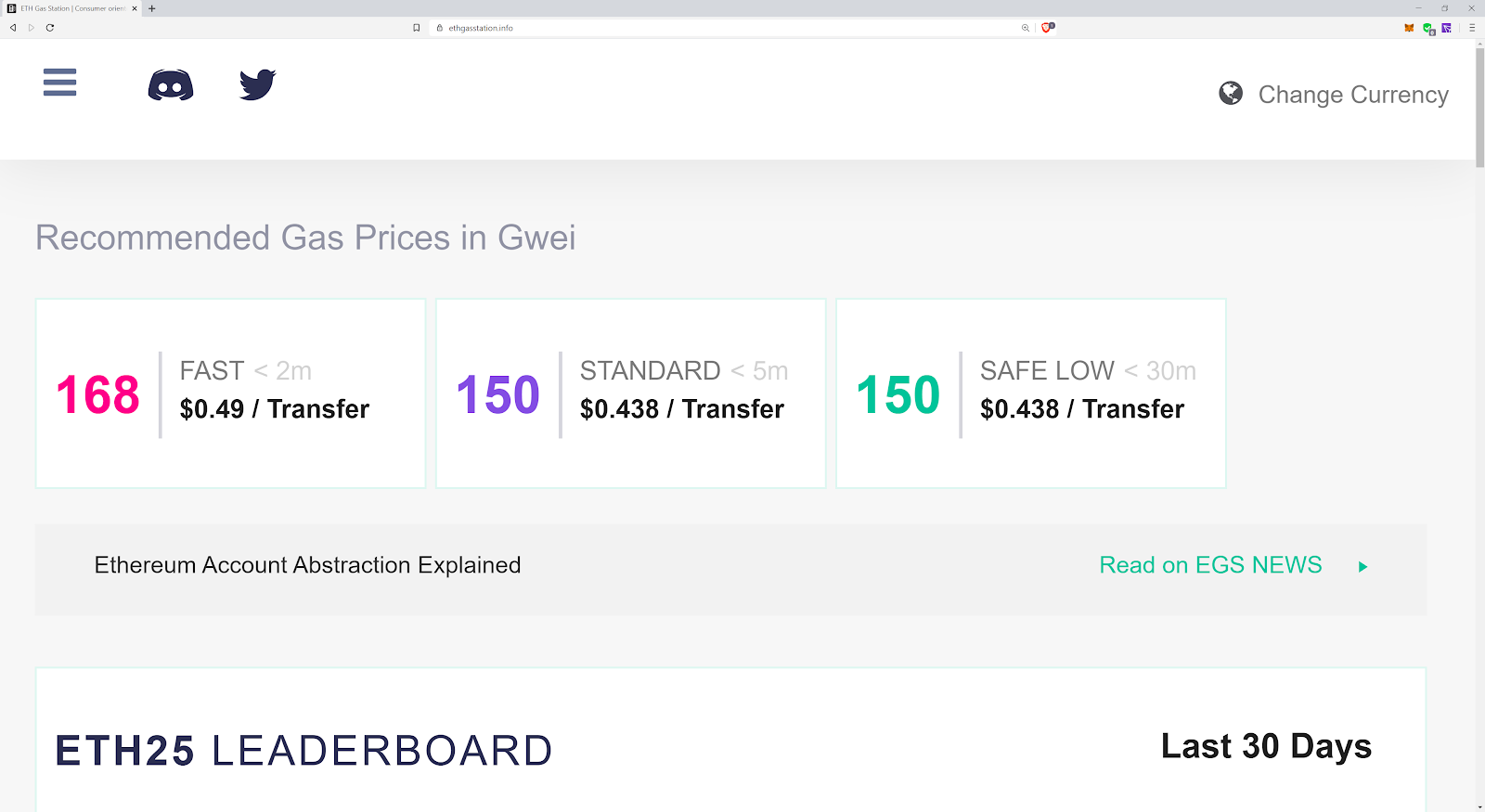

And so, the 150 on ETH Gas Station above, I’m getting for a “standard” transaction is bad.

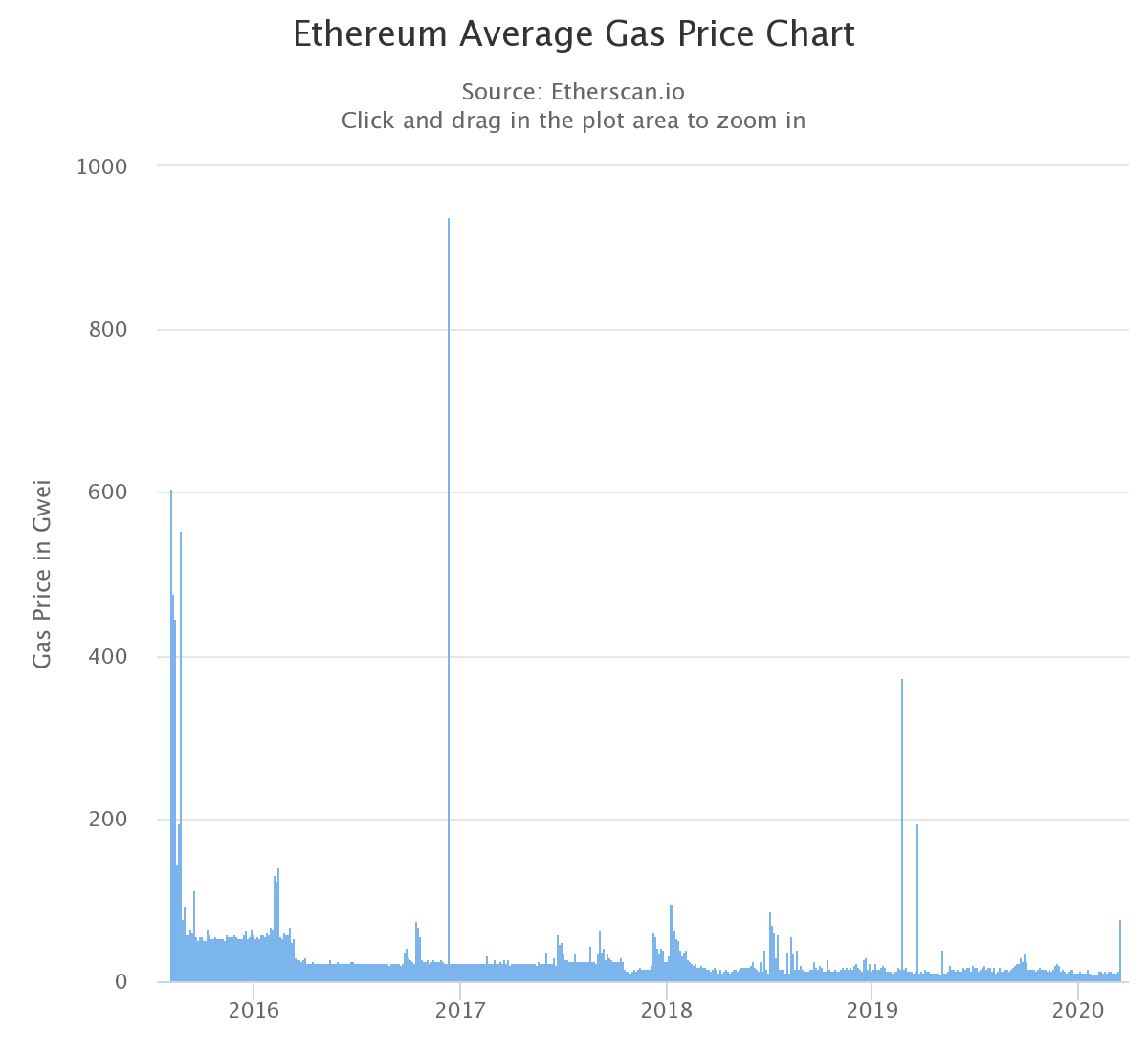

ETH Gas Station a site that predicts what gas price you'll need to pay to get your transaction through. In fact, data from our friends at Etherscan tell us that over the past year the average transaction costs something like 15 Gwei (0.000000015 ETH). So this is like 10x more expensive.

But weren’t blockchains —by being more efficient and eliminating middlemen—supposed to make things cheaper Colin?

Hold on while I stop laughing… hold on… nearly… done… ouch my sides… No. I actually wrote some blog posts about this a couple years ago, here and here. (A sage, yes I know.)

This is all a long way of explaining why we’re not actually reviewing any DeFi sites this week. It’s not like I didn’t try, though. Let’s have a look at what I encountered.

Surveying the DeFi wreckage

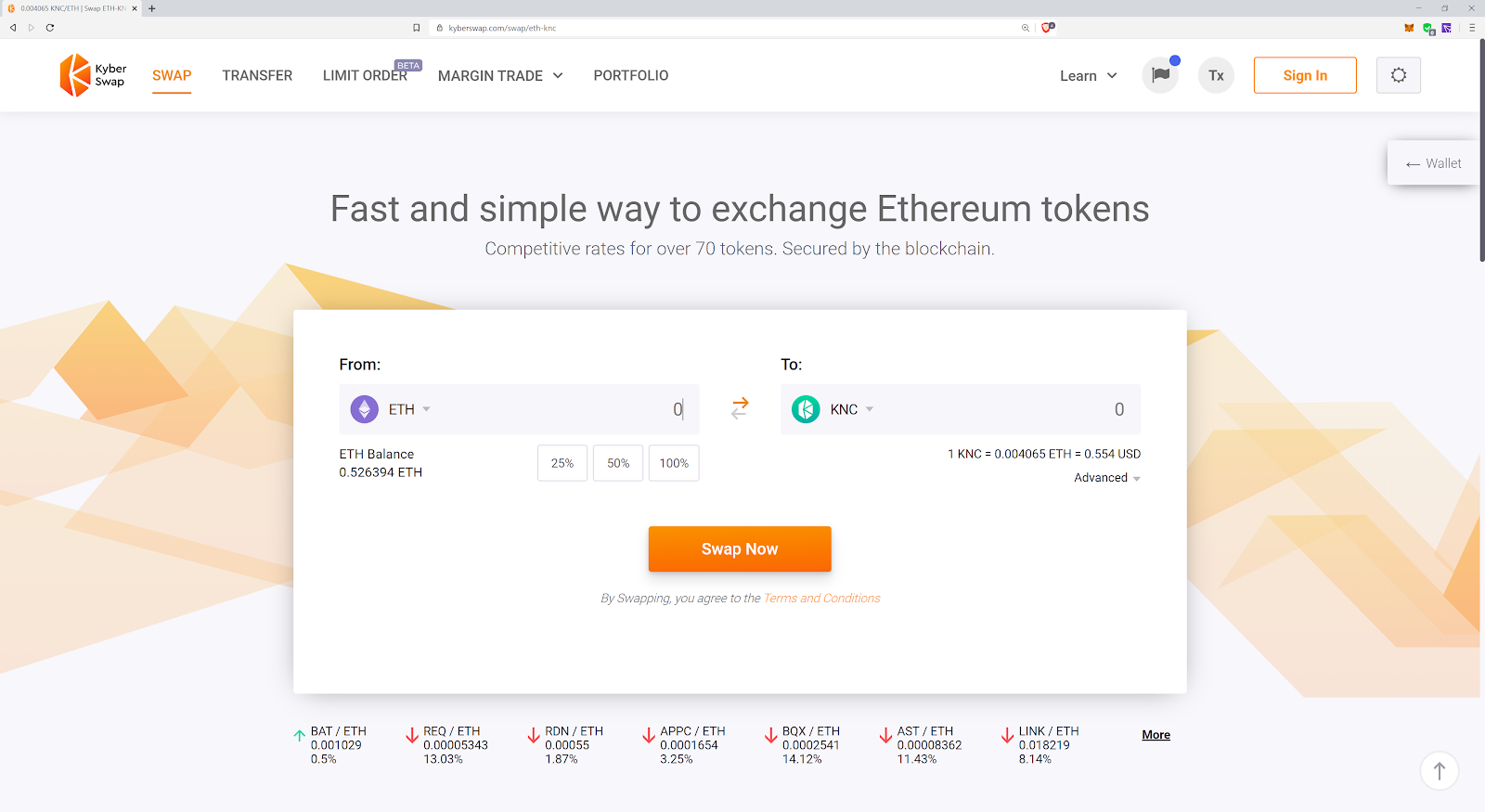

First, I went to Kyber, a decentralized exchange built on Ethereum.

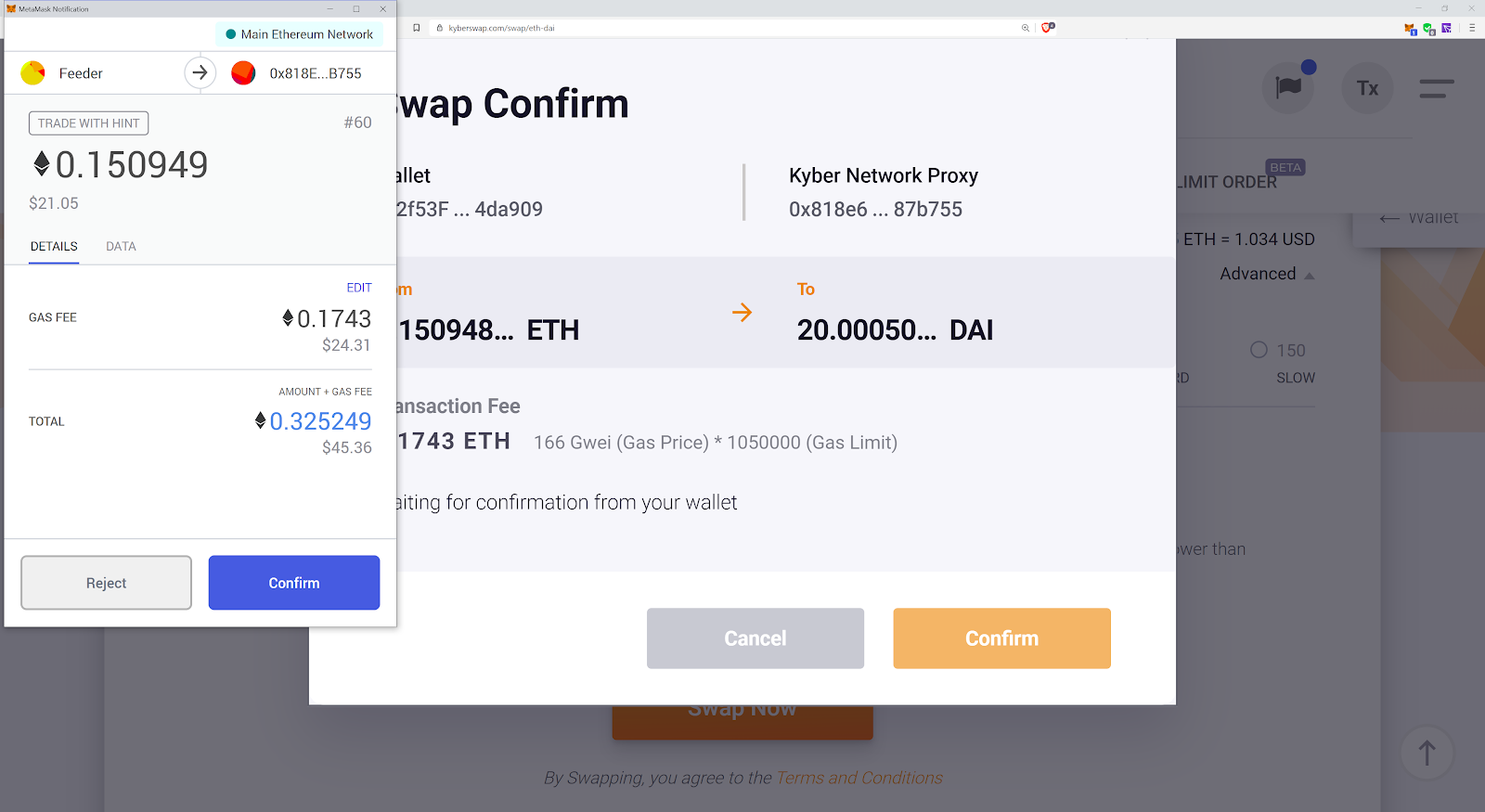

I went there to buy 20 DAI (~$20) with ETH. But when I plugged that into their site, I came up with more than $24 in fees. Yikes! I shall not be doing that.

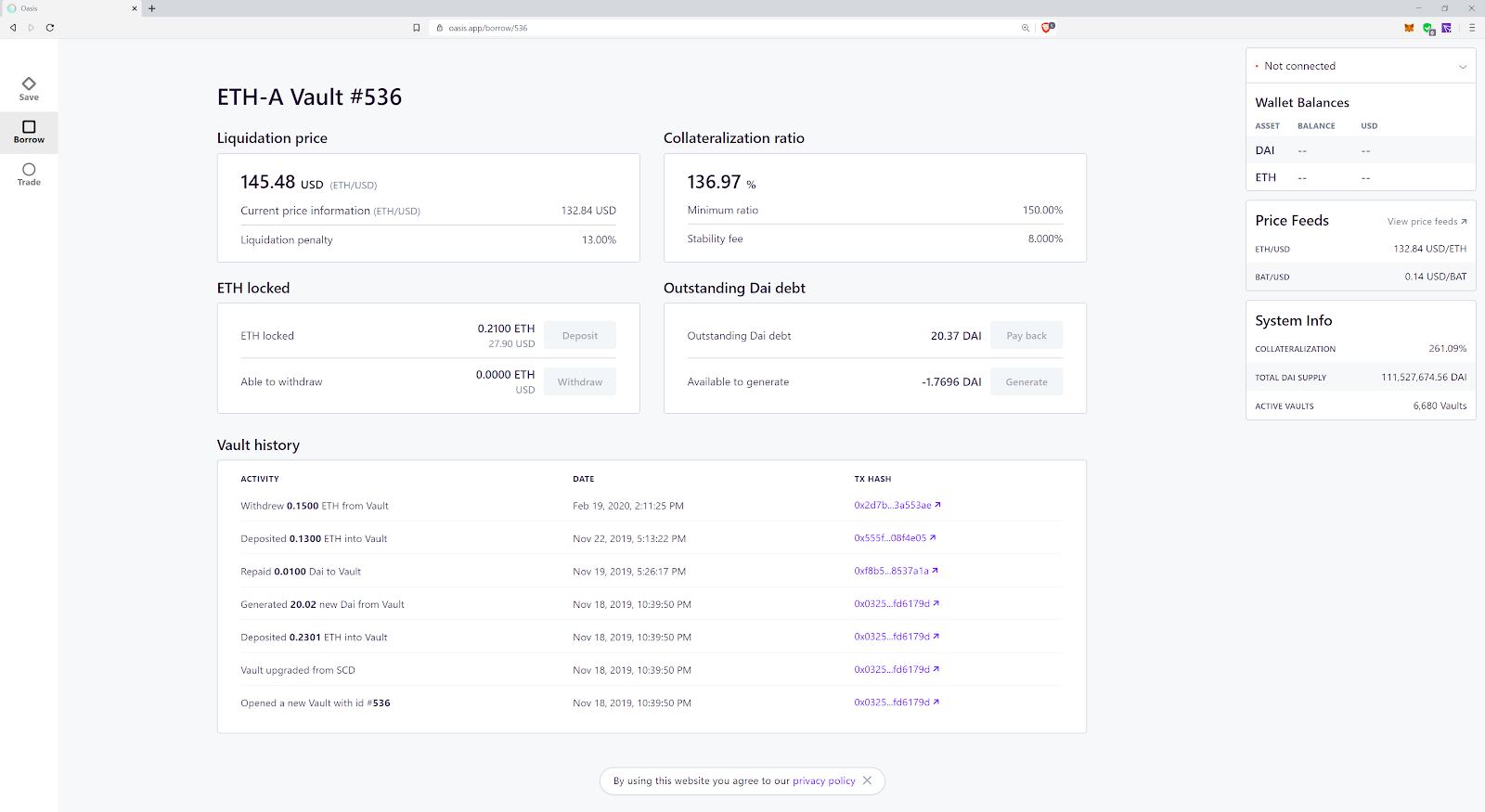

So that was a nonstarter. Then I remembered that last November, when the price of ETH was crashing, I had set up a Maker Vault. The point of that was to essentially take out a loan based on my ETH holdings. But now that the price of ETH was falling even farther, that vault was at risk. I figured that now might be a good time to check into that.

Oops, negative equity. That means I owe more than I have in assets. So, in order to not lose my ETH, I needed to send in more ETH...

But then I checked the gas fee and realized that my wallet didn’t have enough in it to recapitalize the position and pay the transaction fee. So it’s too late, that’s rekt!

Beyond my SFYL (“Sorry for your loss”) situation, this actually came up as a more macro issue for Maker. You know, just a tiny one that ended up costing some $4.5 million, give or take...

Why gas prices went up

Here’s what happened. During times of stress like we saw this week, as the price fell, under-collateralized vaults should have been liquidated (closed down), with the ETH being sold in the market and any leftovers after clearing the debt returned to the vault owner. Normally this means that the price ETH is sold for is somewhat reflective of the market price. In this case, the ETH was basically sold for 0.

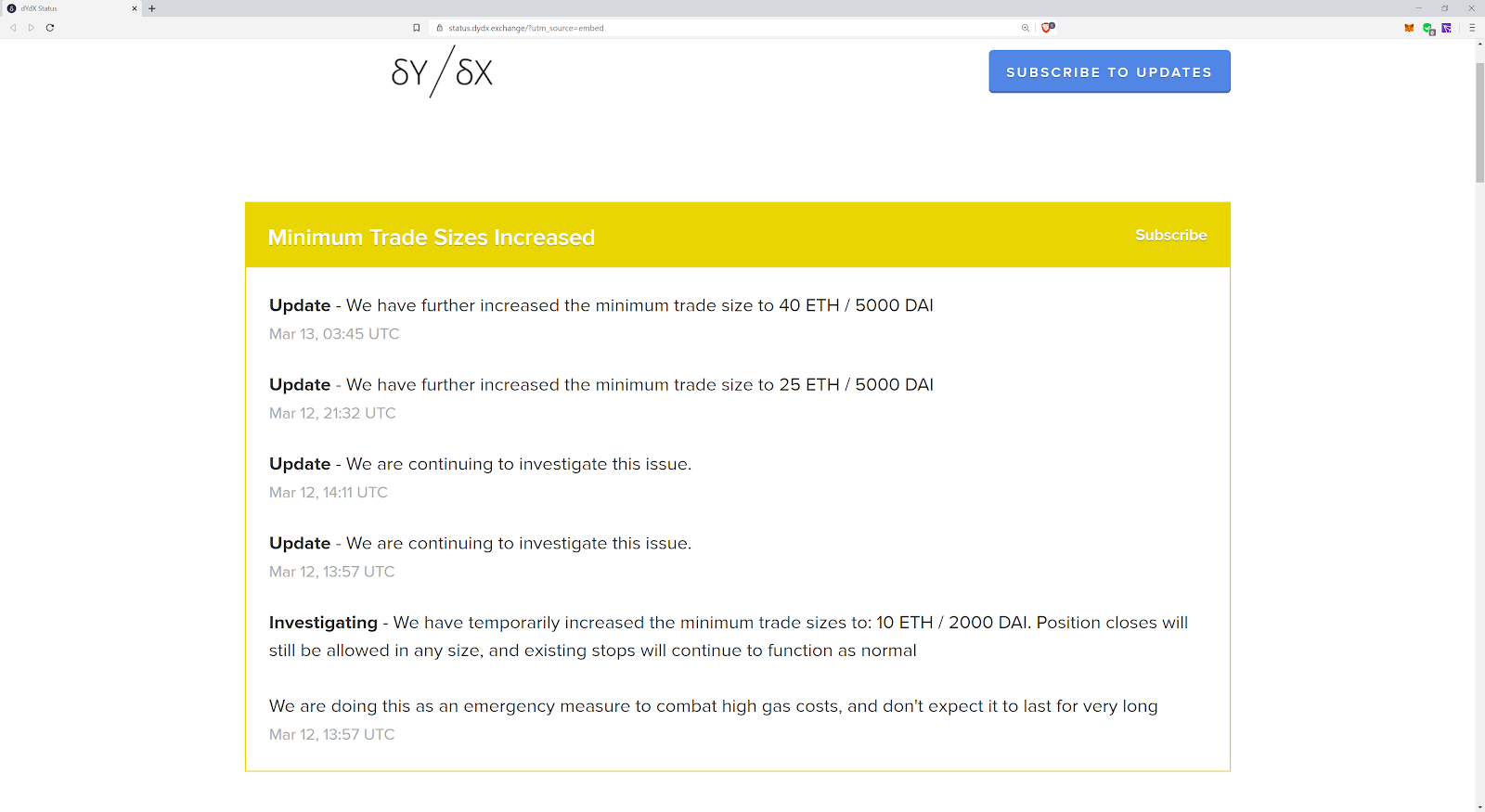

OK, fine. Whatever. Surely we can do better at dYdX. I covered this before, and pointed out that one of the nice things about the site is it pays your gas fees. Must be tough for them now, but a deal is a deal….

Oops.

Well I guess we’re not democratizing margin trading today…

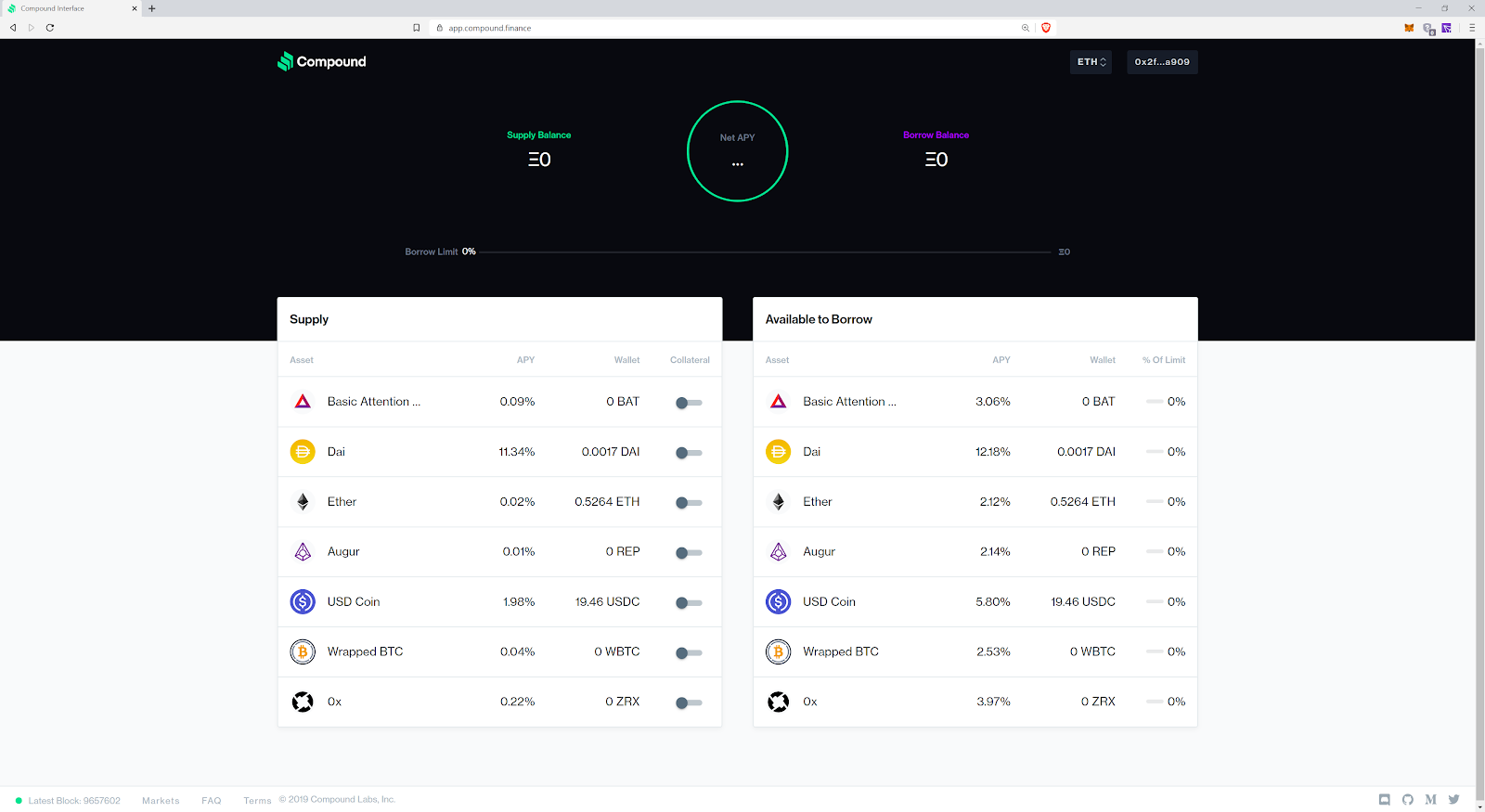

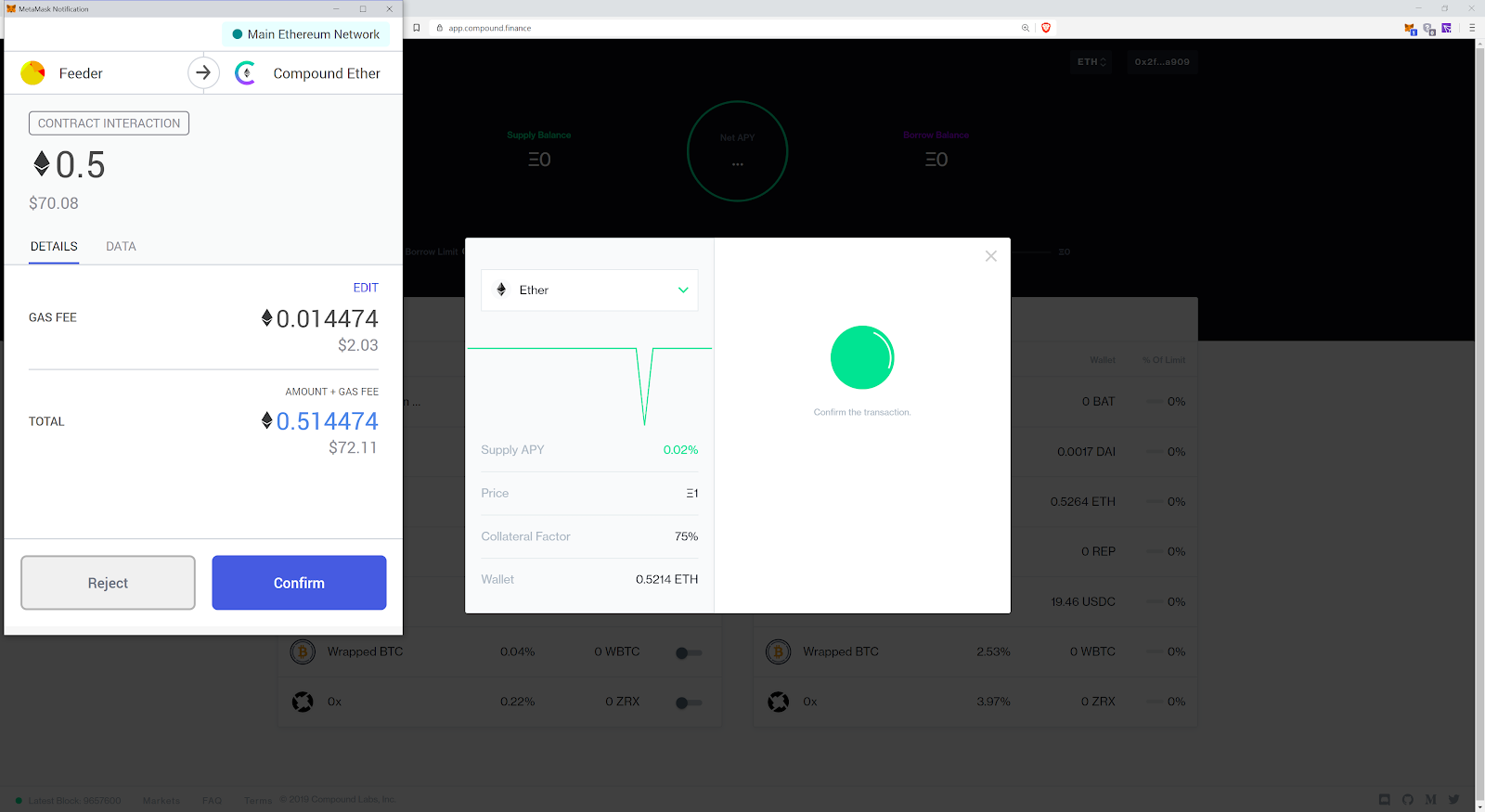

Next, I figured it was probably smart to go over to lending platform Compound and just earn some interest while we ride this thing out. Hmmm... the interest rates on lending ETH isn’t great at 0.02% per year. May as well set-it-and-forget-it, eh?

So I set it up for 0.5 ETH, which after a year should earn me 0.001 ETH (about $0.013). Then I looked at the transaction fee: $2.03… Yeah—nope.

Clearly, it is a hard time for every financial market—and DeFi, it turns out, is no different.

When the financial markets plummet, DeFi follows

Yet, one of the unique things about DeFi is that it typically involves pretty heavy usage of Ethereum onchain transactions, and therefore is extremely sensitive to gas prices. When the price of ETH moves a lot— and quickly—and these services need to respond to those risks, things get tricky.

While it’s easy to pick on DeFi, even “CeFi” had a hard time, with some unlucky person over at the Korean exchange Coinone seemingly paying about $82,000 in transaction fees to move 0.00000001 SNX Synthetix token, valued at about $0.00. In gas that’s, 7,555,792.50 Gwei. Oof.

I guess the bottom line is that while DeFi is still fun to play around with, this week was not its proudest moment. There are about a million and a half kinks to still work out. Fortunately it is looking increasingly likely that we’ll all be self-quarantined for a few weeks, or months, and all of our conferences are cancelled, which should give us time to reBUIDL.

decrypt.co

decrypt.co