Bitcoin History: When DDoS Attacks Made BTC’s Price Drop

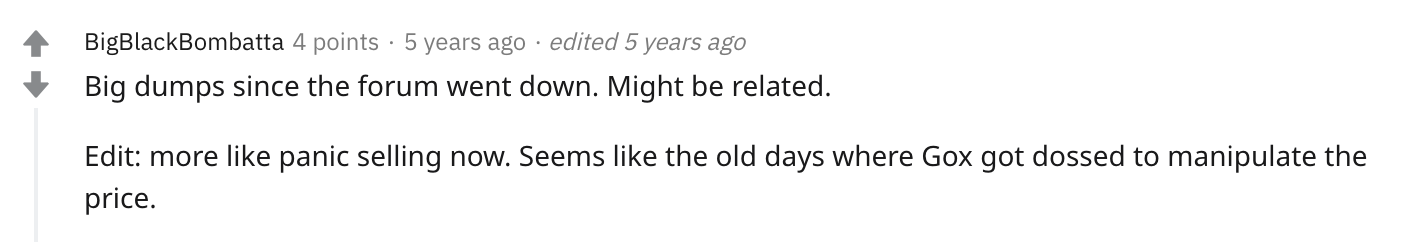

As anyone who has read the Bitcoin History series (or lived through the period in question) will know, the Bitcointalk forum was the crucible of debate in the early days. What’s less known is that – to quote one poster – “DDoSing this forum coincided with dumps on the then dominant Bitcoin exchange Mt. Gox.” That’s right, when the market was in its infancy, bringing a simple message board to its knees was enough to manipulate the market price of BTC.

Massive Panic in Tandem

We are accustomed to hearing about distributed denial of service attacks on cryptocurrency exchanges: just last week, Okex and Bitfinex succumbed, with a sophisticated assault on the former routing 400 gigabytes per second of traffic. DDoS attacks maliciously alter the traffic of a server, network or service by overloading it with a huge amount of junk traffic.

Back when Tokyo-based Mt. Gox was the dominant exchange in the bitcoin ecosystem (and bitcointalk.org the dominant chatter chamber), its trading activity was frequently disrupted by similar attacks, with trade volume falling precipitously in their wake. The exchange’s chief marketing officer, Gonzague Gay-Bouchery, once remarked that the company experienced DDoS attacks “every day, every single hour.”

There are numerous theories as to the perpetrators, with some speculating that new exchanges moving into the market may have been responsible due to the “lawless nature of Bitcoin during this period.” However, profit-motivated traders are the obvious candidates.

In any case, currency exchanges weren’t the only targets of DDoS attacks; gambling websites, mining pools, e-wallets and forums were also benighted. One report by the Computer Science and Engineering Dept of Southern Methodist University found that between May 2011 and October 2013, there were 142 unique DDoS attacks on 40 bitcoin services, with “7% of all known operators” having been targeted.

Dropped by DDoS

The aforementioned poster on bitcointalk.org called the practice of DDoSing the influential forum, which reliably caused the price of bitcoin to drop, “market manipulation wild wild west” – and he had a point. With the forum sluggish or offline altogether (and other bitcoin portals such as Bitcoincharts also affected), panic set in and big dumps quickly followed. Whomever perpetrated the trade would then watch the price fall and buy at the bottom. This sort of scam went on all the time during the Mt. Gox years, with information about the forum hacks detailed here.

The knock-on market effects of DDoS attacks on the Bitcointalk forum, in particular, were recognized elsewhere, such as on Reddit, where one exasperated poster remarked, “We will go up again after the attack stops. These panic sellers never learn.” This was a more sanguine take than another poster who raged “My leveraged long order got margin called because of these fucking assholes.”

Can DDoS Attacks Still Affect Bitcoin’s Price?

DDoS attacks – as indicated by last week’s incidents with Okex and Bitfinex – remain a problem for crypto exchanges, and panic buying and selling can still be triggered by such events. In late 2017, widespread DDoS attacks on crypto exchanges were widely blamed for wiping $53 billion off the total cryptocurrency market cap in less than an hour. In 2018, meanwhile, bitcoin dropped by $300 after Bitmex temporarily closed in the wake of a DDoS attack.

Bitfinex outage caused by supposedly a DDoS attack took about an hour. Almost no trades executed but the service is now resumed. It's interesting that a similar attack took place yesterday against OKEx. pic.twitter.com/wpXtiWgvCv

— Larry Cermak (@lawmaster) February 28, 2020

It should be noted, however, that core processes and DDoS prevention mechanisms have improved a lot since the Mt. Gox years. The prospect of any trader – save for a bitcoin whale – single-handedly influencing the price to the extent that was possible in 2013 is remote. Nowadays crypto Twitter is the closest thing we have to the Bitcointalk forum, and in the unlikely event of the social network being DDoSed, bitcoin won’t blink.

news.bitcoin.com

news.bitcoin.com