Meme cryptocurrency Dogecoin (DOGE) has weathered recent bearish sentiment as it strives to breach key resistance levels.

Indeed, Dogecoin aims to claim the $0.20 mark, and crypto trading expert Michaël van de Poppe believes investors should brace themselves for significant upside potential in the current cycle.

In an X post on May 31, Poppe projected that the token is poised for a massive breakout in the future, potentially resulting in a price surge of approximately 525% to reach the coveted $1 mark. Notably, the $1 threshold has long been a target price for the meme cryptocurrency.

“This is such an easy play. I think we’ll be seeing a massive breakout of this one, and it might even be possible to reach $1 again this cycle,” he said.

Dogecoin’s rising whale activity

Poppe’s analysis comes amidst a flurry of activity in the Dogecoin market, with notable developments fueling growing investor interest.

In this regard, crypto analyst Ali Martinez highlighted in an X post on May 31 that DOGE whales have acquired over 700 million DOGE in the past 72 hours, amounting to approximately $112 million.

This surge in investment from large holders indicates strong confidence in Dogecoin’s potential for future growth.

Initially, Martinez observed that DOGE had turned bearish while pointing out key levels to monitor. According to the analyst, Dogecoin faces significant resistance between $0.166 and $0.171. Breaking through this barrier could propel the price towards the resistance level of around $0.322.

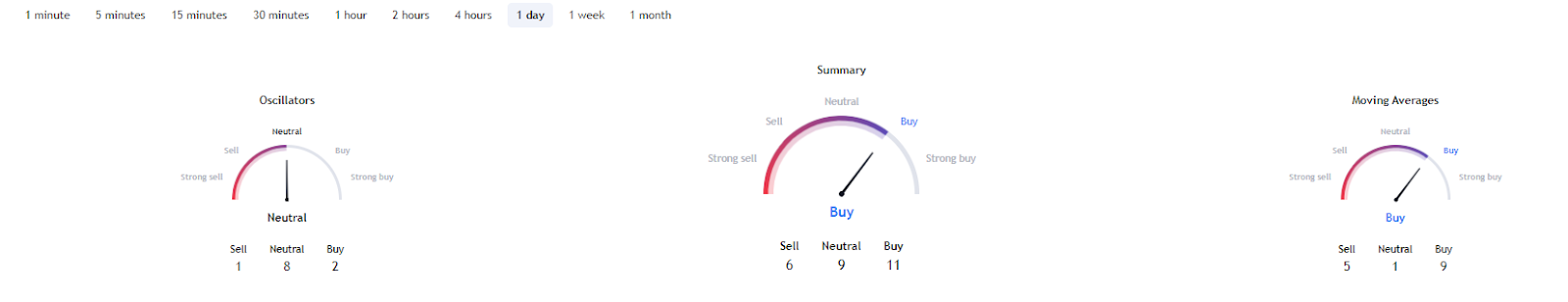

Despite this short-term price correction, Dogecoin’s technical indicators are predominantly bullish. One-day gauges from TradingView summarize a ‘buy’ sentiment at 11, consistent with the sentiment reflected in moving averages, which gauge at 9. On the other hand, oscillators for the coin are ‘neutral’ at 8.

As things stand, DOGE has a considerable journey ahead to reach the $1 mark. Given that the two assets have historically traded in tandem, achieving this milestone will likely require substantial support from Bitcoin.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com