Shiba Inu investors holding between 0.1% and 1% of SHIB’s circulating supply procure over 1.71 trillion (1,710,000,000,000) tokens in a day amid the 9% price spike.

This is according to on-chain data sourced by blockchain analytics resource IntoTheBlock. Notably, Shiba Inu has commanded robust interest from market participants since late February, but blockchain data suggests that this interest has come from smaller investors rather than whales.

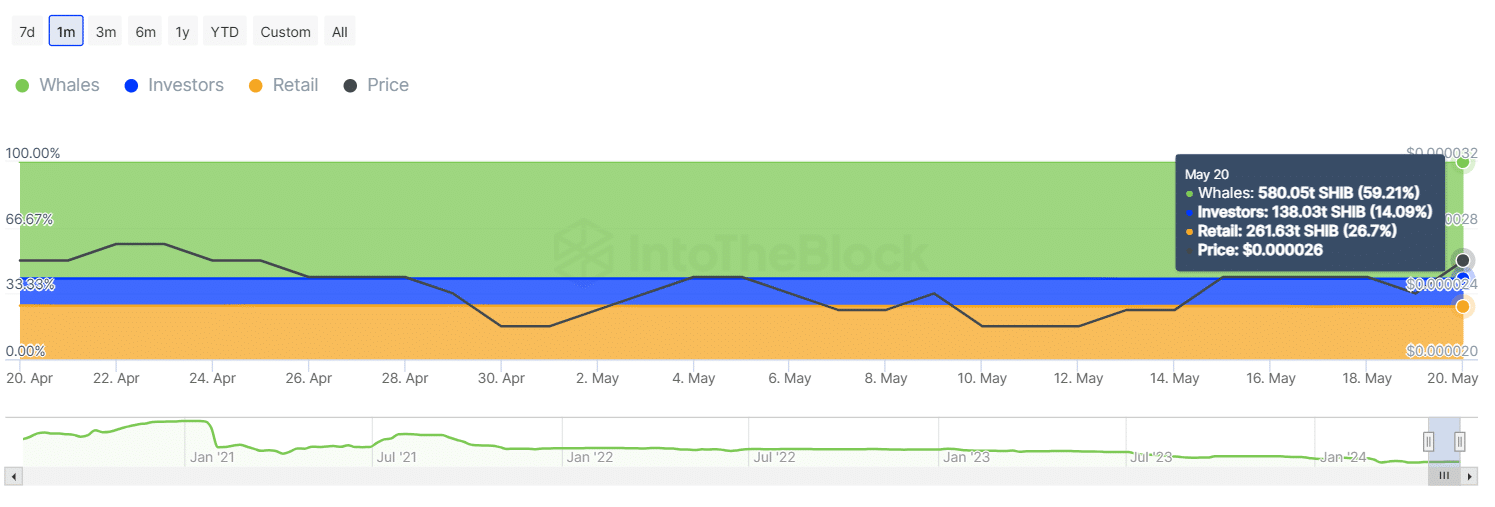

IntoTheBlock’s “Historical Concentration” metric provides insights into this trend. The metric reveals historical data on the holdings of three cohorts of Shiba Inu addresses: the whales who hold more than 1% of the circulating supply, the investors who hold between 0.1% and 1%, and then the retail players who hold less than 0.1%.

Investors Procure 1.7 Trillion Shiba Inu

Per the data, investors holding between 0.1% and 1% have been accumulating more tokens from whales and retail players. As of May 19, the cumulative balance held by these investors amounted to 136.32 trillion Shiba Inu, representing 13.91% of Shiba Inu’s supply. These tokens were worth $3.43 billion.

However, the balance held by this cohort of addresses saw a dramatic increase in less than 24 hours to 138.03 trillion SHIB on May 20, representing 14.09% of Shiba Inu’s supply. The latest figure indicates that these addresses added 1.71 trillion SHIB to their balances in a single day.

Conversely, whales and retail players distributed their holdings within the same timeframe. Specifically, whales saw their cumulative balance drop by 270 billion SHIB to 580.05 trillion. In addition, retail addresses decreased their holdings by 1.45 trillion tokens to a balance of 261.63 trillion.

This trend indicates a divergence in market sentiments among the three cohorts of addresses, as investors augment their bags in anticipation of further price increases while whales and retail players distribute or sell off their tokens to capitalize on the profits from the recent price uptick.

Possible Impact on Price

Recall that Shiba Inu recorded a 9% intraday gain on May 19, as recently reported by The Crypto Basic. This marked SHIB’s highest daily gain in four days, triggering a rejuvenation of investor interest. This renewed interest led to a 109% increase in Shiba Inu’s volume to $709 million on May 20, per CoinMarketCap data.

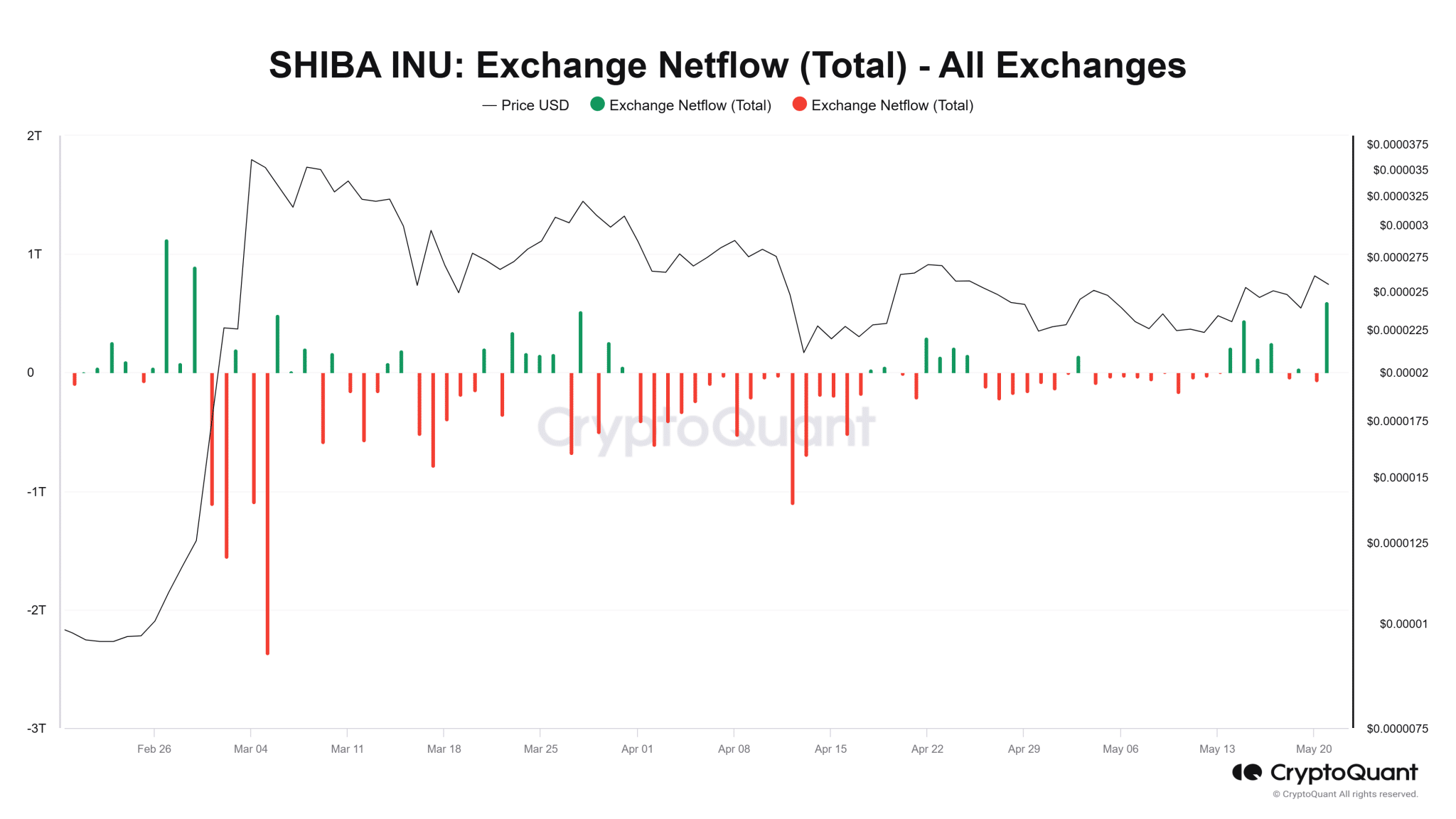

This surge in volume possibly stemmed from the confluence of accumulation by investors and distribution by whale and retail addresses. However, data from CryptoQuant suggests that, while investors pulled out their tokens from exchanges on May 20, there was a massive influx into exchanges on May 21.

Remarkably, exchanges saw a netflow of 574 billion SHIB on May 21, marking the largest positive intraday netflow since Feb. 27, when 1.13 trillion Shiba Inu tokens in netflow reached exchanges. Despite this bolstering selling pressure, SHIB went on to spike to the $0.000045 high on March 5 after this figure was recorded.

In addition, right before the upswing in early March, investors procured 8.8 trillion SHIB between Feb. 27 and March 1. At press time, Shiba Inu currently trades for $0.00002522, having given up some of the gains from May 20. With these signs lining up, market watchers have made lofty projections, with some suggesting a rise to $0.00051.

thecryptobasic.com

thecryptobasic.com