- Cardano price reversal in the cards due to critical Gann time cycle.

- Extended oversold conditions increase the likelihood of anticipated reversal.

- A return too, and above, the $3.00 value area is incoming.

Cardano price action has been some of the most dismal and disappointing out of all the major cryptocurrencies. But Cardano’s fortunes are about to change.

Cardano price ready to spring towards $3.00, Gann time cycle to shock traders

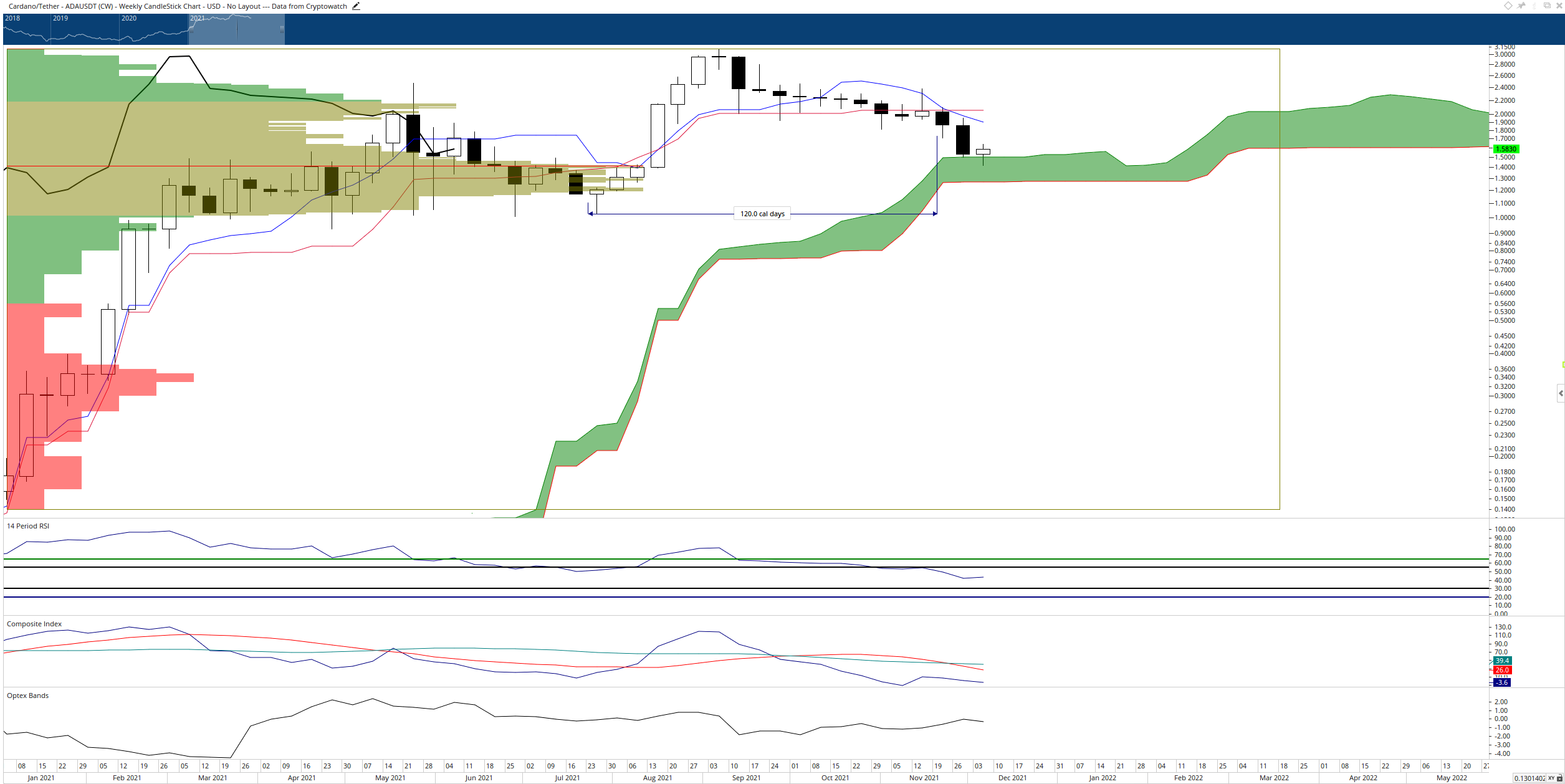

Cardano price has been a consistent loser over the past three months. Since the week of September 3rd, Cardano has trudged lower and lower. Out of the past thirteen weekly candlesticks, only one has a weekly close above its open.

Adding insult to injury, that sole bullish candlestick moved higher by 20%, only to retrace the majority of those gains to settle that week higher by a meager 3%. Now down over 50% from its all-time high, Cardano is ready to make a comeback.

In Gann’s analysis, the most crucial inner year time cycle is Gann’s 90-day cycle. Gann wrote that any instrument that faces persistent selling (or buying) pressure over a 90-day period has a very high probability of finding a low and reversing. Cardano is positioned perfectly for a bullish reversal.

The timing of the 90-day cycle couldn’t have occurred at a better price point. The most recent swing low of $1.41 is directly above the 2021 Volume Point Of Control at $1.38. Additionally, the top of the Cloud (Senkou Span A) at $1.36 increases that support structure.

ADA/USD Weekly Ichimoku Chart

A daily close above the Tenkan-Sen at $1.63 could jumpstart the spike higher. Initial resistance against the Kijun-Sen at $1.90 is possible, but more than likely, Cardano would see some selling pressure at Senkou Span B ($2.17). Cardano must ultimately close above the Cloud and the high volume node at $2.15 to push towards new all-time highs.

In the event of any bearish price action, downside risks should be limited to the $1.20 value area.

fxstreet.com

fxstreet.com