Curve (CRV) continues to buck wider market trends. It is surging in value even as other, seemingly similar Decentralized Finance tokens falter. Over the last 90 days, CRV is up ~113%. Over the same period, Compound (COMP), SushiSwap (SUSHI), UniSwap (UNI), and Aave (AAVE) are down ~41%, ~44%,~32%, and ~37% respectively.

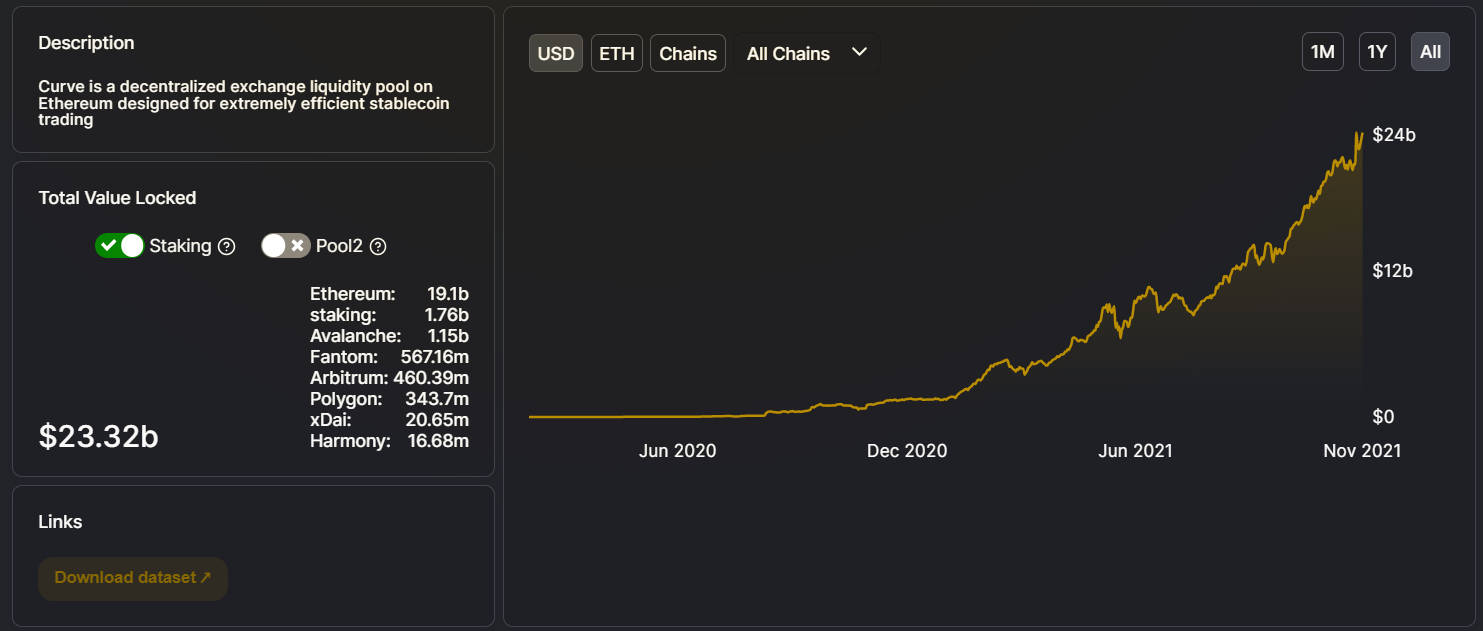

The Total value locked into the Curve protocol is also rocketing upwards. Over the same period it has risen 70% with activity on the platform shooting up alongside the price of the CRV token.

*Source:Defilama. The USD value of assets across Curve pools has surged in 2021. Curve is popular on Ethereum, Avalanche, and many other EVM and layer 2 chains*

# What is Curve Finance?

Curve is an automated market maker-based decentralized exchange with similar mechanisms to Uniswap and Balancer. It differentiates itself from other AMMs, however, by focusing on supporting liquidity pools with similarly priced assets. Examples of pools on Curve include stablecoin based pools, and pools containing wrapped versions of volatile assets (ie. wrapped-BTC, tBTC).

This approach allows Curve to use optimized algorithms that lower fees and slippage, and lead to less impermanent loss when interacting with these like-for-like asset markets.

Curve is also well liked for its charming 90s style user interface that favors substance over style.

# Curve for token swaps

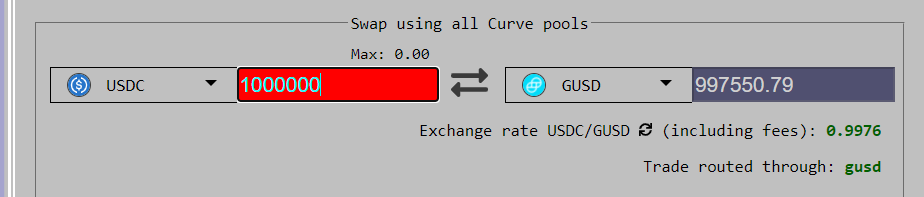

*Source: Curve.fi. A US$1,000,000 USDC for Gemini-USD wap on Curve Finance*

*Source: Uniswap. A US$1,000,000 USDC for Gemini-USD swap on Uniswap*

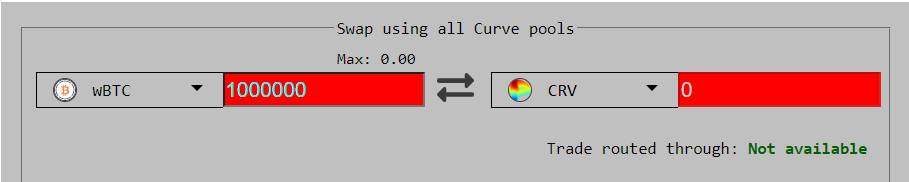

On many automated market makers, token-to-trades that don’t involve ETH, or the native token of the platform being used, can be expensive. This is because the native platform’s token is generally used as a counterparty for trades if there is no liquidity pool set up for the two assets.

When you trade on most AMMs between token A and token B, the AMM processes this as token A for ETH, SOL, or AVAX, and then ETH, SOL, or AVAX for token B. Swappers end up absorbing the cost for two trades instead of one.

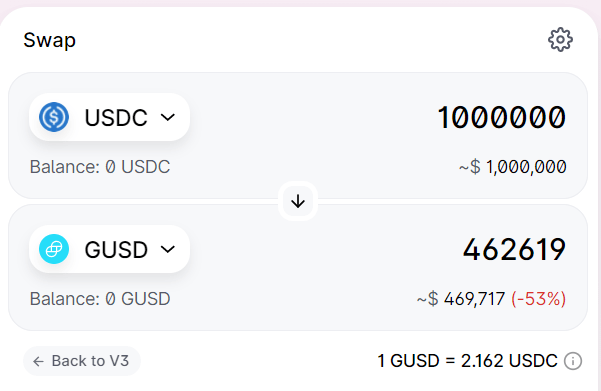

With Curve, tokens are always traded directly between each other. If there is no pool then the trade will simply not be executable. While this means fewer options for swapping it does mean that efficient rates are maintained and users are not left accidentally overpaying for trades. Trading on Curve always consists of just one transaction.

*Source: Curve.fi. There is no pool where wBTC and CRV exist together so it is not possible to trade between the two assets on Curve.*

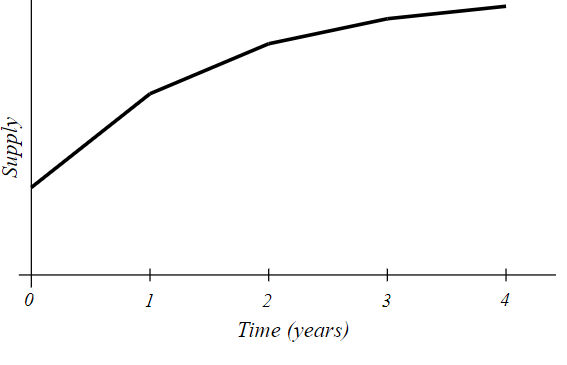

Even when trading between assets where there are pools available, and another counterparty token does not need to be used on AMMs like Uniswap or Sushiswap, Curve still has them beat.

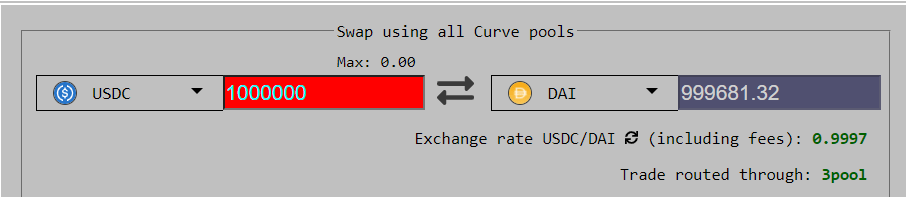

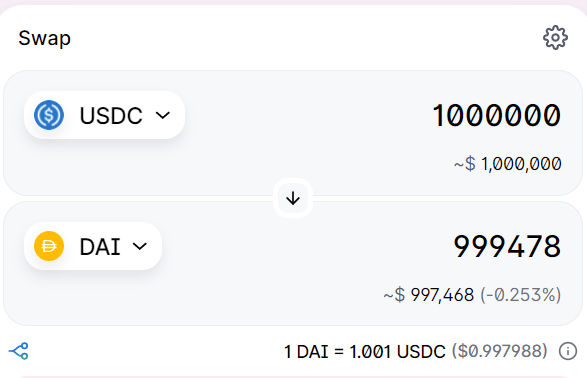

*Source: Curve.fi. Trading 1,000,000 USDC for DAI on Curve Finance*

*Source: Uniswap. Trading 1,000,000 USDC for DAI on Uniswap*

*Source: Sushiswap. Trading 1,000,000 USDC for DAI on Sushiswap*

Curve’s trading algorithm is designed to minimize slippage, while Uniswap’s is designed to maximize available liquidity. The savings on Curve for these sort of like-for-like token trades increase as the trade gets larger.

# Curve for liquidity providers

Curve is also popular with liquidity providers for design reasons. Protocols like Curve are built as a decentralized marketplace of various token trading pairs with automatic liquidity provision.

Trading pairs on the platform are composed of liquidity reserves of tokens managed by a separate smart contract. The model allows any user to become a liquidity provider (LP) for a given liquidity pool if they provide the appropriate reserves to the pool.

Users who provide liquidity for token pools earn LP shares proportional to their services which can be redeemed at any time for the underlying tokens they represent.

Being a liquidity provider can be risky because of impermanent loss. With a number of AMMs, half or both sides of the liquidity pool have to include some volatile asset. Impermanent loss occurs when for example an LP deposits ETH and some other asset into a liquidity pool and the price of ETH changes. When they withdraw they earn less than they would if they had simply held ETH and the other asset. This is because of the way the ownership of pools is structured.

For Curve’s pool that includes stablecoins only, there is very little risk of impermanent loss since the prices of the assets within them are stable. Supplying liquidity to Curve Stablecoin pools is appealing because returns are market neutral.

Curve also integrates with other Defi protocols that offer interest for stablecoin deposits like Compound, Yearn, Convex, and Synthetix. These integrations mean stablecoin depositors can easily access yield farming program rewards without having to worry about shifting between platforms.

*Source: Curve.fi. For example the sUSD pool on Curve. While the base APY is 0.56% when you add the native token rewards (CRV and SNX) that are earned through integrations this yield increases significantly.*

# The native token- What is powering the surge in the value of CRV?

The short answer to the question above is that the asset is nudging towards becoming net deflationary because of spiking demand to lock-up CRV governance tokens.

On top of providing Liquidity providers with a share of trading fees, DeFi protocols like Compound, Uniswap, Sushiswap, and Curve are generally quite generous in offering ‘governance tokens’.

These tokens give holders a share of the responsibility to determine the future direction of the protocol and key structural decisions. They also offer holders a share of the total revenue generated by the protocol, not just on individual liquidity pools like with LP tokens. Finally, governance tokens have speculative value.

Curve holders have the option to “stake” their governance tokens, CRV, into the platform for a period between four weeks and four years. The length of time locked determines the number of voting rights allocated to a staker. CRV stakers are given ve-CRV or vote escrowed-CRV as their tickets to vote in governance decisions.

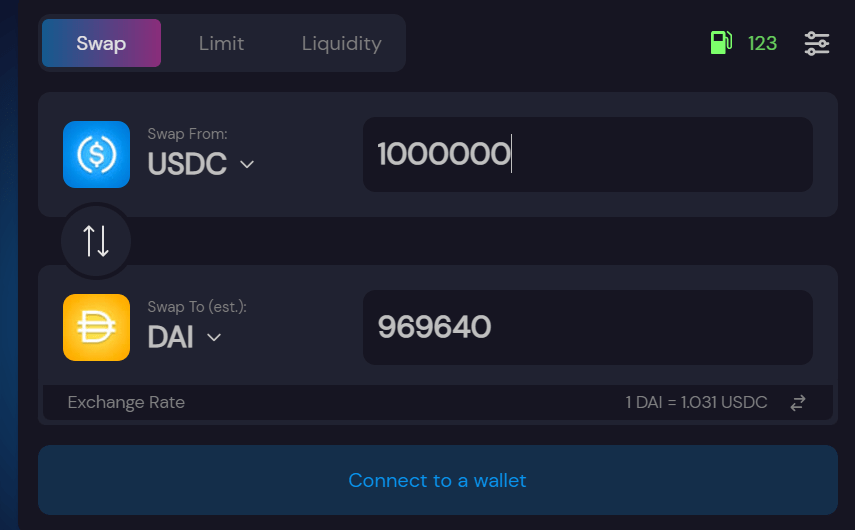

Currently, around 750,000 CRV are distributed daily to liquidity providers on the Curve protocol. The Curve DAO, ve-CRV holders, determine which LPs of which pools get these tokens. These token rewards are allocated based on the predetermined inflation rate of the CRV token.

Every year for the next three years, at a decreasing rate, CRV tokens will be created and allocated to liquidity providers. The Curve interface also comes with tools to let ve-CRV holders know how best to allocate their votes to maximize their potential earnings.

The first reduction in emissions happened in early August 2021. This coincided with the CRV token’s rapid appreciation in value. A halvening type effect?

*CRV inflation rate. Source: Curve.readthedocs.io*

What has emerged within Curve is a quite surreal bribery-based incentive model. Projects like Abracadabra money will pay ve-CRV holders a weekly bribe in their native token, to push them to use voting rights, to allocate more rewards towards the pool that it manages.

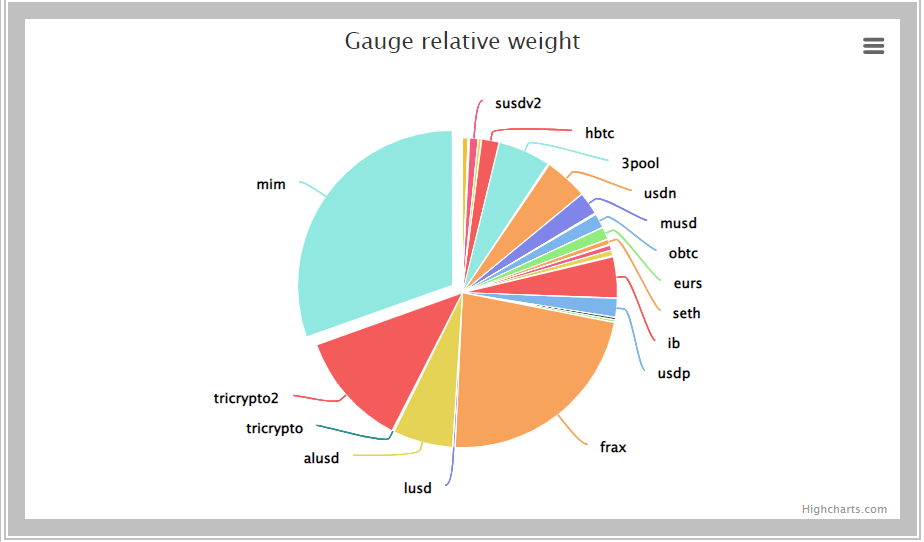

*Source: Curve.Fi/ The current distribution of CRV rewards across Curve pools. The ‘mim pool’ or ‘Magic internet money pool’ is set up best to reward liquidity providers. LPs in this pool receive the most CRV. The mim pool is operated by Abracadabra finance.*

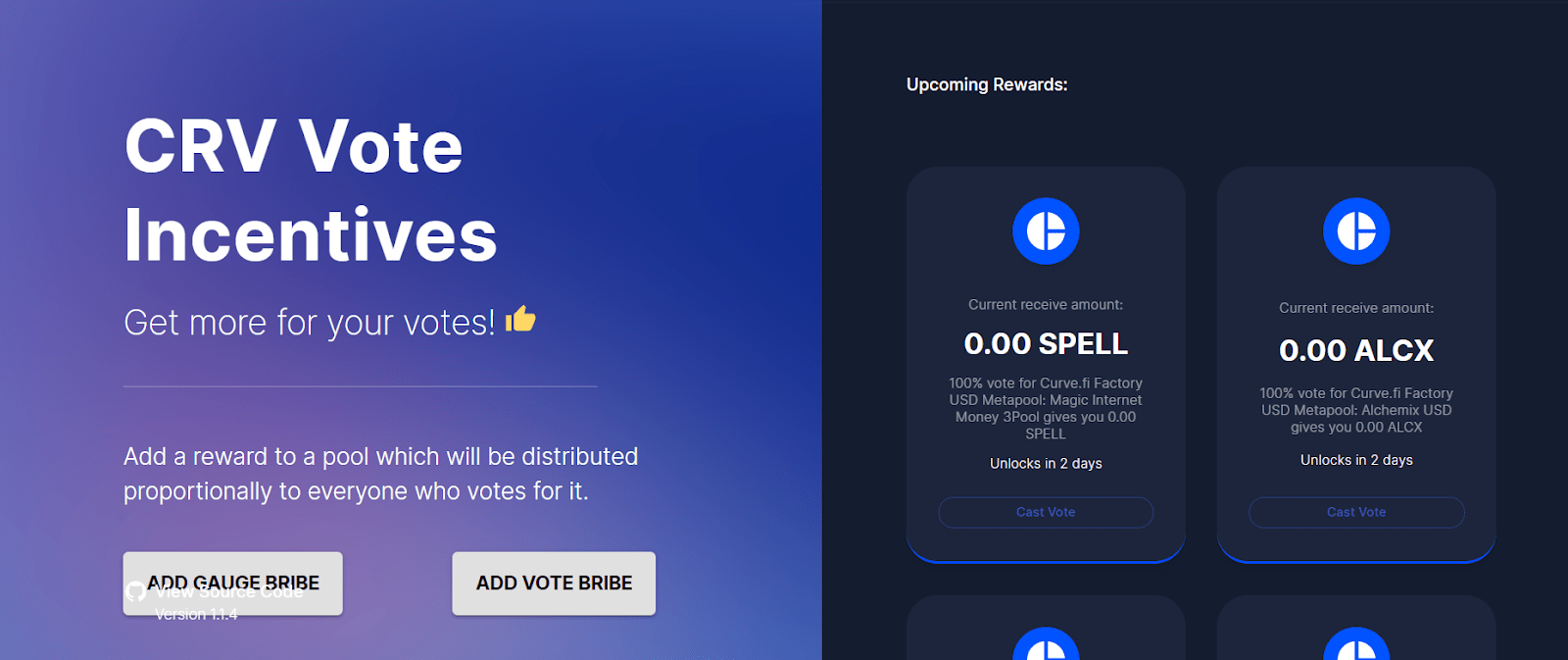

*The dashboard for bribe.crv.finance, a platform built to help ve-CRV holders easily receive bribery payments*

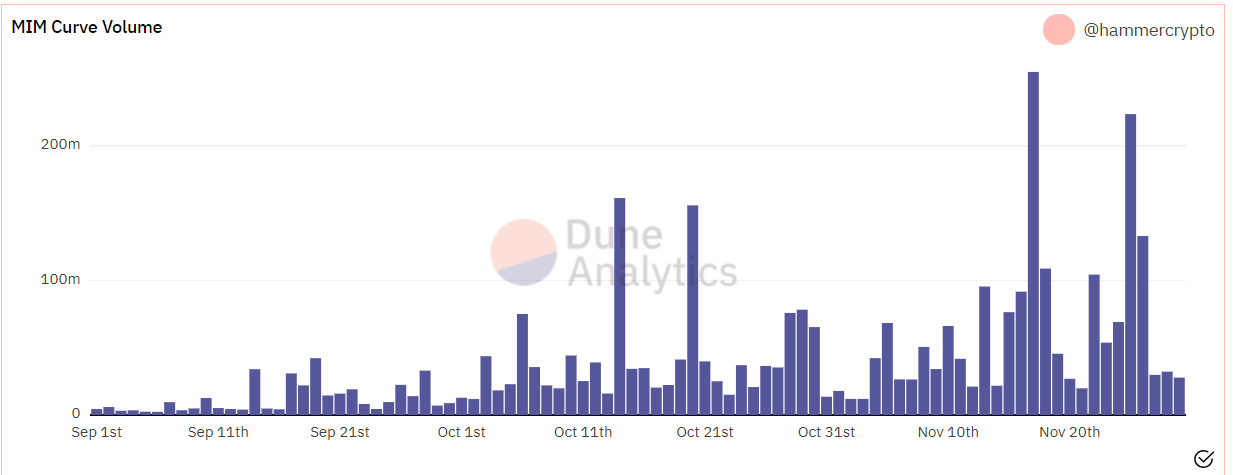

*Source: Dune Analytics. MIM, the stablecoin issued by Abracadabra.money has seen its volume on Curve surge thanks to the bribery payments and the growth of the ‘mim pool’*

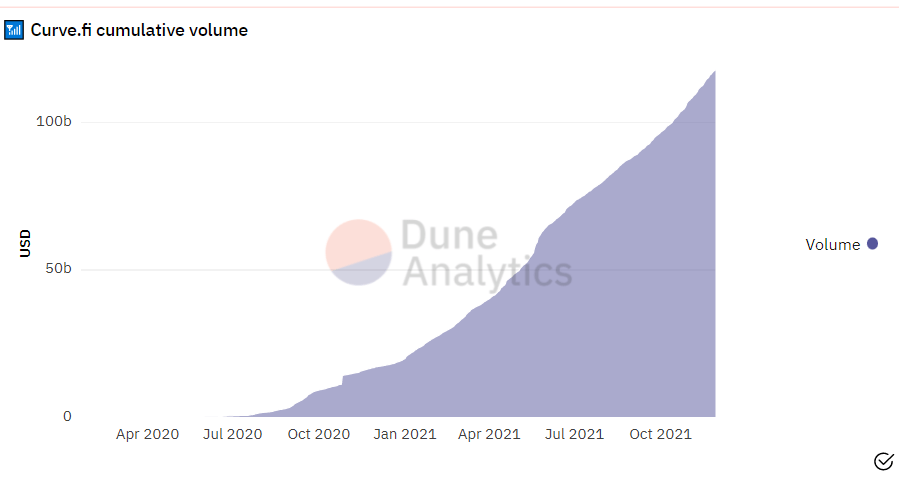

*Source: Dune Analytics. Trading volumes on Curve have increased exponentially since January 2021*

Thanks to a passed community vote, a 50% admin fee was added to all trading fees. Those fees are collected and then used to buy 3CRV, the LP for the Curve 3pool, one of Curve’s most popular pools that contain USDC, USDT & DAI. The 3CRV tokens are then distributed to ve-CRV holders.

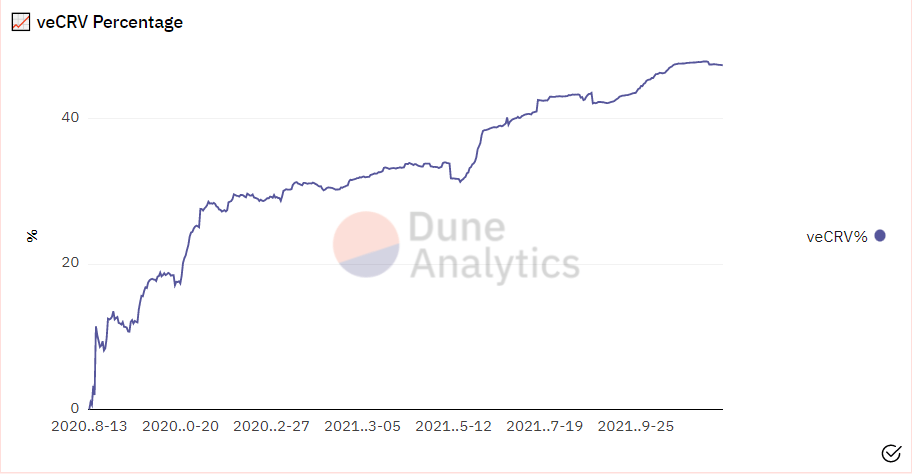

Thanks to the numerous benefits of being a ve-CRV holder, more and more CRV holders are locking in their tokens and turning them into ve-CRV.

*Source: Dune Analytics. The percentage of CRV locked as ve-CRV*

The staking of CRV has a ‘deflationary’ effect. CRV that is locked up as ve-CRV, the majority for up to 3-4 years, is not considered circulating or liquid. Despite the high inflation/emission schedule, the demand for locking up CRV is turning the asset net deflationary.

The combination of more demand to buy into the Curve ecosystem and supply of the CRV tightening thanks to governance lock ups, is creating a double price booster effect that is contributing to the heady gains of the CRV token in recent months.

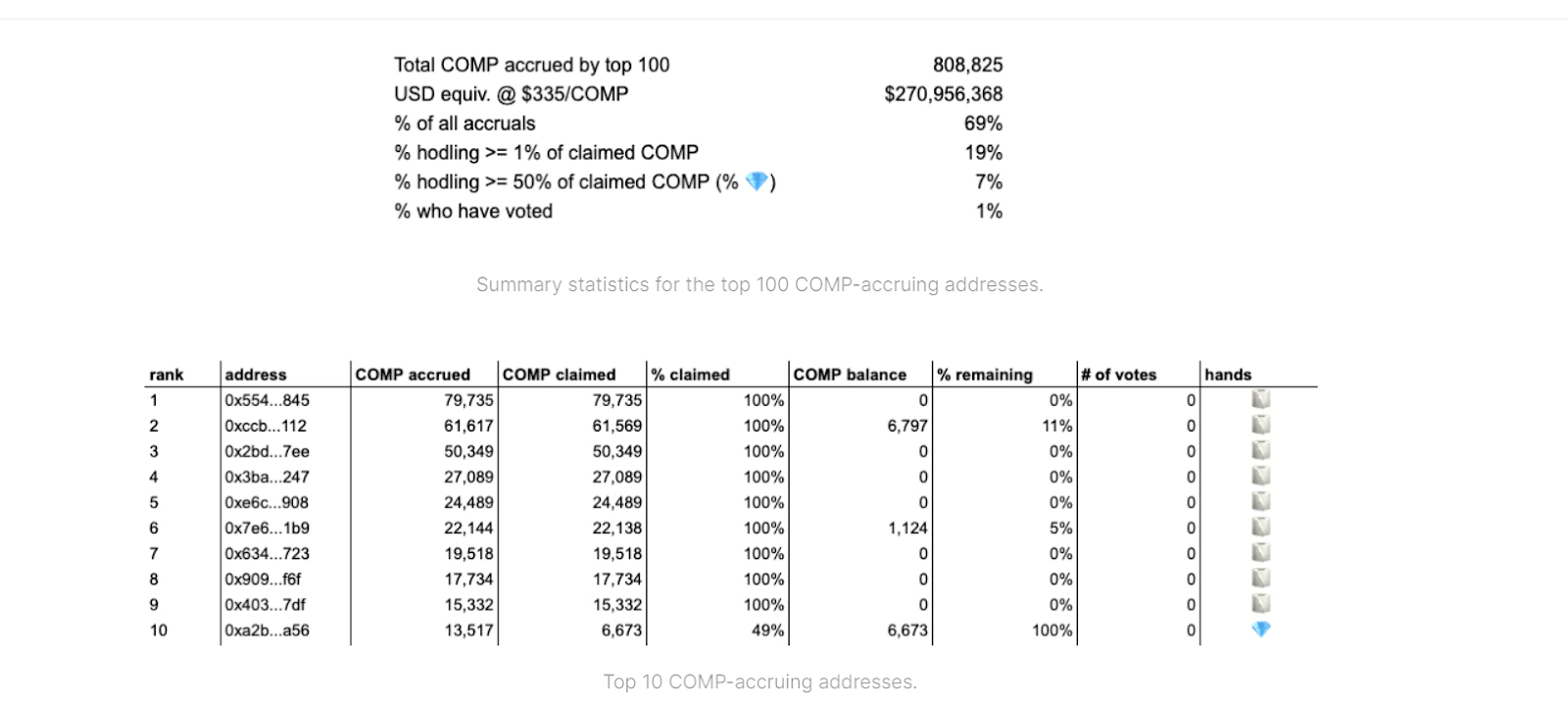

CRV compares favourably with other Governance tokens in DeFi. A recent report from Ethereum researcher Alex Kroeger found that most COMP liquidity miners, users who deposit liquidity into Compound and earn COMP as a reward, have little to no economic interest in the protocol and do not participate in governance.

Analyzing the top 100 accounts by accrued COMP from liquidity mining, Kroeger found that most top miners dump all their COMP rewards quite quickly after receiving them.

*Source: Alex Kroeger, Mirror.xyz*

This contrasts with Curve where there is a fervour to lock up tokens for governance. It is unsurprising that CRV has outperformed COMP in recent times.

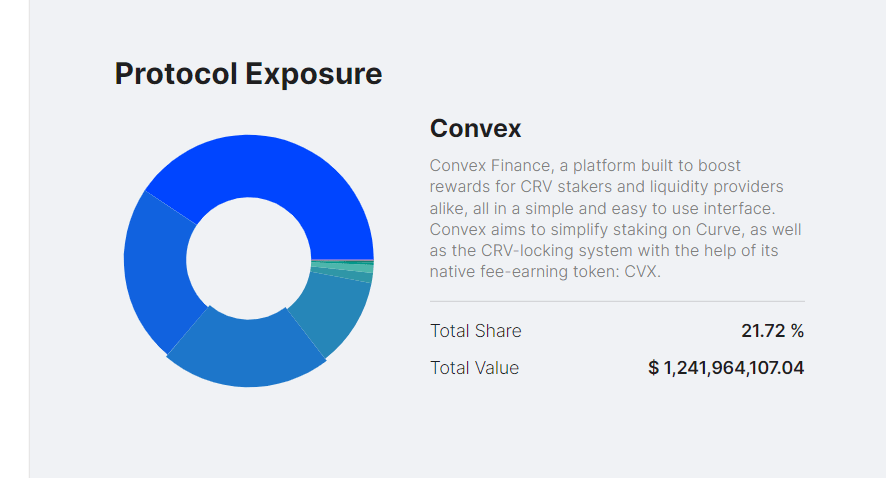

# Yield farmers Convex, Yearn, and StakeDAO battle to control Curve

This year, as CRV tokens have become more scarce, top yield farming protocols Yearn, Convex, and StakeDAO have battled to control the governance of the Curve protocol. Curve, because of its capabilities to connect with so many other DeFi protocols, and the excellent reward options for CRV holders is a popular building block for Yield farming platforms.

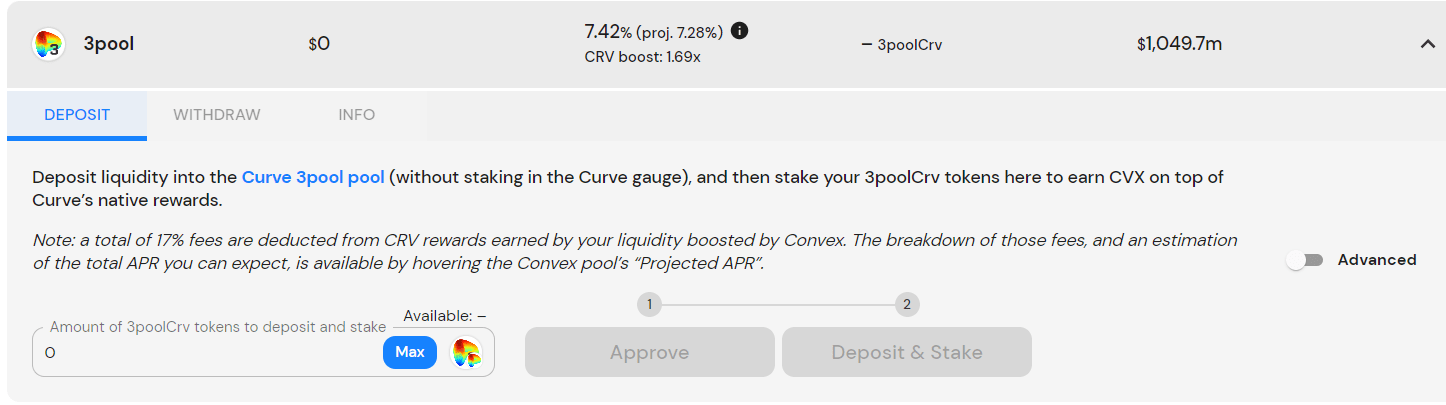

Yearn and Convex are both dominated by Curve-based strategies which invite users to either deposit Curve LP tokens or CRV into vaults and earn yields. These yields are earned by compounding LP positions, re-investing in CRV, earning the native tokens of the yield farming platforms.

*Source: Convex.Finance. An example of a Convex yield farming strategy that invites users to deposits 3CRV LP tokens and then CRV tokens and Convex tokens*

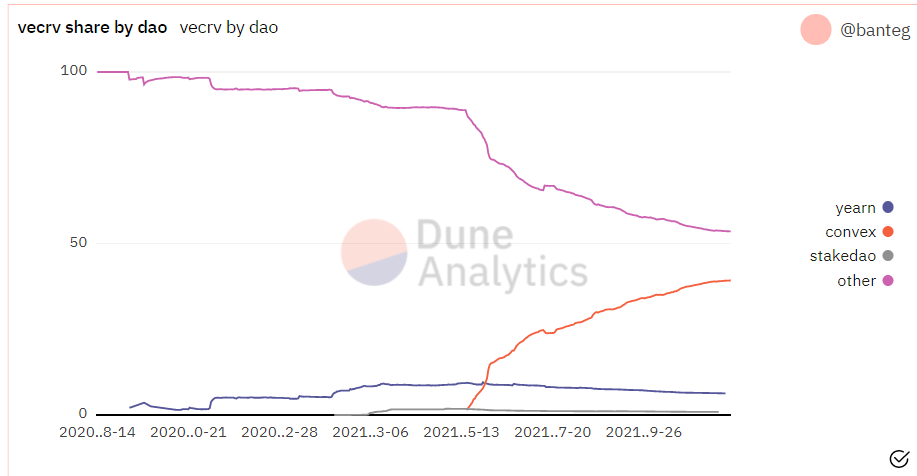

*Source: Dune Analytics*

The chart above shows how much of the ve-CRV supply the DeFi protocols that build on top of Curve hold. At one point in early 2021, Yearn was the undisputed top yield farmer using Curve holding 10% of the ve-CRV in circulation.

Convex, however, quickly emerged to become by far the largest platform to capture Curve LP and CRV multiplier opportunities. It now controls over 40% of the ve-CRV supply. The race between Convex and Yearn to Control ve-CRV was dubbed the Curve wars.

The existence of platforms such as Convex and Yearn that encourage users to be liquidity providers to Curve has helped to grow the exchange ecosystem over the last six months.

While at first glance, they appear to be competitors, Yearn is actually one of the largest depositors into Convex. Yearn users have over US$1.2 Billion locked into Convex. All three entities, Curve, Convex, and Yearn, have a symbiotic relationship that is beneficial to each in different ways.

*Source: https://yearn.fi/system*

# Conclusion

The deeper we head into a more than 18-month crypto bull market the more appealing it becomes to lock assets into stable yield bearing platforms like Curve.

If a crypto investor locks a speculative asset like ETH into a liquidity pool on Uniswap or a protocol like Compound, there is a possibility that a fall in the price of the asset offsets gains. Impermanent loss means they can better off holding assets during periods when prices are rising.

US dollar stablecoins, however, retain value during periods of crypto market volatility. They are market neutral. This means Crypto users feel comfortable locking into yield programs like the one offered by Curve.

Stablecoins combined with DeFi yield solutions are fantastic hedging options for crypto investors to protect against inherent crypto market volatility.

During a period in time when capital markets are offering historically low-interest rates, decentralized finance offering double-digit yields on USD equivalent deposits is sending shockwaves through financial markets. The complexity and interconnectivity of DeFi means platforms can offer high returns with initial capital remaining secure.

Depositing into a Defi protocol is essentially providing liquidity to a trading market. Depositors on protocols like Curve are market makers. DeFi opens the door for anyone to earn the fees and rewards typically only available to Wall street firms and institutions. It is a relationship that benefits both sides, DeFi protocols can easily attract a wider pool of investors and can bootstrap growth quickly as a result. Users earn high yields for providing financial services.

Curve stands out amongst them because its native token CRV offers power and a wide array of incentives for holders.

CRV holders are being courted every week by Curve pool operators that are willing to offer them big payouts for favourable governance. Day by day more CRV is being locked for governance and the asset is turning net deflationary. As the inflation rate of CRV slows, the more appealing it becomes to be a CRV holder and ‘get-in-while-you-still-can’ pressure builds.

Beyond this, Curve remains one of the most actively used and efficient decentralized exchanges in crypto thanks to its philosophy of focusing on like-for-like swaps.

bravenewcoin.com

bravenewcoin.com