- The crypto market recedes due to leading coin prices depreciation.

- Bitcoin, in contrast to the past few days, shows a reducton by 7.13%.

- Binance Coin and Ethereum face the same fate and depreciate 9.05% and 8.50%, respectively.

- Tether USD is the only coin in the top ten to gain price, but be careful.

The world of cryptocurrencies is full of uncertainties, and that makes the ecosystem flourish, a problem. When writing the previous roundup, the leading coins were bullish and setting new records. But then the tables turned, and they saw a depreciation.

All three top-leading coins are in the red club. Despite Bitcoin‘s resurgence, there was little time to recuperate and gain momentum. The short-lasted green signals are again red. But who knows how short-lasting this period of redness is going to be!

This recession in the prices of top currencies has also impacted the total market cap of cryptocurrency. The market cap has shrunk from $2.66T to $2.47T. Let’s see what’s next because no trend is permanent in the crypto market, which is an understatement.

Bitcoin’s depreciates at 7.13% in the last 24 hours

Bitcoin (BTC) has gained momentum in the last 24 hours and has soared high, aiming for new highs. It was expected to reach $60K soon, but that trend didn’t last long. The last 24 hours have been recessive in the market, and except one, the remaining currencies in the top 10 are going recessive.

Bitcoin’s chart took the downward direction and showed a reduced value by 7.13% in the last 24 hours. At the time of writing, its price is recorded to be in the $54,415 range, nearing $58K 24 hours back. Compared to its weekly performance, BTC has also been impacted if the redness recorded is 7.70%. The current market cap of Bitcoin is $1,026,605,206,267.

BTC’s volume recorded in the last 24 hours is $42,138,053,033 which in US dollars equals $775,120 BTC. The current circulating supply of Bitcoin is 18,884,175 BTC. The overall performance of BTC in the last seven days has been recessive.

Ethereum dips to $41K after a red signal

As the top leading currency, Bitcoin, the second in ranking Ethereum, has also halted in the run. ETH was showing progress for the last few days, and it even crossed $45K, but then it also faced a red signal. It has witnessed a reduction in prices amounting to 8.50%, and we are back to the same game of whether it would cross 42K.

The price recorded for Ethereum at the time of writing is in the $41,110 range. It has seen a recession of 5.15% in the last seven days as evidently impacted by the recent bearish prices. The current market cap of Ethereum is $486,926,404,935, which has also impacted the total crypto market cap. The volume of Ethereum is $26,376,063,036 which equals 6,419,233 ETH.

The overall weekly performance of Ethereum, like Bitcoin, has been affected by the recent bearishness in the market. Its current circulating supply is recorded to be 118,504,466 ETH.

Binance Coin depreciates at 9.05% in the last 24 hours

Binance Coin (BNB) was the fastest-growing amongst the top three coins, but it is also a victim of the recent change in tide. BNB has witnessed a depreciation of 9.05% in the last 24 hours. Even though it has made losses in the last 24 hours, it shows a positive trend for overall weekly performance. Its bullishness for the past week is recorded as 0.53%, which is much better than for ETH and BTC, both of which have been impacted by the bearish market. Its price recorded at the time of writing is in the $592 range.

The current market cap recorded at the time of writing for BNB is $98,856,725,317. It has been performing much better than its predecessors, and it is expected to resurge sooner than them.

The volume recorded for Binance Coin has been $4,221,447,278, this equals 7,122,856 BNB. If we have a look at its circulating supply, then it has reached 166,801,148 BNB. Its overall weekly chart shows bullishness, and expectedly it will be back in the race, leading the rest.

Tether gains 0.10%, reaching $1

Tether (USDT) is the only currency that is going ahead without facing any red signal. In contrast to all the nine currencies in the top 10 list, it is the only currency that remained bullish in the last 24 hours. This price movement shows not only the resilience of this currency but also the investors’ trust. It is hoped that other top 10 currencies will also join in the race, but it might take time to recover their momentum.

The price recorded for Tether at the time of writing is $1.0. The overall weekly bullishness amounted to be 0.07%. Its current market cap, at the time of writing, is $73,258,317,857. The volume recorded for Tether by CoinMarketCap is $107,471,366,554 which equals 107,270,276,122 USDT. Its overall performance for the last seven days has been bullish.

Terra LUNA 14th in the list shows a depreciation of 5.64%

Terra (LUNA), the moon coin, has been recessive for the last seven days. Its recorded performance for the last seven days has been -2.41%. It continued the same trend, shedding 5.64% in the last 24 hours.

LUNA’s price recorded at the time of writing is in the $41 range. The current market cap of this coin is $16,632,186,950.

Top gainer and loser

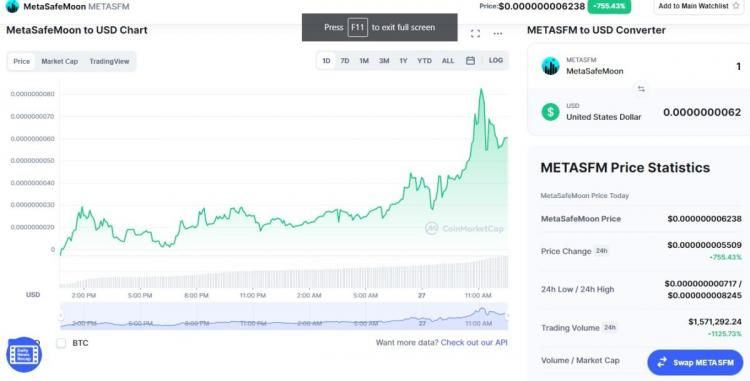

The top gainer in the list is MetaSafeMoon, whose bullishness is estimated to be 578.54%, much less than the previous days’ top gainers. But due to ongoing reduction in prices, it is still much better. The price recorded for MetaSafeMoon at the time of writing is $0.000000004948.

The top loser in the list is Cheems Inu which shed 98.37% in the last 24 hours. Its current price is $0.000106.

Final thoughts

The recent change in the mood of the market is not something unfamiliar to the crypto market. Volatility has been the market’s primary characteristic for a long time, and crypto loyalists hope that this bearishness will soon turn bullish. Though this might last for a short while, the sudden dips and surges variedly give chills or cheers to most investors. Crypto trading is not for the faint-hearted; consider that as a warning. But you can HODL the coin if you believe in the concept of a blockchain project.

The current reduction in the crypto market cap is not new, and hopefully, it will turn to new highs in the charts. According to research, higher volatility corresponds to a higher probability of a declining market, while lower volatility corresponds to a higher probability of a rising market. Straddle and strangle options, volatility index options, and futures can be used in the stock market to profit from volatility.

How can you use these rules of thumb about volatility to gain a better position in the crypto market? Please tell us in your comments below.

Victorious warriors win first and then go to war, while defeated warriors go to war first and then seek to win.

Chinese general and military strategist, Sun Tzu (545 BC-470 BC) Art of War

cryptopolitan.com

cryptopolitan.com