A closely followed crypto analyst says the top two digital assets by market cap are currently hovering at make-or-break levels following a correction that erased nearly $400 billion off the market.

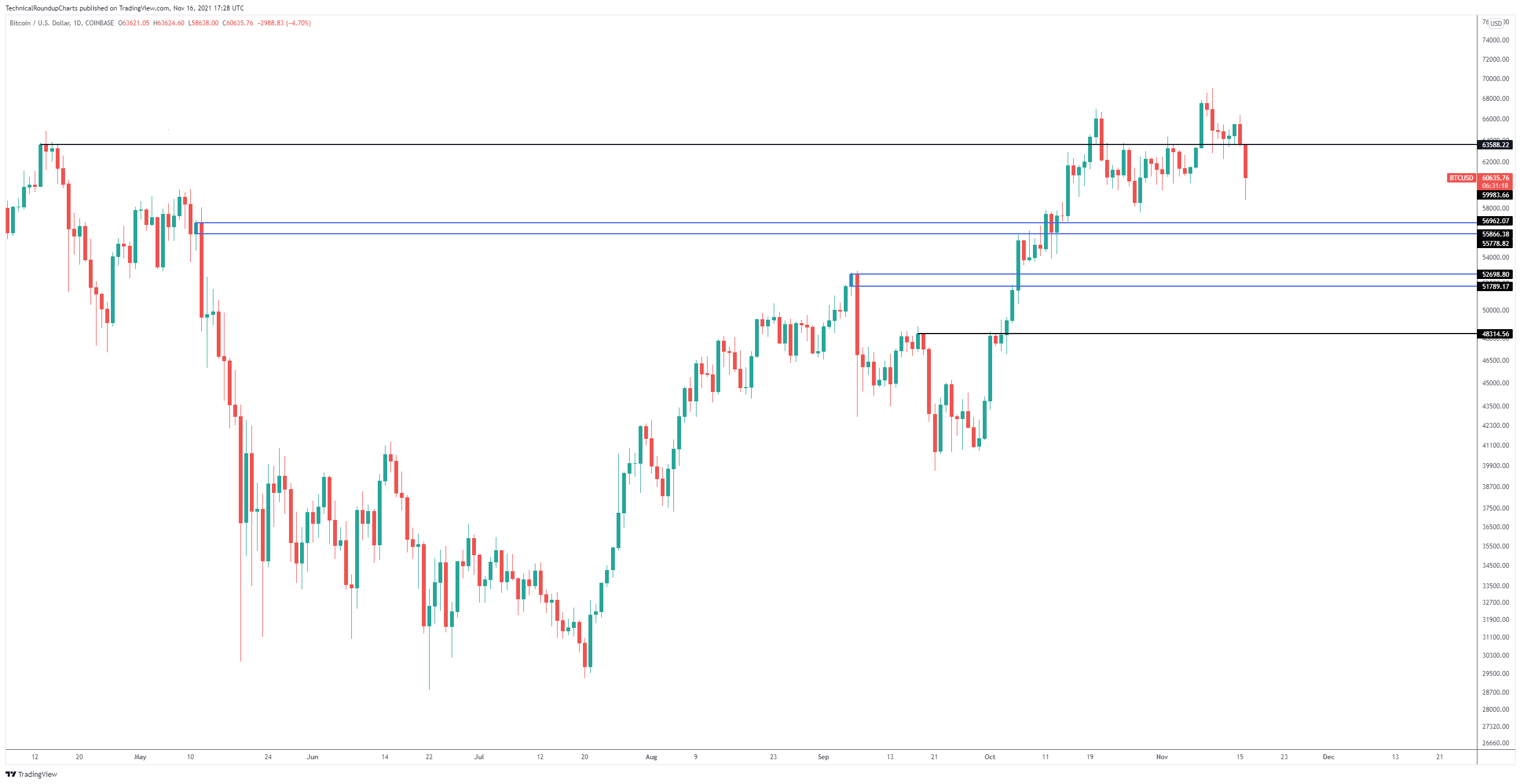

In the latest TechnicalRoundUp newsletter, pseudonymous analyst Cred says that if Bitcoin plunges below the $55,800 range and closes the week there, he would shift to a bearish point of view on BTC.

“This weekly range high is a compelling line in the sand for directional bias. If the breakout turns into a failed breakout, which would be strongly implied by a weekly close below $55800, then our bias would shift bearish.”

Cred says BTC bulls can get confident after a convincing reclaim of the $60,000 level or try a “do-or-die” trade at $50,000.

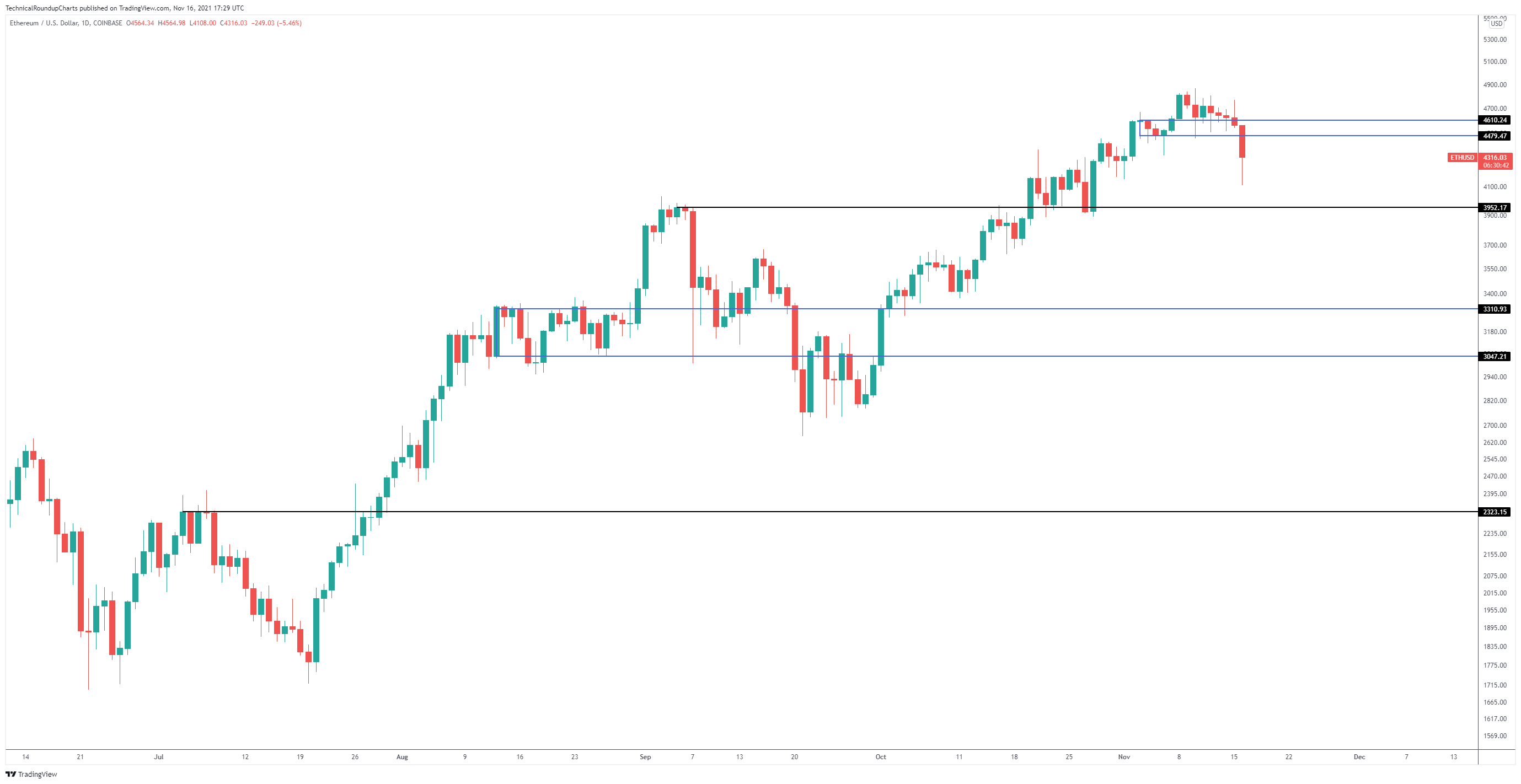

Looking at Etheruem, the analyst says ETH just broke its daily upward trend and could be in danger of losing its strength on the higher time frames as well. He says a break below the $4,000 level, specifically $3,952, would cause him to flip bearish for the medium term.

“Similar to Bitcoin/Dollar, the weekly range high is an inflection point. $4000 is support and it’s intact until proven otherwise. If it’s lost, our bias will be bearish in the short to medium term. This daily trend shift is worth taking seriously. It’s the first significant daily lower low since the bottom in September. Ethereum’s seamless march has seemingly been interrupted. In other words, the market is still above weekly support at $4000 (good) but daily trend just broke down (less good).”

At time of writing, BTC is trading at $60,511, while ETH is priced at $4,244.

dailyhodl.com

dailyhodl.com