Bancor and Perpetual Protocol price actions are divergent. However, BNT is bullish above $3.5, while PERP may tear higher after breaking above $15.

Bancor (BNT)

The DEX is amongst the find allowing trustless swapping of tokens using BNT for governance.

Past Performance of BNT

The Bancor token price is relatively stable, under-performing BTC and ETH on the last trading day. At the time of writing, buyers are still in control. However, the uptrend's momentum is fizzling out, reading from the BNT technical analysis.

Day-Ahead and what to Expect

As per the BNT crypto candlestick arrangement, the failure of bulls to close above $4.1 and gallop higher signals weakness and decreasing momentum.

At present, there are lower lows relative to the upper BB, dropping three percent.

Besides, the bear bar of October 9 is defining the short-term trend and may see the BNT token slide below the middle BB and $3.5.

Bancor Technical Analysis

The Bancor coin price is within a $0.6 range, with resistance at $4.1 and support at $3.5.

While buyers appear in control, risk-averse traders can wait for a close above any of the above levels before committing.

A breakout above $4.1 may see BNT/USDT glide to September 2021 highs of around $4.8.

On the flip side, losses below $3.5 may see BNT drop to $3.1, mirroring losses of September 2021.

Perpetual Protocol (PERP)

Perpetual Protocol offers perpetual contract trading on every asset. Its unique AMM distinguishes the trading platform. It uses PERP for governance.

Past Performance of PERP

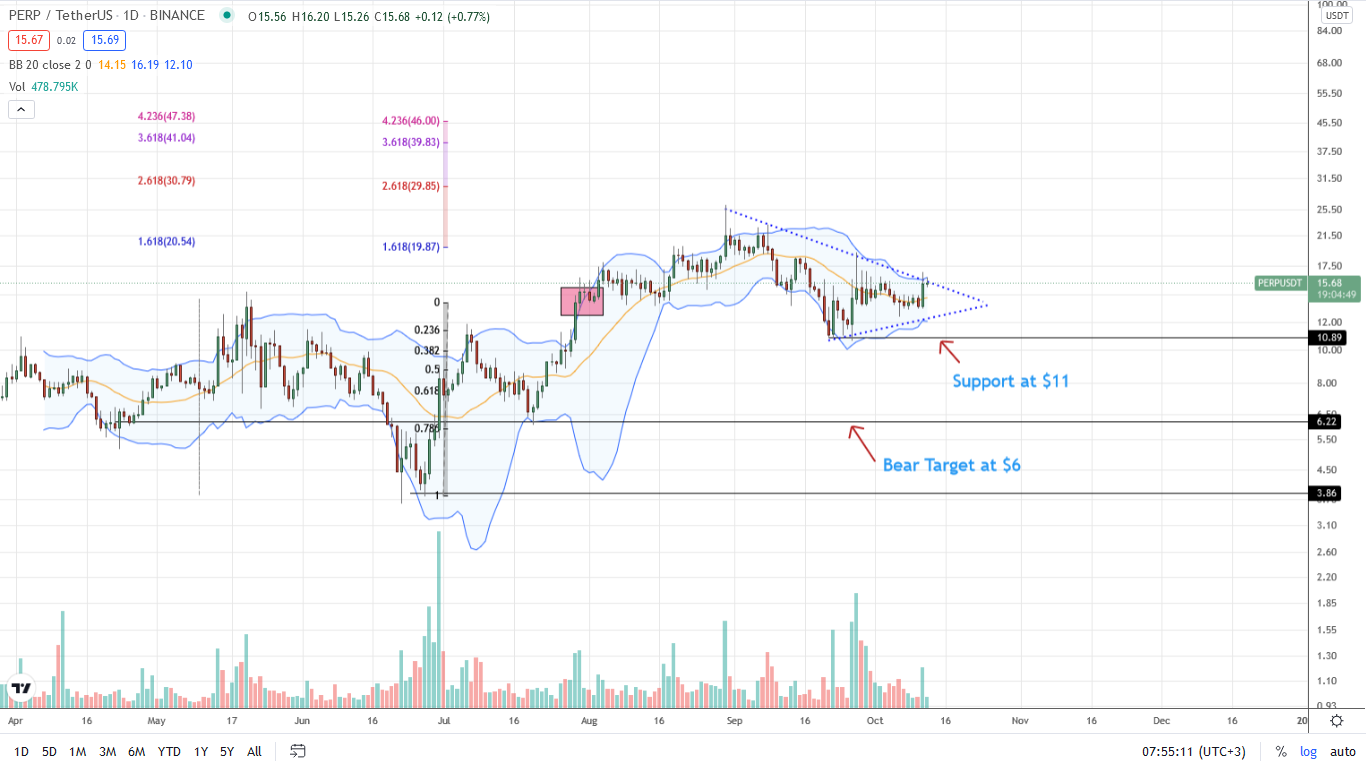

Perpetual Protocol crypto prices are tracking lower, pulling back from all-time highs.

As of writing, the PERP token is springing higher after a period of consolidation above the September 2021 lows of $11.

Technically, sellers are in control, but the trend could change once there is a break above $15 and the resistance trend line.

Day-Ahead and What to Expect

The PERP coin buyers appear to be resisting lower lows reading from the PERP technical analysis in the daily charge.

As prices are within a descending wedge, a close above $15 and the resistance trend line may be draw buyers, lifting PERP towards $20 and $25.

However, if sellers press lower, a break below $13 could open the door for bears of September.

Perpetual Protocol Technical Analysis

Technically, PERP crypto sellers are in control, reading from the series of lower lows in the past few days.

The weakness in the daily chart may see PERP prices drop to $11 if there are losses below $13—recent lows.

On the reverse side, a welcomed revival may force PERP above the resistance trend line in a lift-off towards $20.

cryptoknowmics.com

cryptoknowmics.com