On its official Twitter account, Solana stated that it is the fastest-growing developer ecosystem as per Electric Capital’s Developer Report. According to the report which seeks to quantify the developer activity within the Web 3 space, Solana is the fastest-growing ecosystem which surpasses over 2,000 total developers in 2022.

1/ A new report by @ElectricCapital shows that Solana is the fastest growing developer ecosystem, surpassing 2,000 total developers in 2022. It's second in raw numbers only to Ethereum.

— Solana (@solana) January 17, 2023

Let's dig into the numbers.https://t.co/HQvPbQzQD2 pic.twitter.com/xV6pnoT7db

Furthermore, the tweet which read “It’s second in raw numbers only to Ethereum” made a succinct point in itself. As per the chart linked in the tweet, by December 15, 2022, Ethereum had 1,873 full-time developers while Solana had 383. However, when the increase in the number of developers was taken as a percentage for one year, SOL overtook ETH with 36% while ETH stood at 6%.

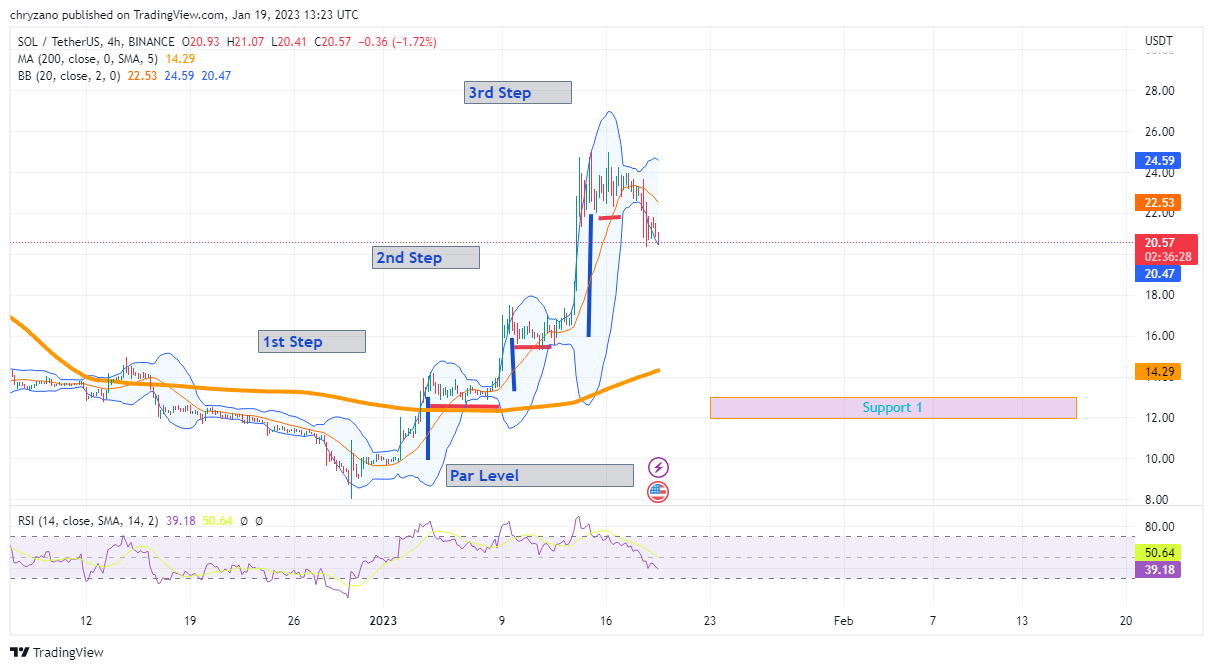

Meanwhile, SOL’s vertical movements have been quite lethargic from mid-November to late December. Nonetheless, the dawn of January gave SOL some momentum making it scale the heights.

Looking at the steps marked in the chart above, the width of the step (red line) decreases when the prices rise higher. The blue lines marked on the chart represent the height of the rise. Specifically, the height between the second step and third step is greater than the height between the second and the first steps.

When the whole scenario is considered, SOL gained some momentum from the bulls as shown in the chart. However, although the increase in the price got bigger, the bulls lost their power to hold the position. This can be seen by the width of the steps shortening, as the bulls fail to consolidate.

In other terms, the bears seem to be taking over the market, as currently there’s nothing that the bulls could do. Hence, traders should be on the lookout to short their assets before their profits shrink or tank into a loss.

However, for those holding a long position, there seems to be a glimpse of hope– SOL has touched the lower Bollinger band and the market could correct the price and make it surge. The RSI is 39.18 and is tilting downward to the oversold region, hence a spike of hope could be on the horizon.

If the bulls can contend with the excessive pressure from the bears, then SOL could move sideways but if the bears dominate, it would land on Support 1.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk, Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

coinedition.com

coinedition.com