A new report by the San Francisco Open Exchange (SFOX) claims the market is still largely interested in bitcoin over altcoins and makes the argument that ethereum may no longer fall into the category of an altcoin.

Libra Talks Solidified Bitcoin's Market Dominance

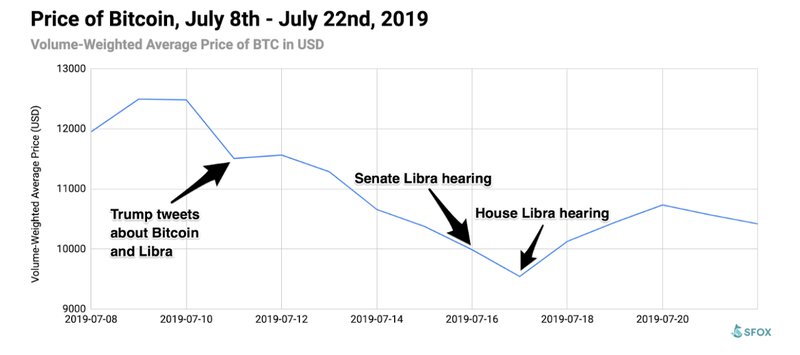

SFOX, an institutional cryptocurrency exchange, published a Volatility Snapshot on July 24 analyzing the correlation data for cryptocurrency following President Trump’s tweets about bitcoin. The research team determined that, in spite of global chatter over Facebook’s “cryptocurrency that may not be a cryptocurrency” libra, the market is more interested in bitcoin over alternative digital assets.

Rather than distracting investors from the leading cryptocurrency by market cap, the near-constant rhetoric and news coverage of libra has put bitcoin back into mainstream media, in addition to pumping its market dominance to a yearly high.

SFOX examined the comments made by lawmakers during the Congressional hearings held over libra. The team determined that bitcoin volatility and market dominance was affected most by the national discussion, despite not being the focus of the hearings and only tangential to Facebook’s digital currency.

Price of Bitcoin through July 2019 | Source: SFOX

Price of Bitcoin through July 2019 | Source: SFOX

Regulatory Concerns

During the weeks covering President Trump’s tweets and the Congressional hearing on libra, bitcoin volatility increased from 89.33 percent to 100.30 percent--its highest point since March 6th 2018.

The SFOX team speculates that market uncertainty in the face of increased regulatory pressure likely led to the erratic pricing for BTC,

“One possible explanation for this combination of downward trend in bitcoin’s price and upward trend in bitcoin’s volatility is that the market doesn’t fully understand what implications the increased government scrutiny towards a private blockchain and cryptocurrency (i.e. Libra) may have for public blockchains and cryptocurrencies (e.g., Bitcoin).”

The report continues,

“This kind of uncertainty is understandable given the wide range of Bitcoin-related comments surrounding Libra: on the one hand, the President of the United States has denied that bitcoin is money and has said that he is “not a fan” of it; on the other hand, Congressman Patrick McHenry (R-Nc.) called Bitcoin “an unstoppable force” which Congress should not attempt to deter.”

Altcoin Correlation

According to the research team, bitcoin occupied the center stage of cryptocurrency in the midst of the libra deliberations, while leading altcoins such as ethereum, bitcoin cash and litecoin became less correlated to BTC than in recent months. Instead, market-leading alts became highly correlated with each other, which SFOX interprets as investors being more interested in bitcoin.

The report states,

“These correlation data reinforce the idea that investors and traders may still be much more attuned and responsive to Bitcoin rather than other altcoins, especially when the crypto sector enters the national regulatory spotlight.”

The team suspects a self-fulfilling prophecy is taking place, whereby investors believe increased regulatory attention will benefit bitcoin first before trickling down to alts.

Ethereum: a Distinct Cryptoasset

SFOX also points out that ethereum may be breaking away from its historic classification as an ‘altcoin.’

While many have commented on bitcoin’s growing market dominance, few have noticed the growing correlation between BTC and ETH. The team speculates that ethereum could be “coming into its own” as a technology, leading the market to recognize it as a distinct crypto-asset similar to bitcoin.

cryptoglobe.com

cryptoglobe.com