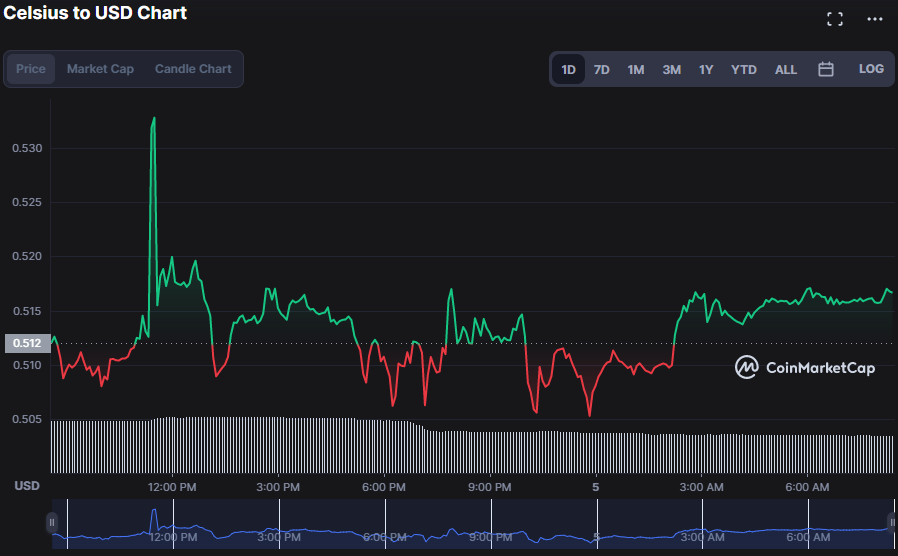

Bulls have so far been successful in reversing Celsius’s (CEL) negative trend, although price action has failed to break above the 0.5352 resistance level since yesterday. Since this bull trend took hold, the CEL price has risen 0.96% from $0.5051 to $0.5148.

As a consequence of this bullish control, market capitalization climbed by 0.70% to $123,209,348 while 24-hour trading volume decreased by 28.52% to $1,336,832. In an upturn, a decrease in 24-hour trading volume may indicate to investors that the positive ascent in CEL is losing strength and may soon terminate.

The Bollinger Bands are rising on the CEL price charts, signaling more interest in the CEL market. The top and bottom bands cross at 0.5254 and 0.4972. As the price approaches the top band, bulls’ hopes rise, and a green candlestick forms, signaling that the bulls are strengthening their grip.

The Moving Average Convergence Divergence (MACD) on the 1-hour price chart is trending south and moving below the signal line. The signal line reading is 0.0062, as opposed to the MACD value of 0.0057. Bears are gaining momentum, based on this movement and the histogram’s placement in the negative zone.

The relative strength index (RSI), which is now going below the simple moving average (SMA) line with a value of 56.04 and heading south, is another indication that bears are gaining power in the CEL market. This motion suggests a reversal is imminent if bulls do not step up and pull up their socks.

The market is usually expected to continue upwards when the shorter moving average (MA) climbs above the longer MA. This notion is supported by the 20-MA, which is at 0.5111, and the 5-day MA, which is at 0.5162. The market’s closing price being above the two moving averages (MAs) is bullish in that it indicates the bulls have gained strength and will likely continue their advance.

Stochastic RSI is below the signal line and moving into the oversold zone, indicating that the bears’ power is building (20.09). This action indicates that the current trend is coming to an end and that a reversal is forthcoming, dampening traders’ hopes for a bull run.

The bulls must push prices higher and defend the resistance level to fight the bears’ dominance expectations.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

coinedition.com

coinedition.com