BeInCrypto presents its annual recap of developments in major cryptocurrency market sectors over the course of the past year.

1- DeFi

Unlike the prosperous DeFi Summer of 2021, the past year was marked by collapses and stagnation, although signs of growth persist. Towards the beginning of the year, there was already a decline in users of decentralized applications. DApp Radar attributed this Feb. drop to the outbreak of the war in Ukraine.

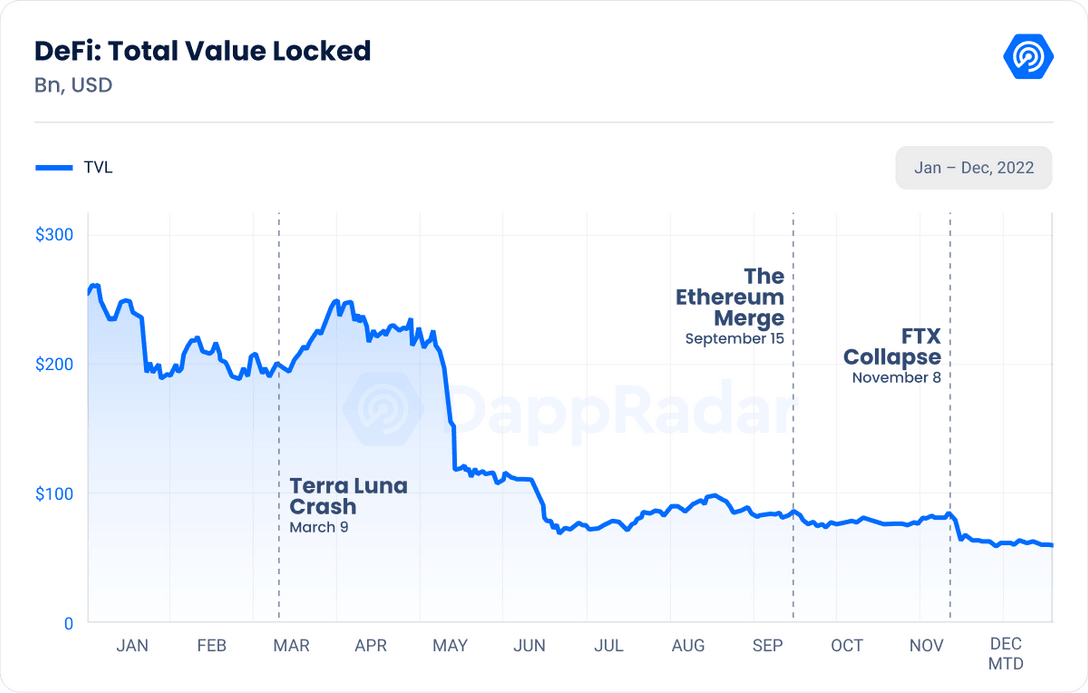

The industry was significantly impacted by the depegging of Terra’s TerraUSD (UST) and its subsequent collapse and resulting market decline. One of the most important indicators of DeFi is total value locked, which dropped sharply following the events of TerraUSD. Total TVL in DeFi sank from $158 billion in April to $89 billion in the days following the collapse a month later.

Meanwhile, Layer 1 DeFi protocols also experienced a declining TVL, with Ethereum falling to $32 billion and BNB Chain to $6.5 billion. These constitute a year-on-year fall of 74.56% and 62.5%, respectively. On the other hand, Layer-2 protocols fared somewhat better, with significant growth for Ethereum-based solutions Optimism and Arbitrum. Displacing other blockchains from leading positions, many projects actively integrated these networks with users utilizing them to test their products.

Despite the success of these protocols, DeFi ultimately struggled in 2022, with total TVL falling from a high of $211.4 billion in Jan. to $55 billion in Dec., a loss of 73.97%. But while investment has declined, usership seems to have advanced. The number of unique active wallets saw a 50% increase year-on-year from 1.58 million in 2021 to an average of 2.37 million in 2022.

2- Proof-of-Stake

One of the most significant cryptocurrency events of the past year was the Merge, Ethereum’s transition to a proof-of-stake system. This upgrade not only economized Ethereum significantly, but also brought proof-of-stake to greater prominence.

Taking place between Sept. 14-15, the Merge was accompanied by several hardforks that continued to enable proof-of-work. Although the performance of these networks turned out to be much worse than expected, Ethereum’s oldest hardfork, Ethereum Classic, prospered. This was likely because miners had switched over their equipment to the classic network in anticipation of the Merge.

However, it was difficult to determine which other proof-of-work blockchains the surplus capacity of Ethereum miners was distributed to. As a consequence of the Merge, many miners may forgo mining, sell their equipment, and look for other sources of income. One of the popular alternatives could be Ethereum staking, which has lower returns, but is more sustainable long-term.

3- Non-fungible tokens

While cryptocurrency prices tanked over the course of the past year, non-fungible tokens fared fairly well. According to on-chain metrics, NFT trading volume largely stagnated, increasing by just 0.41% year-on-year. However, the number of unique traders skyrocketed by 876%, reaching 10.6 million users, while total NFT sales increased by 10.6% to reach $68.35 million.

The most significant development for NFTs this past year has to be the increased integration by popular consumer brands. Twitter started incorporating NFTs in January, while PayPal announced an integration with MetaMask. Over the spring and summer, Meta made several strides with regard to NFT integration. It partnered with Polygon to support this in May, which enabled Instagram to then support NFTs. Meta also launched an NFT integration through multiple wallets in August.

4- Web3

While investment in cryptocurrencies may have plummeted this year, the same could not be said for other blockchain-based developments, or Web3. A key metric in determining Web3 progress is the number of downloads of two critically important programming libraries: Ethers.js and Web3.js.

In the third quarter this year, Web3 developers downloaded the Ethers.js and Web3.js libraries more than 1,536,548 times per week. This constitutes a 178% increase year-on-year. Since 2018, developers installing either of these libraries on a weekly basis, has increased every year. Now, in 2022, that number increased 10-fold since 2018’s high of 145,799 weekly downloads.

Additionally, Web3 metaverse projects raised $10 billion in 2022, almost triple the amount from last year. For example, Nike launched a new Web3 platform called Swoosh offering Polygon-based NFT products in Nov.. Earlier in April, Nike acquired Web3 studio RTFKT in 2021 and released digital Nike sneakers as Ethereum NFTs. This is a promising sign for the industry, as it will increase the exposure of NFTs and Web3 technologies to a larger audience.

5- Stablecoins

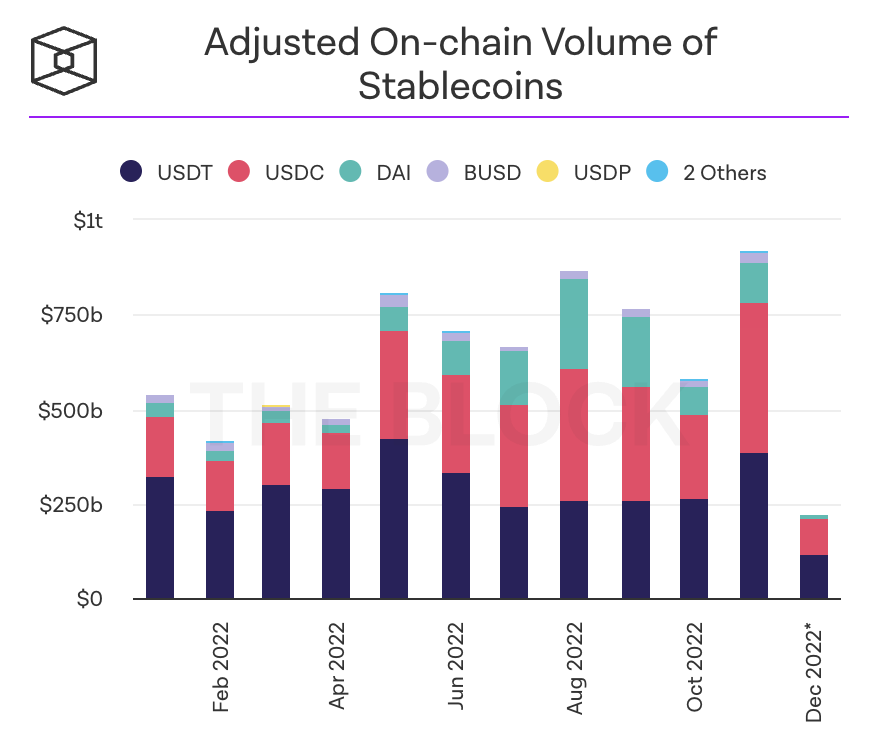

Despite being at the bottom of the list, stablecoins ultimately played one of the largest roles in crypto developments in 2022. Apart from declining crypto prices, the largest contributing factor to the major market tribulations of the past year was the depegging and collapse of the TerraUSD stablecoin. In addition to losses of up to $40 billion, its collapse also triggered succeeding crypto companies to fail.

But while algorithmic stablecoins like TerraUSD have lost significant appeal, fiat-based stablecoins continue to prosper. Circle, which issues USD Coin, retains $45 billion in the stablecoin and includes Blackrock and BNY Mellon as its custodians. Paxos’ Binance USD stablecoin and Paxos dollar combined have about $20 billion in circulation. Despite making gains in market share, Tether still remains roughly 50% larger.

beincrypto.com

beincrypto.com