Cryptocurrencies were mostly lower on Friday after a volatile week. The sell-off appears to be stabilizing, although many alternative coins in the CoinDesk 20 are underperforming bitcoin over the past seven days.

Bitcoin was trading around $45,000 at press time and is down about 8% over the past week. Some analysts expect BTC to consolidate with support nearby at the 200-day moving average, although resistance remains strong around the $50,000 price level.

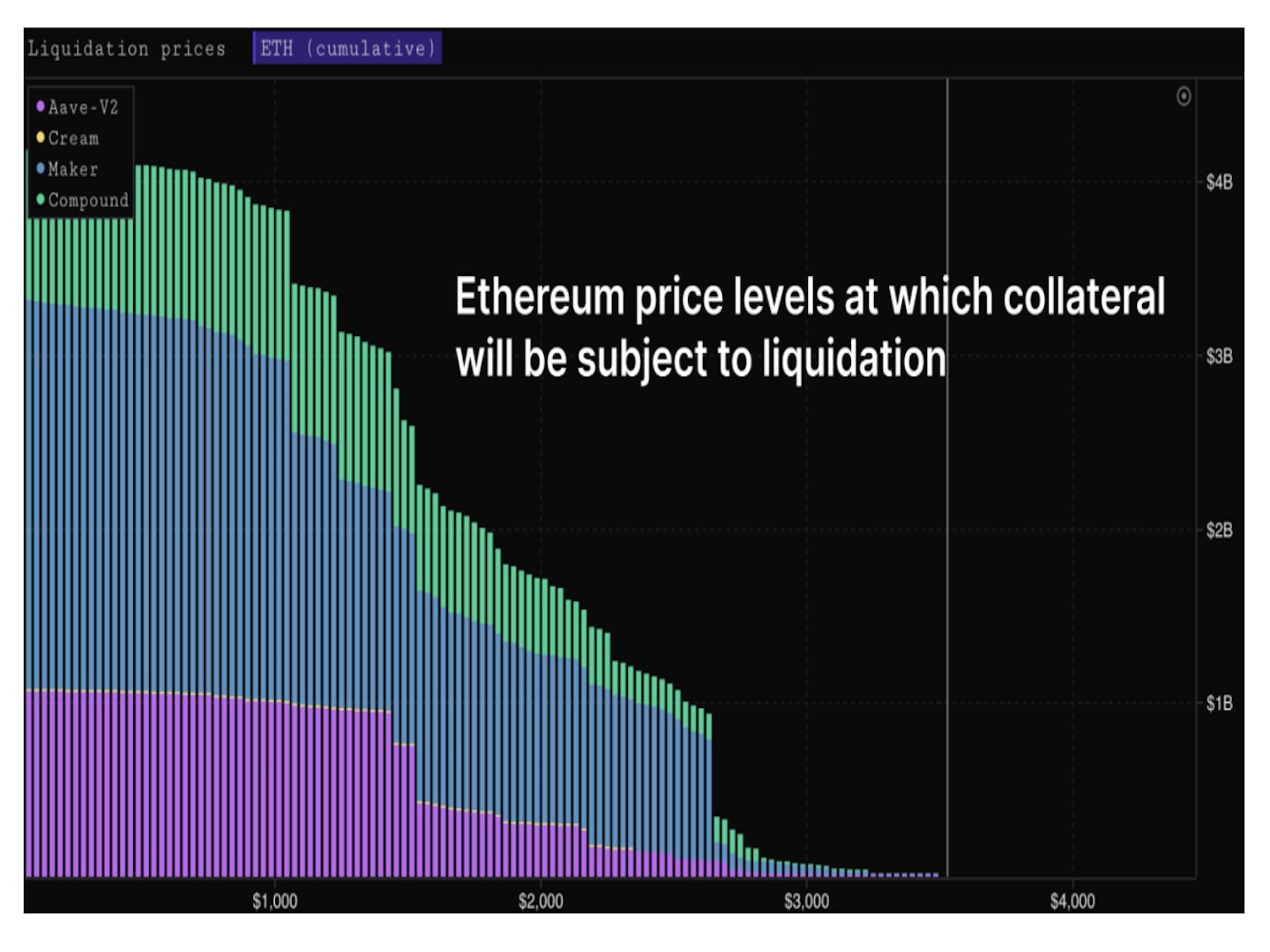

“Tuesday’s liquidations were possibly exacerbated by the leverage embedded in the Ethereum market and the wider altcoin universe,” FundStrat, a global advisory firm, wrote in a newsletter published on Wednesday. “The macro and on-chain (blockchain) pictures remain consistent, and therefore we believe these mid-cycle liquidations are good opportunities to consolidate positions.”

Analysts and traders are also monitoring regulatory risk, which could damp sentiment in the crypto market.

Latest Prices

-

Bitcoin (BTC): $45,701, -1.2%

-

Ether (ETH): $3,326, -3.2%

-

S&P 500: -0.8%

-

Gold: $1,797, +0.3%

-

10-year Treasury yield closed at 1.339%

Regulatory concerns

Recent headlines suggest the global regulatory crackdown on cryptocurrencies is not over. On Thursday, the State Power Company of China announced that it is conducting inspections on bitcoin and other crypto mining facilities.

“The article stated that virtual currencies such as bitcoin waste energy and evade financial supervision, and have no clear legal status in China,” crypto newswire WuBlockchain tweeted.

Also on Thursday, Sweden’s Riksbank Governor Stefan Ingves warned that “private money usually collapses sooner than later” during a banking conference. Ingves also compared bitcoin to “trading in stamps” and expressed concerns about money laundering.

And last week, the European Securities and Markets Authority published a report stating that “crypto assets are highly volatile in price and operate outside of the existing EU (European Union) regulatory framework, which raises investor protection issues.”

Ether holds support

Ether, the world’s second-largest cryptocurrency by market capitalization, is holding support above the $3,000 breakout level that was achieved in August. ETH declined from the $4,000 resistance level as buyers were unable to match the all-time price high around $4,360 reached in May.

For now, ETH appears to be oversold on short-term charts, and will likely consolidate into the weekend.

Coinbase exchange volumes rise

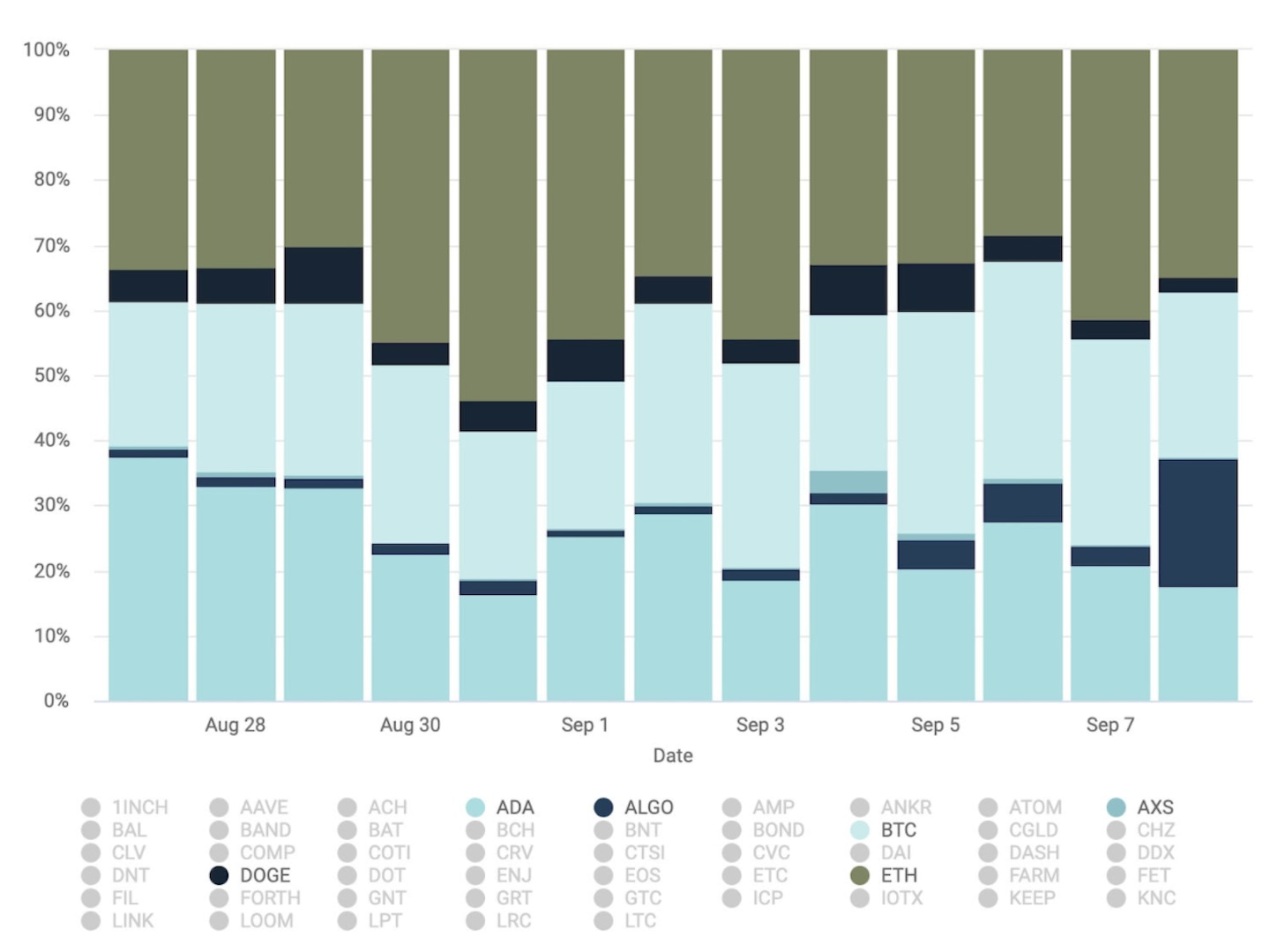

Trading volume on Coinbase has risen to the highest level since May as investors broaden their crypto exposure beyond bitcoin.

“Our expectation is for this trend to continue given the normally volatile September/October periods not just in crypto but in global markets as a whole,” Coinbase wrote in a report to institutional clients on Friday.

Altcoin roundup

-

Binance will support the Cardano hard fork scheduled for Sunday, Sept. 12: Cryptocurrency exchange Binance announced its support of Cardano’s hard fork, which will commence at approximately 21:44 UTC on Sunday. Deposits and withdrawal of ADA, the native token of Cardano, will be suspended at approximately 21:00 UTC and will be reopened once the exchange deems the upgraded network to be “stable.” The network upgrade is expected to bring smart-contract functionality to the Cardano mainnet, which is currently operating in a testnet environment. The exchange also noted that trading of ADA will not be affected.

-

Miami’s SCOPE Art Show is selling VIP tickets as NFTs: The art festival is working with YellowHeart, a blockchain-based live event ticketing platform, to sell tickets in the form of non-fungible tokens (NFTs). NFTs have been a growing trend in the art and entertainment space by giving access to unique content and experiences and eliminating middlemen, according to CoinDesk’s Helene Braun.

-

Olympian Apolo Ohno is being sued over his role in an alleged $50M ICO fraud: Former speed skater Apolo Ohno is being sued over his role in the now-defunct crypto exchange HybridBlock, which raised an estimated $50 million from the sale of HYB tokens in 2017. The civil suit against HybridBlock comes as the U.S. Securities and Exchange Commission (SEC) continues to hunt down fraudsters that took advantage of the largely unregulated initial coin offering (ICO) boom of 2017 and 2018.

Relevant news

-

European Finance Regulator Calls Crypto ‘Volatile’ but Innovative

-

IRS Makes New Crypto Broker Guidance a ‘Priority’ in 2021-22 Plan

-

BIS Signals Central Banks to Start Work on CBDCs

-

Swiss Stock Exchange Gets Regulatory Nod to Launch Digital Asset Exchange

Other markets

All the digital assets in the CoinDesk 20 ended the day lower.

Notable winners as of 21:00 UTC (4:00 p.m. ET):

-

None

Notable losers:

-

Algorand (ALGO), $1.97, -14.0%

-

Filecoin (FIL), $82.98, -5.7%

coindesk.com

coindesk.com