This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

Latest Prices

Top Stories

Bitcoin was roughly flat at around $17,000 early Friday ahead of the November jobs report due at 8:30 a.m. ET. The U.S. employment report for November is expected to show a sizable slowdown in hiring, but the labor market remains too tight, according to Federal Reserve Chairman Jerome Powell. Ether was climbing ahead of the report, up slightly on the day.

Derivatives marketplace Chicago Mercantile Exchange and cryptocurrency index provider CF Benchmarks this month will introduce reference ratesand real-time indexes for aave (AAVE), curve (CRV) and aynthetix (SNX). The new rates will be calculated and published starting on Dec. 19. They aren’t tradable futures products now.

Binance’s chief strategy officer said the company's centralized exchange may not exist in 10 years because the crypto market is moving toward decentralized finance. For now, the exchange is trying to keep customers' trust after the collapse of rival exchange FTX by implementing "proof of reserves," which is a way to show customers that their assets are fully backed by liquid assets.

Chart of the Day

(Source: Bloomberg, @Marcomadness2)

-

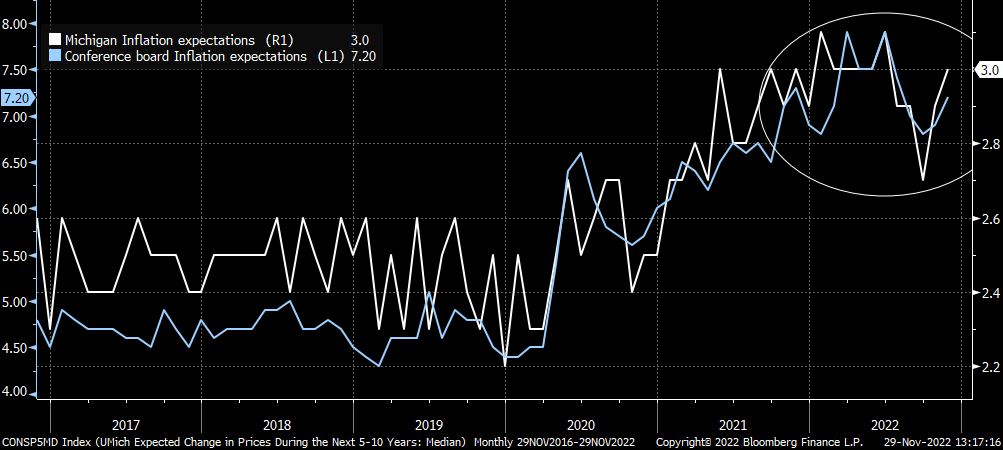

The chart shows a renewed uptick in the U.S. consumer inflation expectations tracked by the Conference Board and the University of Michigan.

-

The data suggests the consumer price index may moderate slower than markets anticipate, delaying the potential Fed pivot away from liquidity tightening.

-

Risky assets, including cryptocurrencies, have taken a beating this year predominantly because of the Fed's liquidity tightening.

Trending Posts

-

Coinbase Disables Mobile NFT Transfers, Citing Apple’s App Store Policies

-

DeFi Protocol Ankr Exploited for Over $5M

-

US CFTC Commissioner Cites Latest Crypto Sanction in Call for New Rules

coindesk.com

coindesk.com